86

Key function/machine feature (P3)

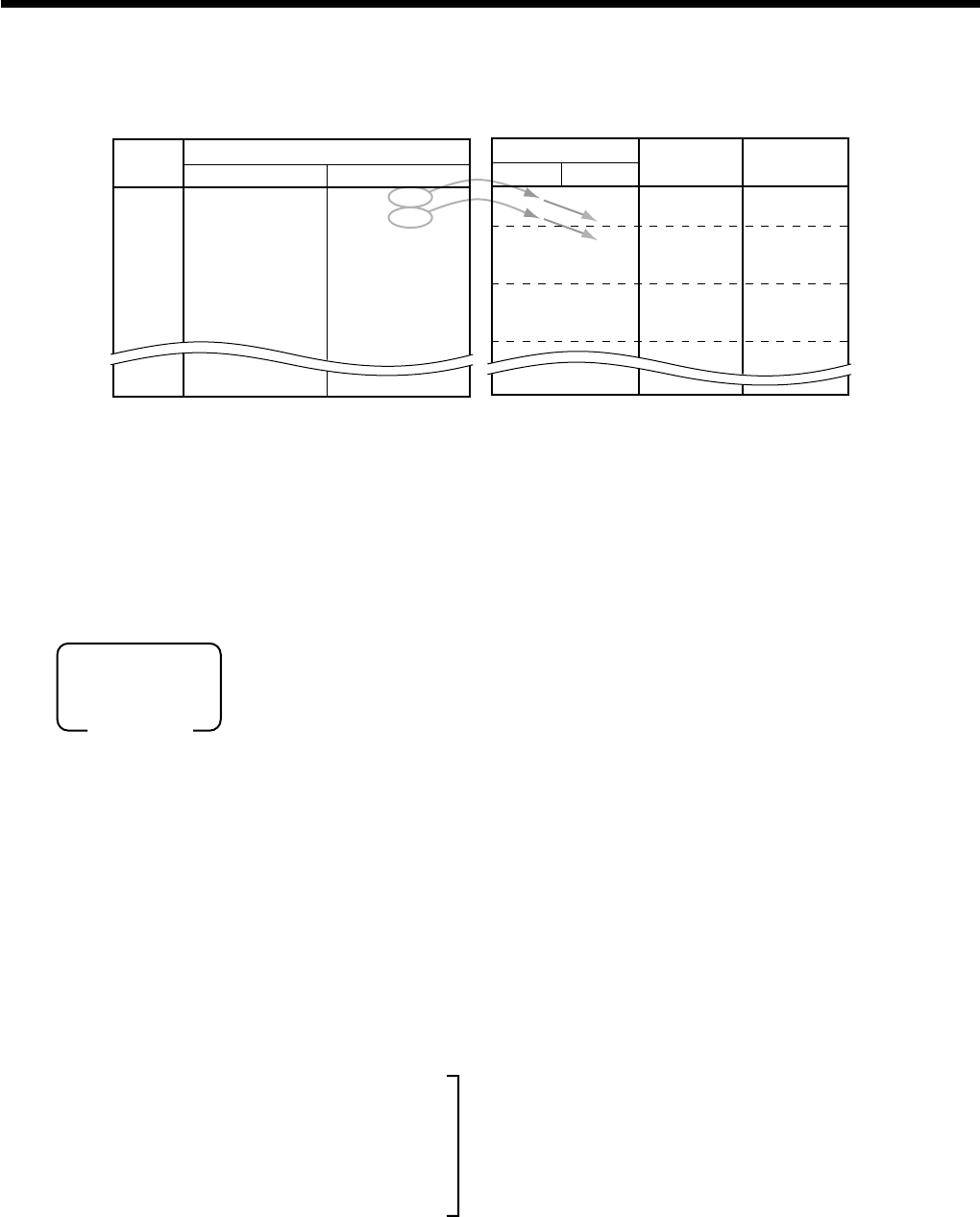

Example 2:

U.S. tax table without rate setting

TAX Price range

(6%) Min. break point Max. break point

$ .00 $ .01 $ .10

.01 .11 .24

.02 .25 .41

.03 .42 .58

.04 .59 .74

.05 .75 .91

.06 .92 1.08

.07 1.09 1.24

.08 1.25 1.41

Max. break point

Upper Lower

Difference Pattern

10 – 0 = 10

24 – 10 = 14

Non cyclic

41 – 24 = 17

58 – 41 = 17 Cyclic

74 – 58 = 16

91 – 74 = 17

108 – 91 = 17 Cyclic

124 – 108 = 16

141 – 124 = 17

17 Cyclic

Tax rate (2-digit for integer + 4-digit for decimal) ............................... 0 %(Table only)

Tax table maximum value (“0” means unlimited). ............................... 0 (Table only)

Rounding/tax table system code ........................................................... 01 (Table only)

Sum of a cyclic pattern ......................................................................... 50 (17+17+16)

Number of values in each cyclic pattern............................................... 3

Number of values in each non-cyclic pattern ....................................... 24 (10+14)

Actual value of difference of the non-cyclic and cyclic values ............ 10, 14, 17, 17, 16

3s

8

::::s

8

0a

8

0a

8

01a

8

50a

8

3a

8

24a

8

1014a

8

1717a

8

1600a

8

s

Tax table No. (0125 ~ 0325)

Tax rate (2-digit for integer + 4-digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Sum of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values.

You must enter these values in 4-digit block. If the last block

comes out to be only two digits, add two zeros.

PGM

Mode switch