26

E

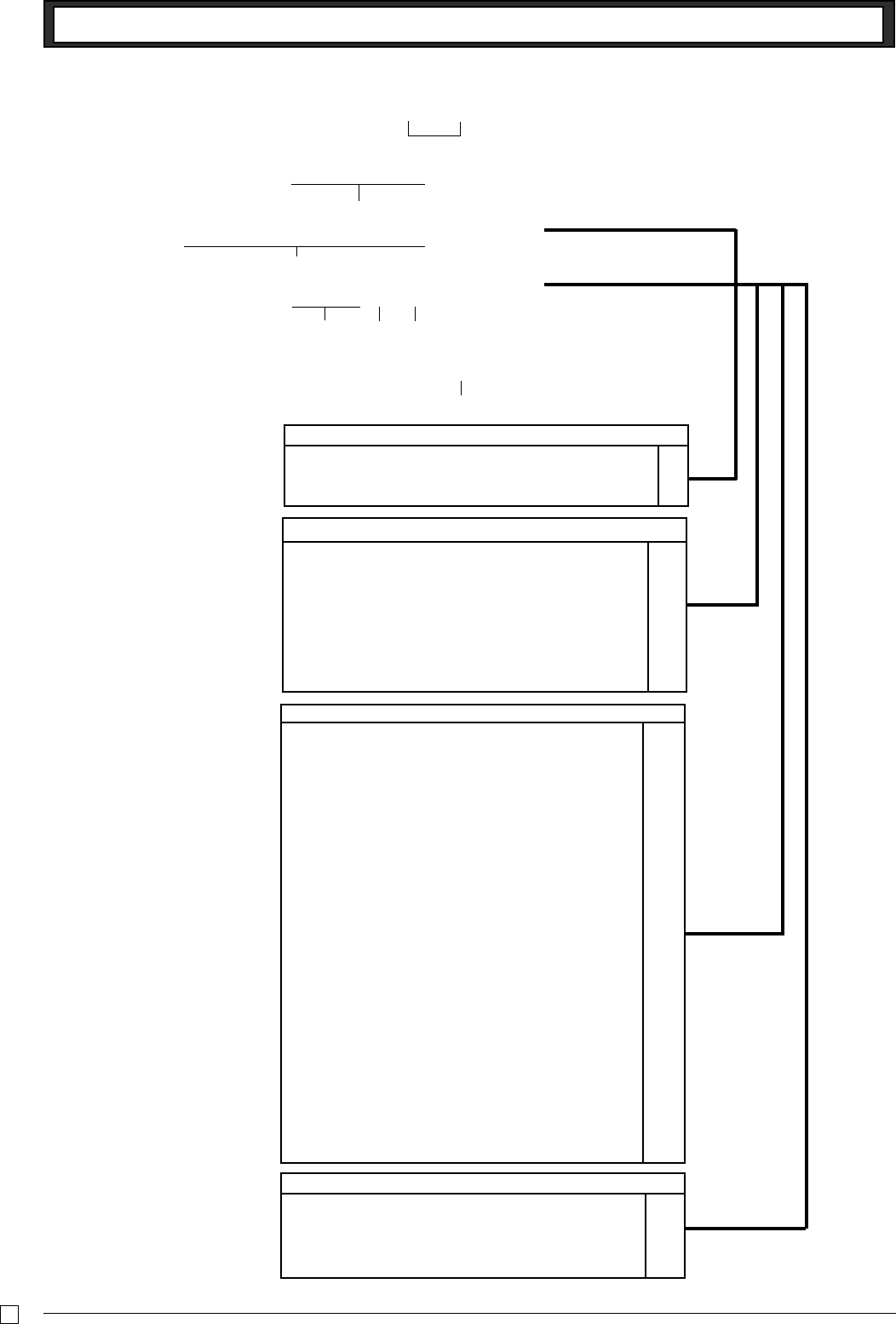

1-9 Setting the Tax Rate

and rounding

Part-2 CONVENIENT OPERATION

P3 appears in mode display

Program set code No. for tax rate 1*

1

Tax rate specifications

A

The tax rate within the range of 0.0001 ~ 99.9999%.

Use

" key for decimal point.

Normal rounding specifications

B

Cut off to 2 decimal places. ??

(1.544=1.54; 1.545=1.54)

Round off to 2 decimal places.

B?

(1.544=1.54; 1.545=1.55)

Round up to 2 decimal places.

>?

(1.544=1.55; 1.545=1.55)

Special rounding specifications for subtotal and total amounts

C

No specifications ?

Special rounding 1 Z

0 ~ 2 ➝ 0; 3 ~ 7 ➝ 5; 8 ~ 9 ➝ 10

Examples: 1.21=1.20; 1.26=1.25; 1.28=1.30

Special rounding 2

X

0 ~ 4 ➝ 0; 5 ~ 9 ➝ 10

Examples: 1.123=1.120; 1.525=1.530

Denmark rounding

C

(set the amount tender restriction on page 18 also)

00~ 12 ➝ 0; 13 ~ 37 ➝ 25; 38 ~ 62 ➝ 50;

63 ~ 87 ➝ 75; 88 ~ 100 ➝ 100

Examples: 1.11=1.00; 1.28=1.25; 1.39=1.50;

1.80=1.75; 1.99=2.00

Scandinavian rounding

N

00~ 24 ➝ 0; 25 ~ 74 ➝ 50; 75 ~ 99 ➝ 100

Examples: 1.21=1.0; 1.30=1.50; 1.87=2.00

Australian rounding (only for tax rate 1)

M

0 ~ 2 ➝ 0; 3 ~ 7 ➝ 5; 8 ~ 9 ➝ 10

Examples: 1.21=1.20; 1.26=1.25; 1.28=1.30

Tax system specifications for subtotal and total amounts

D

No specifications. ?

Specifies add-on rate tax. X

Specifies add-in rate tax (VAT). C

• You can use either an add-on

rate tax or an add-in rate tax

(VAT), depending on the require-

ments in your area. You can

specify only one tax rate.

• The normal rounding specifica-

tion tells the cash register how to

round tax amounts to the proper

number of decimal places.

• The special rounding specifica-

tion and Denmark rounding tell

the cash register how to round

off subtotals and totals so that

their rightmost 2 digits are 00,

25, 50 and 75.

• Note that the rounding specifi-

cation you program for your cash

register depends on the tax laws

of your country.

▲

Co

?ZXBo

??"????p

????p

o

Select numbers

from list B

Select

number

from

list C

Select number

from list D

(To end the setting)

*

1

Program set code No. for Tax

rate 2 is ?XXB.

Enter tax rate A

▲