VICTOR TECHNOLOGY

27

¾ Touch b SOYD for sum of years number option

No matter which depreciation method is used the remaining depreciated value

may be displayed by touching x ↔ y .

Example

Your company purchases a car for $3,500, which depreciates over 6 years.

The salvage value is expected to be $900. Find the amount of depreciation

and remaining depreciable value 1 year and after 4 years of car ownership

using the declining-balance method at double the straight-line rate (200%).

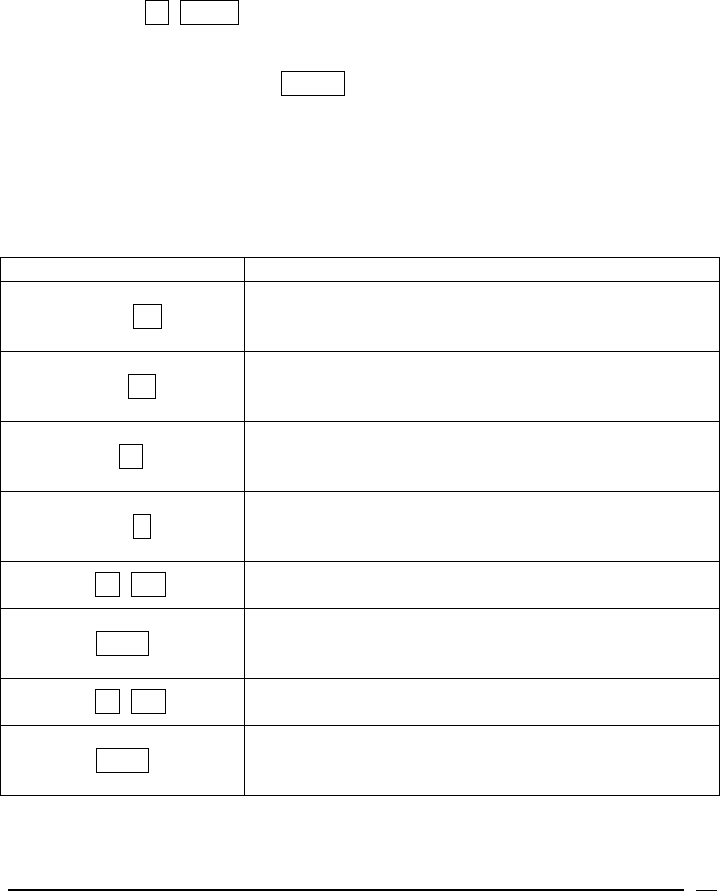

ENTRIES DISPLAY

3500 PV

3,500.00

Stores the purchase price of $3,500 as the Present

Value

900 FV

900.00

Stores the salvage value of $900 as the Future

Value

6 n.

6.00

Stores 6 years as the number of periods for which

depreciation will be calculated

200 i.

200.00

Stores 200% as the accelerated rate at which

depreciation will be calculated.

1 b DB

1,1667.67

Displays the depreciation for year one

x ↔ y

1,433.33

Displays the amount left to be depreciated after

one year

4 b DB

137.04

Displays the depreciation for year four

x ↔ y

00.00

Displays the amount left to be depreciated after

four years