19

E

TE-2400 User's Manual

Getting Started

X1

Z1

X2/Z2

REG2

REG1

OFF

RF

PGM

Mode Switch

3s

8

: : : :

s

8

7a

8

2007a

8

0002a

8

100a

8

7a

8

7a

8

0714a

8

1414a

8

1514a

8

1415a

8

s

0125

0225

0325

{

Tax table 1 =

Tax table 2 =

Tax table 3 =

Tax rate (2-digit for integer + 4-digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Number of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

You must enter these values in 4-digit block. If the last block

comes out to be only two digits, add two zeros.

Tax table programming (continued…)

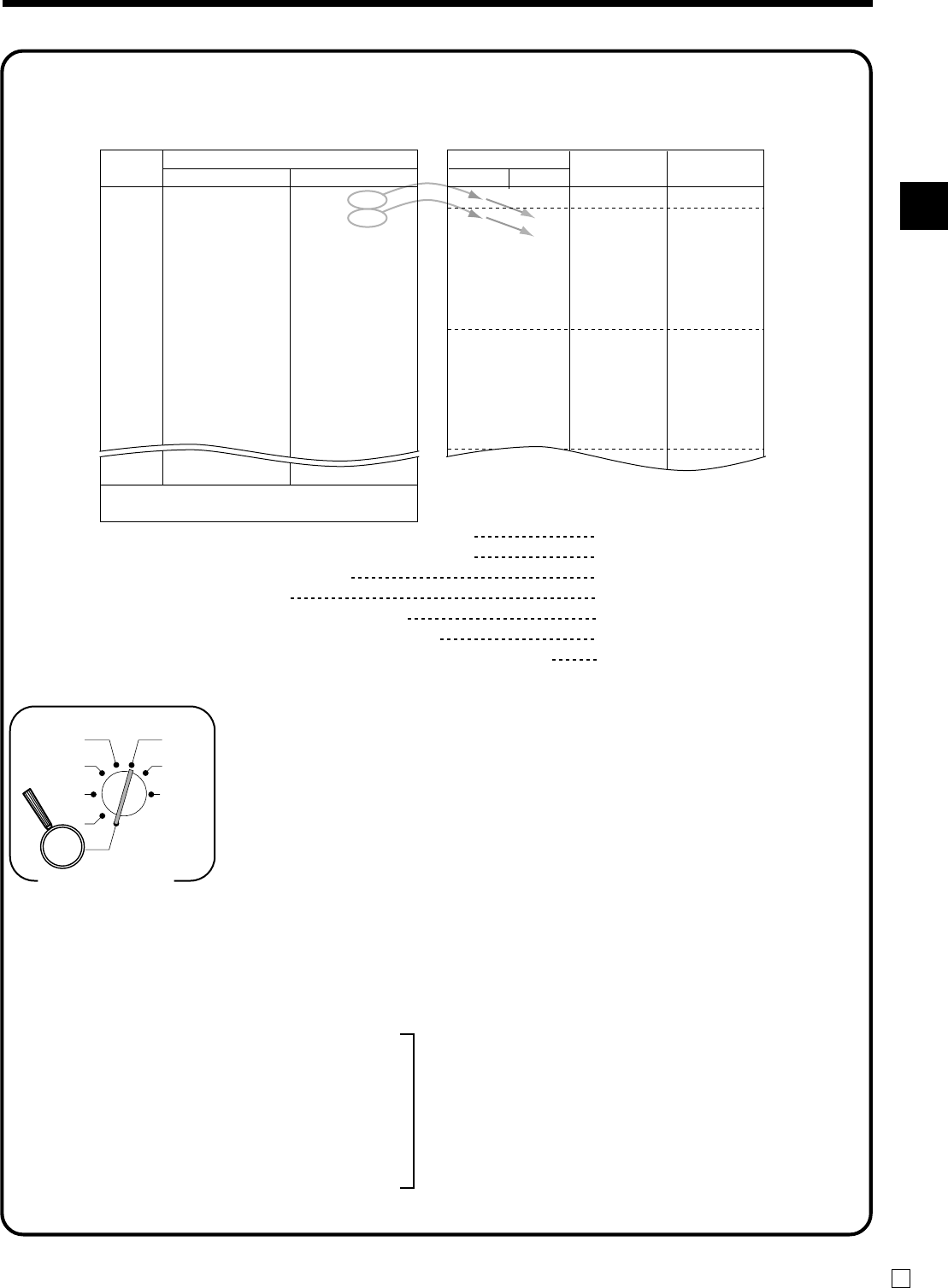

Example 3, With rate tax:

Preparation:

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

=

=

=

=

=

=

=

=

=

=

=

=

=

=

=

TAX

(7%)

Price range

Min. break point Max. break point

$ .00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

.14

1.40

$ .01

.08

.22

.36

.50

.65

.79

.93

1.08

1.22

1.36

1.50

1.65

1.79

1.93

19.93

$ .07

.21

.35

.49

.64

.78

.92

1.07

1.21

1.35

1.49

1.64

1.78

1.92

2.07

20.07

Max. break point

7

21

35

49

64

78

92

107

121

135

149

164

178

192

207

0

7

21

35

49

64

78

92

107

121

135

149

164

178

192

7

14

14

14

15

14

14

15

14

14

14

15

14

14

15

Upper Lower

Difference

Pattern

Non-cyclic

Cyclic

Cyclic

Tax rate (2-digit for integer + 4- digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Number of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values

7%

2007

0002 (Cut off & table + rate)

100 (14+14+14+15+14+14+15)

7

7

14, 14, 14, 15, 14, 14, 15

On all sales above $20.07, compute the tax

at the rate of 7 %.

Programming procedure: