E-69

Useful features

Advanced programmings and registrations

Example:

• On the xed total report, not printing gross sales total (a = 1), not printing net sales total (b = 2), not

printing cash in drawer. (c = 4): D10 = 7 (1 + 2 +4 ).

• Not printing amount in drawer on xed total report: D9 = 1.

• On xed total report, not printing check amount in drawer (a = 1), not printing credit amount in drawer (b

= 4): D8 = 5 (1 + 4).

• D7 must be always 0.

• Not printing refunded amount in RF mode on xed total report: D6 = 4.

• Not printing total number of customers on xed total report (a = 1), not printing average sales amount

per customer (b = 2): D5 = 5 (1 + 4).

• D4 must be always 0.

• On xed total report, not printing commission 1 amount (a = 1), not printing commission 2 amount (b =

2), not printing amount of foreign currency cash and check (c = 4): D3 = 7 (1 + 2 + 3).

• On xed total report, not printing net total of <MINUS>, <COUPON>, <%-> etc. (a = 1), not printing

<REFUND> and <VOID> amounts (b = 2): D2 = 3 (1 + 2).

• On xed total report, not printing non-taxable amounts (a = 1), not printing rounded down amount (b =

2), not printing cancelled amount (c = 4): D1 = 7 (1 + 2 + 3).

Press 3o0822o7150450737Fo

Set code 10 (Print control of taxable amount)

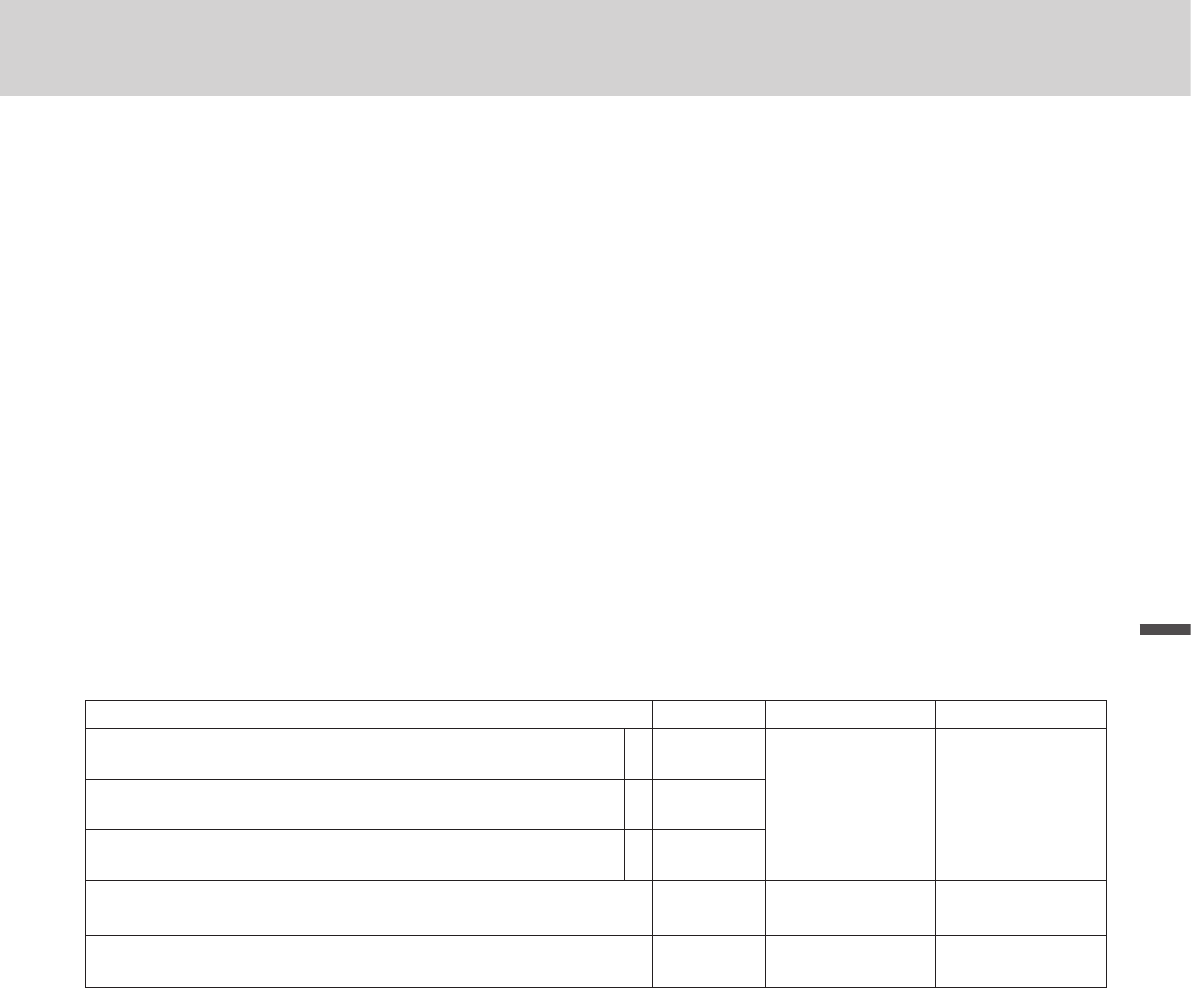

Description Selection Program code Default value

Print taxable amount 1 on receipt/journal.

a

Yes = 0

No = 1

B

(a+b+c) D10

º

(a+b+c) D10

Print taxable amount 2 on receipt/journal.

b

Yes = 0

No = 2

Print taxable amount 3 on receipt/journal.

c

Yes = 0

No = 4

Print taxable amount 4 on receipt/journal. Yes = 0

No = 1

B

D9

º

D9

Must be “00000000” (eight zeros)

º to º

D8 to D1

º to º

D8 to D1