82

<Sampletaxtable>

New Jersey tax table: 6%

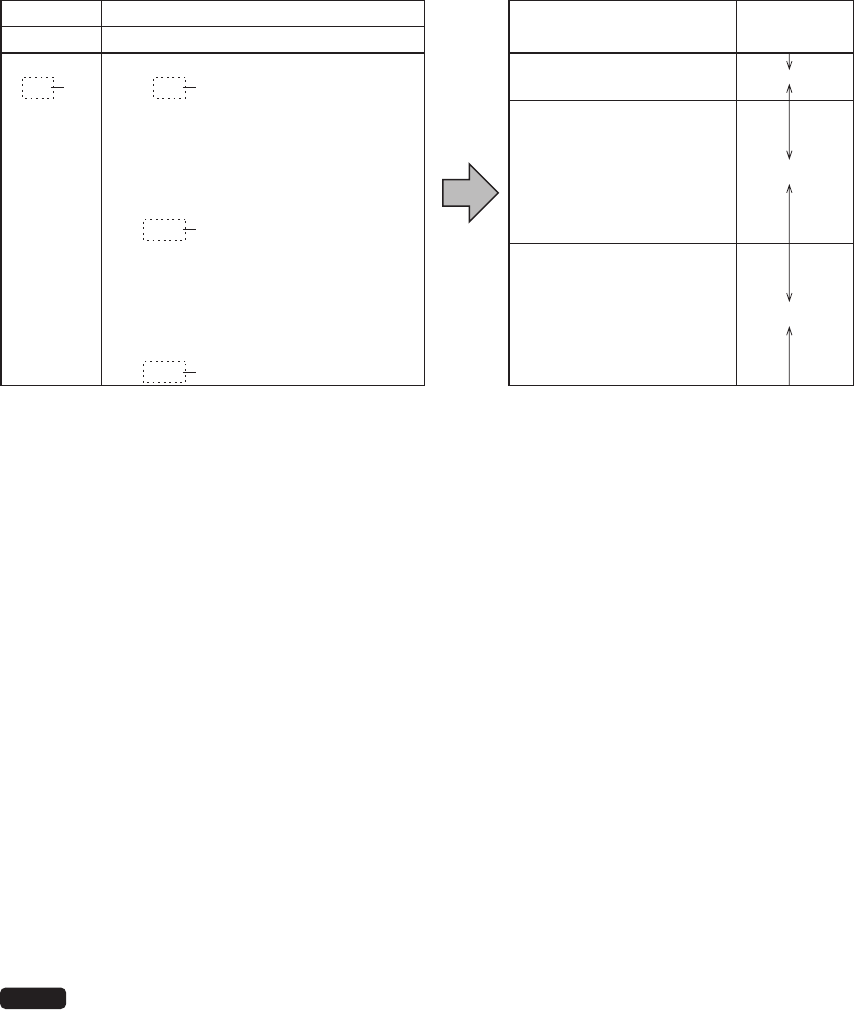

To program a tax table, rst make a table like the right table shown below.

From the tax table, calculate the differences between a minimum break point and the next one (A). Then,

from the differences, nd irregular cycles (B) and regular cycles (C and D). These cycles will show you the

following items necessary to program the tax table:

T: The tax amount collected on the minimum taxable amount (Q) →INITIALTAX

Q: The minimum taxable amount → LOWERTAX

M1: The maximum value of the minimum breakpoint on a regular cycle (C)

We call this point “MAX point.”

M2: The maximum value of the minimum breakpoint on a regular cycle (D)

We call this point “MAX point.”

M: Range of the minimum breakpoint on a regular cycle: difference → CYCLE

between Q and M1 or between M1 and M2

ExampledataofNewJerseytaxtable(6%)

TAXRATE: 6.0000 (enter 6)

CYCLE: 1.00 (enter 100)

INITIALTAX: 0.01 (enter 1)

LOWERTAX: 0.11 (enter 11)

BREAKPOINT1: 0.23 (enter 23)

BREAKPOINT2: 0.39 (enter 39)

BREAKPOINT3: 0.57 (enter 57)

BREAKPOINT4: 0.79 (enter 79)

BREAKPOINT5: 0.89 (enter 89)

BREAKPOINT6: 1.11 (enter 111)

NOTE

If the tax is not provided for every cent, modify the tax table by setting the tax for every

cent in the following manner.

When setting the tax, consider the minimum breakpoint corresponding to unprovided tax to be the same as

the one corresponding to the tax provided on a large amount.

Taxes

Range of sales amount

Minimum breakpoint

.00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

.01

.11

.23

.39

.57

.73

.89

1.11

1.23

1.39

1.57

1.73

1.89

2.11

Maximum breakpoint

.10

.22

.38

.56

.72

.88

1.10

1.22

1.38

1.56

1.72

1.88

2.10

2.22

to

to

to

to

to

to

to

to

to

to

to

to

to

to

T Q

M1

M2

A: Difference between the

minimum breakpoint and

the next one (¢)

–

10 (0.11 - 0.01)

12 (0.23 - 0.11)

16 (0.39 - 0.23)

18 (0.57 - 0.39)

16 (0.73 - 0.57)

16 (0.89 - 0.73)

22 (1.11 - 0.89)

12 (1.23 - 1.11)

16 (1.39 - 1.23)

18 (1.57 - 1.39)

16 (1.73 - 1.57)

16 (1.89 - 1.73)

22 (2.11 - 1.89)

B: Non-cyclic

C: Cyclic-1

D: Cyclic-2