73

Advanced Operations

TK-7000/7500 User’s Manual

Mixed food stamp/cash change (continued…)

Food stamp + Taxable 1 + Taxable 2

When food stamps are received as partial tender for items preset with the status “food stamp”, “taxable 1”, and

“taxable 2”, the calculation are performed using one of the two cases described in this section. The case used

depends on the food stamp amount received as partial tender.

Case 1

This case is used when the total amount of the items preset with the status “food stamp”, “taxable 1”, and

“taxable 2” is greater than or equal to the food stamp amount received as partial tender. Case 1 subtracts the

food stamp amount tendered from both the taxable 1 amount and taxable 2 amount.

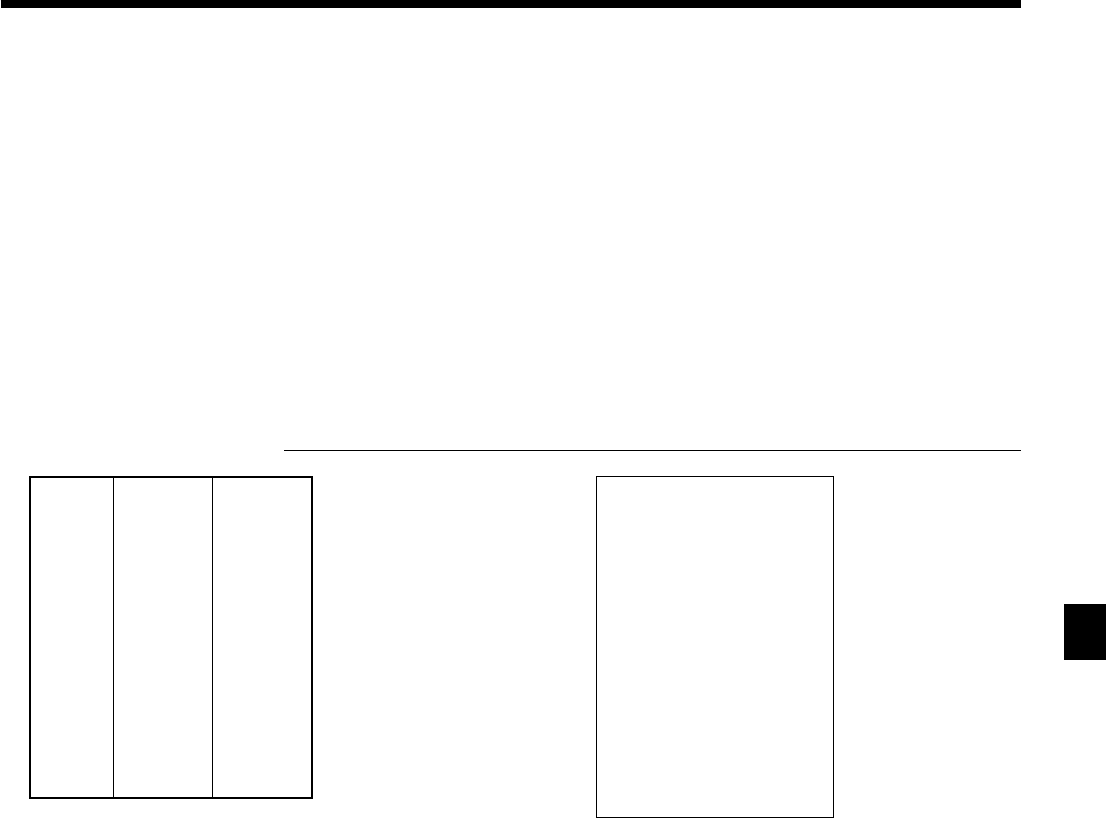

Example 5

OPERATION RECEIPT

2-!

3-"

T2-!

J

2-

II

II

I

a

In this example, the food stamp received as partial tender is $2.00, so that amount is deducted from both the

taxable 1 amount and taxable 2 amount. This means that the remaining taxable 1 amount is $2.00, while the

remaining taxable 2 amount is $3.00.

Dept. 1

$2.00

Item 1 —————————

Taxable 1, F/S

—————————————

Dept. 2

$3.00

Item 2 —————————

Taxable 2, F/S

—————————————

Dept. 1

$2.00

Item 3 —————————

Taxable 1/2, F/S

—————————————

Food stamp

$2.00

Payment —————————

Cash $5.23

REG 03-04-2000 15:50

C

01 MC#01 000135

1 DEPT01 T1 F $2.00

1 DEPT02 T2 F $3.00

1 DEPT01 T12F $2.00

FSST $7.00

FSTD $2.00

TA1 $2.00

TX1 $0.08

TA2 $3.00

TX2 $0.15

CASH $5.23