23

Automatic tax

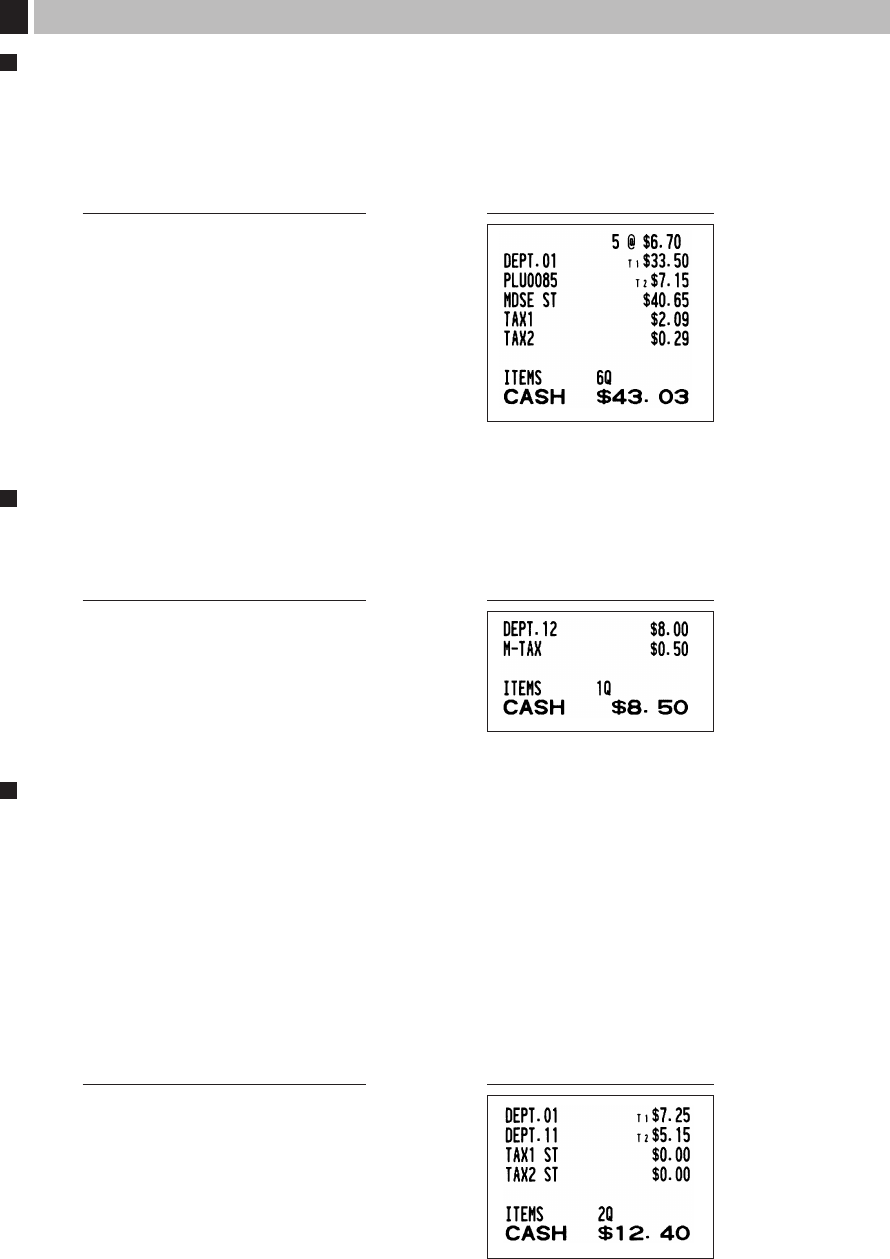

When the register is programmed with a tax rate (or tax table) and the tax status of an individual department is

set for taxable, it computes the automatic tax on any item that is entered directly into the department or indirectly

via a related PLU.

Example: Selling five $6.70 items (dept. 1, taxable 1) and one $7.15 item (PLU 85, taxable 2) for cash

Manual tax

The machine allows you to enter tax manually after it finalizes an item entry.

Example: Selling an $8.00 item (dept. 12) for cash with 50 cents as tax

Tax delete

You can delete the automatic tax on the taxable 1 and taxable 2 subtotal of each transaction by pressing the

t

key after the subtotal is displayed.

To delete taxable 1 subtotal, press

T

,

s

to get taxable 1 subtotal, and then press

t

to delete the

subtotal.

To delete taxable 2 subtotal, press

U

,

s

to get taxable 2 subtotal, and then press

t

to delete the

subtotal.

To delete all taxable (1-4) subtotals, press

T

,

U

and

s

( “TAX ST 0.00” is displayed) and press

t

to delete all the taxable subtotals.

Example: Selling a $7.25 item (dept. 1, taxable 1) and another $5.15 item (dept. 11, taxable 2) for cash and

entering the sale as non-taxable

725

¡

515

œ

Ts

t

Us

t

A

Receipt printKey operation example

800

∑

50

t

A

Receipt printKey operation example

5

@

670

¡

85

p

A

Receipt printKey operation example

Tax Calculation

6

A406_2 FOR THE OPERATOR 09.10.14 9:02 AM Page 23