14

Getting Started

E

Tax table programming (continued)

Programming for Canadian tax tables procedure

State sales tax calculation data tables for all of the states that make up all Canadian provinces are included on

this page. This data is current as of October 30, 1994. Simply find your province in the tax tables and input

the data shown in its table.

Programming tax table

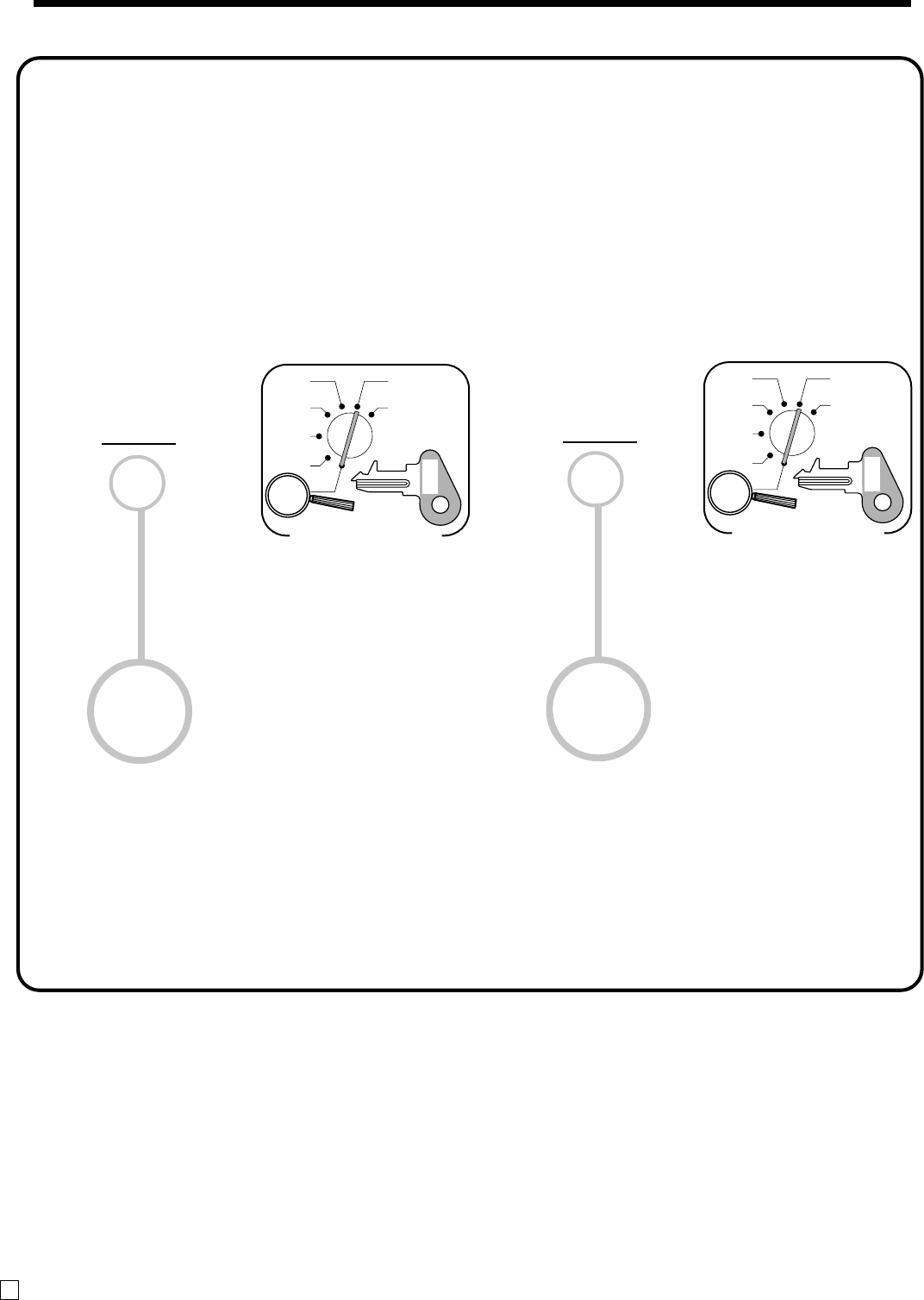

Example 1: Federal tax 7% (Add-on/round-off) Example 2: Ontario 10 % (Tax-on-tax/Round-off)

11.

• 4 tax tables are used for the following purpose

Table 1: Used for the federal taxable items.

Table 2: Used for the provincial taxable items.

Table 3/4: Used for the provincial taxable items for different tax table.

CAL

REG

OFF

RF

PGM

X

Z

Mode Switch

PGM

C-A32

CAL

REG

OFF

RF

PGM

X

Z

Mode Switch

PGM

C-A32

ONTARIO

7%

7

5002

4

3s

4

0125s

4

7a

4

5002a

4

s

4

3s

4

0225s

4

10a

4

5004a

4

s

ONTARIO

10%

10

5004

2

2

2

2

2

2

2

2

Assign table 1

7

5002

Terminate the program

Assign table 2

Table 3/4: 0325/0425

10

5004

Terminate the program