84

Key function/machine feature (P3)

Tax table programming

Programming procedure

8

3s

8

::::s

8

::^::::a

8

::::a

8

::::a

8

::::a

8

::::a

8

::::a

8

::::a

8

s

(for the U.S., Singapore)

Tax table 1 =

0125

Tax table 2 = 0225

Tax table 3 = 0325

(for Canada)

Tax table 1 =

0125

Tax table 2 = 0225

Tax table 3 = 0325

Tax table 4 = 0425

{

(for other area)

Tax table 1 =

0125

Tax table 2 = 0225

:= :

Tax table 10 = 1025

{

{

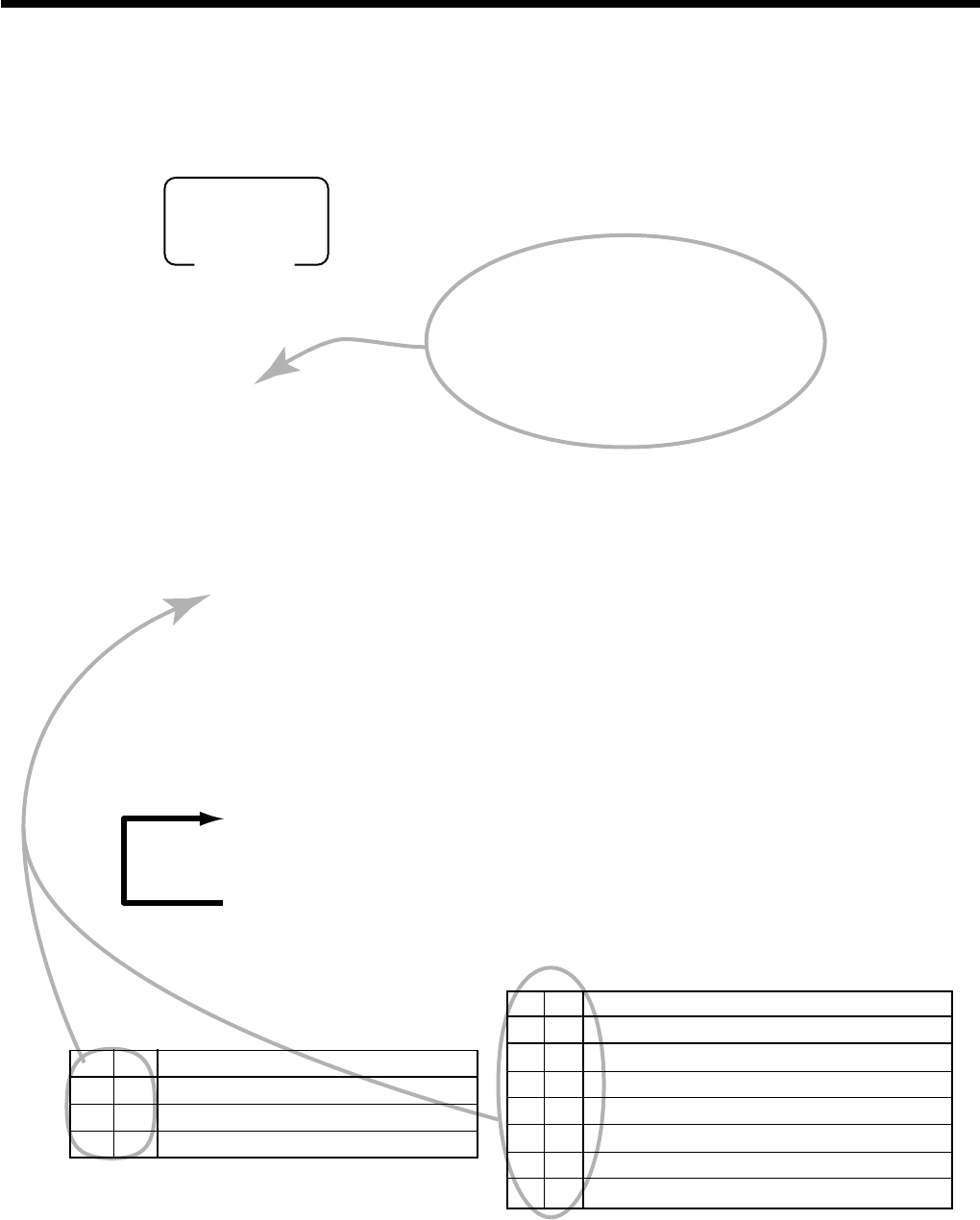

Tax rate (4-digit for integer + 4-digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

*1

Sum of a cyclic pattern

Number of values in each cyclic pattern

Sum of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

You must enter these values in 4-digit block. If the last block

comes out to be only two digits, add two zeros.

Loop to input the next block.

Canadian tax system

For both add-on and add-in tax systems.

To program Tax-on-tax system, you must use the tax address “0225”, “0325” or “0425.”

To program Donuts tax system, you must use the tax address “0125” or “0225.”

Tax system code specification

D

2

D

1

Rounding

4--Singapore rounding

-- 1 Tax table only

-- 2 U.S. tax table with tax rate or add-on tax only

-- 3 Add-in tax rate

-- 4 Tax-on-tax (Canada, Singapore)

-- 6 VAT-on-tax (Thailand)

-- 7 VAT & VAT_2

D

4

D

3

D

2

D

1

*1 Rounding/Tax system code

Rounding code specification

D

4

D

3

Rounding

50Rounding off two decimal places

90Rounding up to two decimal places

00Cut off two decimal places

PGM

Mode switch