E-66

Advanced programmings and registrations

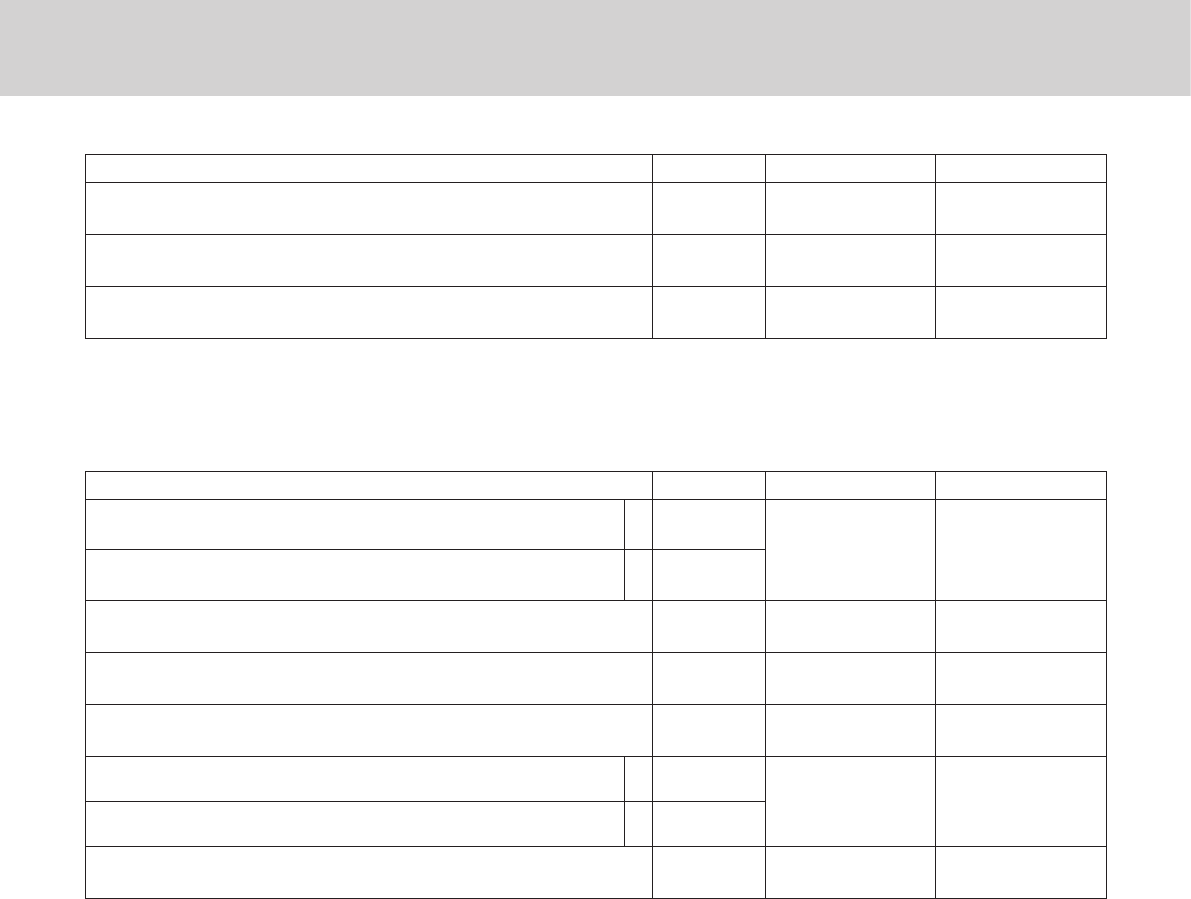

Set code 04 (Tax system)

Description Selection Program code Default value

Canadian rounding system

Roundings Last digit: 0 to 2 → 0, 3 to 7 → 5, 8 and 9 → 10

No = 0

Yes = 7

B

D10

º

D10

US tax system = 1, Canadian tax system = 2 (Default value

depends on the country shipped to)

Select

0 or 1

B

D9

¡ or ™

D9

Must be “00000000” (eight zeros)

º to º

D8 to D1

º to º

D8 to D1

Example: To set Canadian tax system with canadian rounding system.

Press 3o0422o7200000000Fo

Set code 05 (Receipt printing selections)

Description Selection Program code Default value

Print total line during nalization.

a

Yes = 0

No = 1

B

(a+b) D10

º

(a+b) D10

24- hour system (0) or 12 -hour system (2)

b

Select

0 or 2

Buffered receipt print (enables key operations during printing) No = 0

Yes = 2

B

D9

º

D9

Skip item prints on journal. (journal skip) No = 0

Yes = 1

B

D8

º

D8

Must be “000”

ººº

D7 D6 D5

ººº

D7 D6 D5

Print number of item sold. (item counter)

a

No = 0

Yes = 1

B

(a+b) D4

º

(a+b) D4

Print tax symbols.

b

Yes = 0

No = 2

Must be “000”

ººº

D3 D2 D1

ººº

D3 D2 D1

Example:

• On a receipt, not printing total amount (a = 1), printing 12 -hour system (b = 2): D10 = 3 (1 + 2).

• Buffered receipt printing: D9 = 2.

• Not printing items on journal (journal skip): D8 = 1.

• D7 – D5 must be 000.

• Printing number of items (a = 1), not printing tax symbols (b = 2): D4 = 3 (1 + 2).

• D3 – D1 must be 000.

Press 3o0522o3210003000Fo