Basic Operations and Setups

TE-2400 User’s Manual

39

E

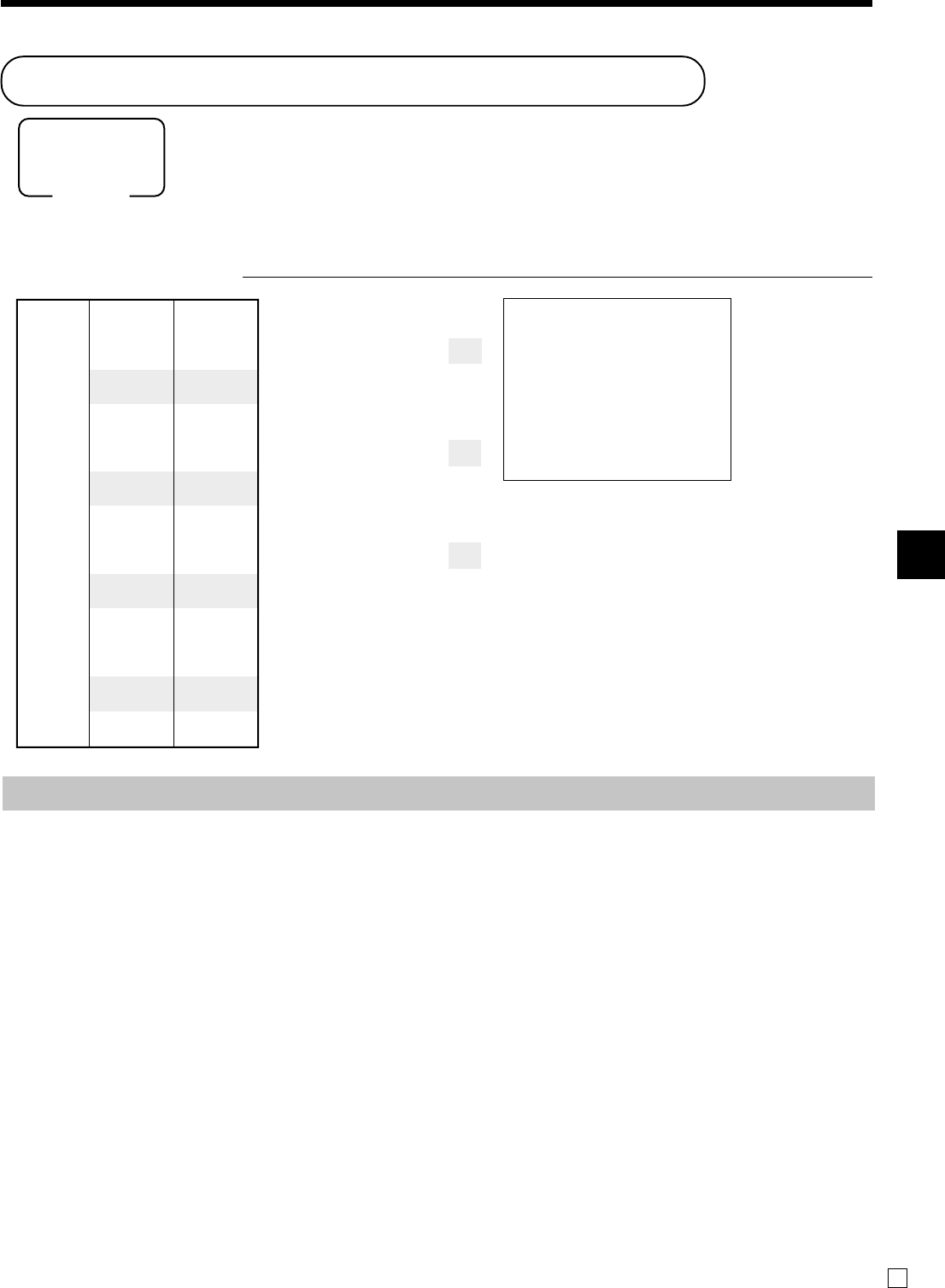

Shifting the taxable status of an item

By pressing “Tax Shift” key, you can shift the taxable status of an item.

Calculation merchandise subtotal

OPERATION RECEIPT

4-!

t

2-"

T

6-#

T

7-$

s

20-F

Important!

• To change the tax status of the next item to be registered, be sure to press t, T.

If the last item registered is programmed as nontaxable, a discount (p key) operation on this item is

always nontaxable.

In this case, you cannot manually change the tax status to Taxable 1 or 2 by pressing the t, T

keys.

Dept. 1 $4.00

—————————

Item 1 Quantity 1

—————————

Taxable (2)

preset

—————————————

Dept. 2 $2.00

—————————

Item 2 Quantity 1

—————————

Taxable (No)→1

—————————————

Dept. 3 $6.00

—————————

Item 3 Quantity 1

—————————

Taxable (1)→1, 2

—————————————

Dept. 4 $7.00

—————————

Item 4 Quantity 1

—————————

Taxable (2)→No

—————————————

Payment Cash $20.00

Pressing

t

changes the tax status

from Nontaxable to Taxable 1

Pressing

T

changes the tax status

from Taxable 1 to Taxable 1, 2

Pressing

T

changes the tax status

from Taxable 2 to Nontaxable

Mode switch

REG

1 DEPT01 T2 $4.00

1 DEPT02 T1 $2.00

1 DEPT03 T12 $6.00

1 DEPT04 $7.00

TA1 $8.00

TX1 $0.32

TA2 $10.00

TX2 $0.50

TL

$19.82

CASH $20.00

CG $0.18