- 95 -

EO1-11116

MA-516-100 SERIES

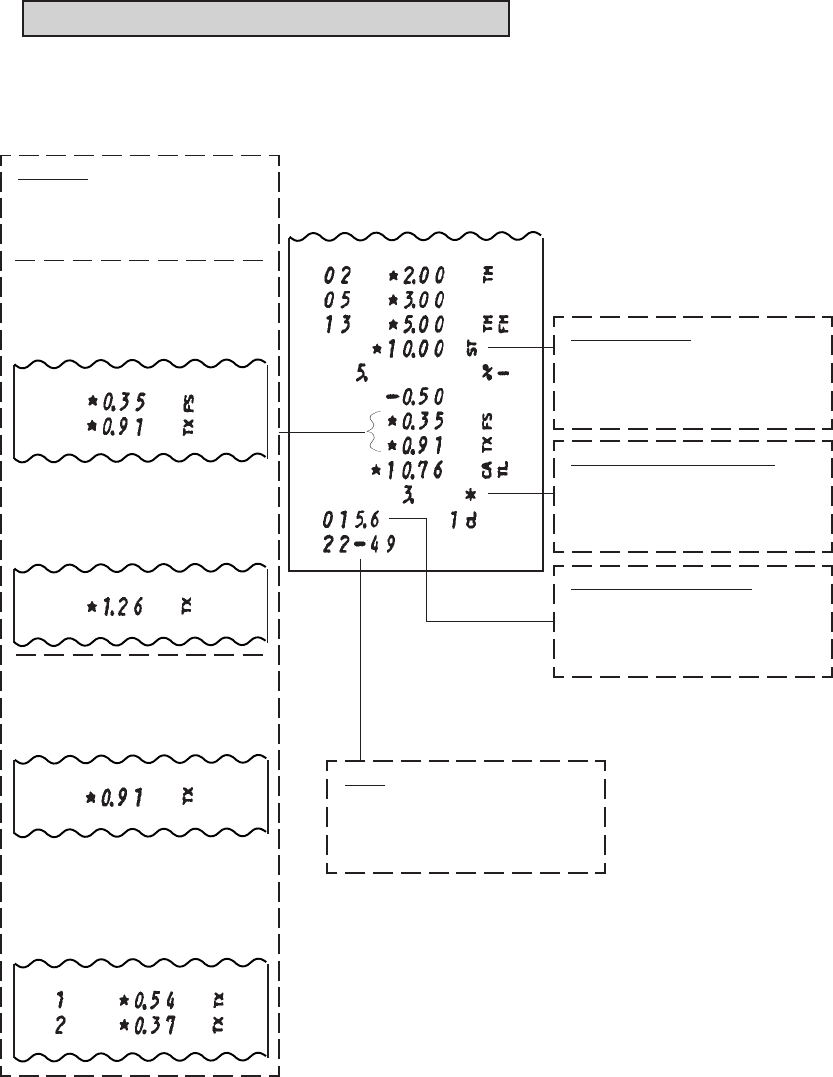

Print/Non-print Options on Sale Receipts

The following are items that can be programmed to be printed or not on sale receipts.

To change the print/non-print status,

refer to Chapter “22. System Option Setting”. For changing the print/non-print

status of each item, further refer to the Address No. and Bit No. in the chapter.

Tax Lines

Address 14 - Bit 4

Initial Status:

GST Print

Address 14 - Bit 5

Initial Status:

Separate Lines for Tax/PST

and GST

Optional Status:

Consolidated Amount Print

for TAX/PST and GST on one

line

Address 13 - Bit 3

Initial Status:

Consolidated Tax (PST)

Amount Print on one line

Optional Status:

Separate Lines for Individual

Taxes (PST) (“Separate” sta-

tus must be selected for Ad-

dress 14 - Bit 5 in this case.)

Time:

Address 1 - Bit 1

Initial Status:

Print

Manual Subtotal:

Address 1 - Bit 3

Initial Status:

Print

Number of Purchased Items:

Address 1 - Bit 2

Initial Status:

Non-print

Receipt Consecutive No.:

Address 15 - Bit 2

Initial Status:

Print