- 120 -

EO1-11116

MA-516-100 SERIES

→

→

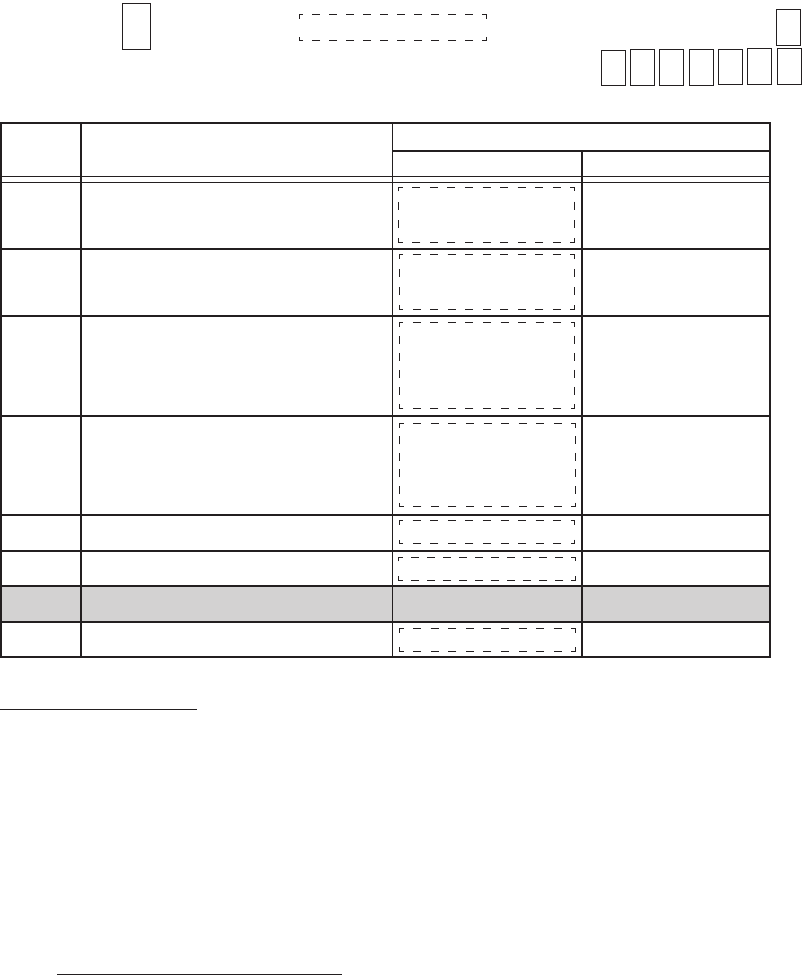

Address: 2 initial SET Bit Nos. 0

(Optional Functions 1)

Your Selection

Selective Status

RESET SET

1 Fraction Rounding Process on Quantity

Extension or % Calculations

2 Fraction Rounding Process on Quantity

Extension or % Calculations

3 Credit Balance (over-subtraction of the

sale by [DOLL DISC], [VOID] keys, etc.)

in REG mode

4 Obtaining Taxable Total (sale total

including taxes) by [TXBL TL] or [ST]

key before finalizing each sale

5 SPP Fraction Round-up Process

6 Department Zero Skip on Report

7

-- vacant --

8 Cashier Identifying Function

ROUND UP

Supplementary Description:

Bit 1 & Bit 2: If both RESET, ROUND OFF status is obtained.

If both SET, Bit 2 status prevails, i.e., ROUND DOWN.

(Fraction Rounding Process on tax/PST calculations is fixed to ROUND OFF, out of the

application of the process selected here. As for GST, see Address 14 -Bits 2 & 3)

Bit 3: The [RTN MDSE] key is operable to turn the sale into negative regardless of this bit status

selection.

Bit 5: ex.)When a customer wants 2 items (Purchased Quantity) of the 3 items (Whole Package

Quantity) of $1.00 (Whole Package Quantity):

RESET status (ROUND UP PRODUCT)

{100 (Whole Package Price) ÷ 3 (Whole Package Q’ty)} x 2 = 66.666...

→ Round up to $0.67

ROUND DOWN

ALLOWED

COMPULSORY

ROUND UP ITEM PRICE

ZERO SKIP

NOTHING

ROUND OFF

Follow Bit 1 status.

PROHIBITED

NOT COMPULSORY

ROUND UP PRODUCT

NO ZERO SKIP

PROVIDED

Bit No. Content