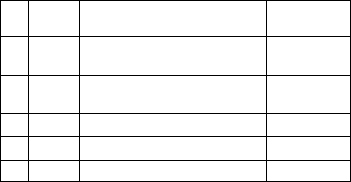

E-72

No. Display Name

Values Used

in Examples

4 n

Number of Coupon

3

Payments Until Maturity

5 RDV*

4

Redemption Price per $100

$100

of face value

6 CPN*

5

Coupon Rate 3%

7 PRC*

6

Price per $100 of face value

–97.61645734

8 YLD Annual Yield 4%

*

1

•You can specify a date (Date) or a number of coupon

payments (Term) as the term for bond calculations.

See the “Bond Date” setting under “Configuring

Settings” (page E-16).

•You can specify once a year (Annual) or once every

six months (Semi-Annual) as the number of coupon

payments per year. See the “Periods/Y” setting under

“Configuring Settings” (page E-16).

*

2

•You must input two digits for the month and day. This

means you should include a leading zero for values

from 1 through 9 (01, 02, 03... etc.)

•You can specify either month, day, year (MDY) or day,

month, year (DMY) as the date input format. See the

“Date Input” setting under “Configuring Settings” (page

E-16).

*

3

When calculating the yield on call, input the call date

for d2.

*

4

When calculating the yield of maturity, input 100 for RDV.

*

5

In the case of a zero coupon, input 0 for CPN.

*

6

•When calculating the redemption price per $100 of

face value (PRC), you can also calculate accrued

interest (INT) and purchase price including accrued

interest (CST).

•Input money paid out as a negative value, using the

y key to input the minus sign.