10. REGISTERING PROCEDURE AND PRINT FORMAT

EO1-11095

10-20

10.33 TAXABLE TOTAL READ and SUBTOTAL PRINT

- - -

- - -

10.33 TAXABLE TOTAL READ and SUBTOTAL PRINT

(when only one of [ST] and [TXBL TL] keys, not both, is installed on the keyboard)

In this case, the key is usually programmed as [ST] key with [TXBL TL] functions. Since this key has both [ST]

and [TXBL TL] functions, it may be labeled as “[ST]” in some stores or as “[TXBL TL]” in others.

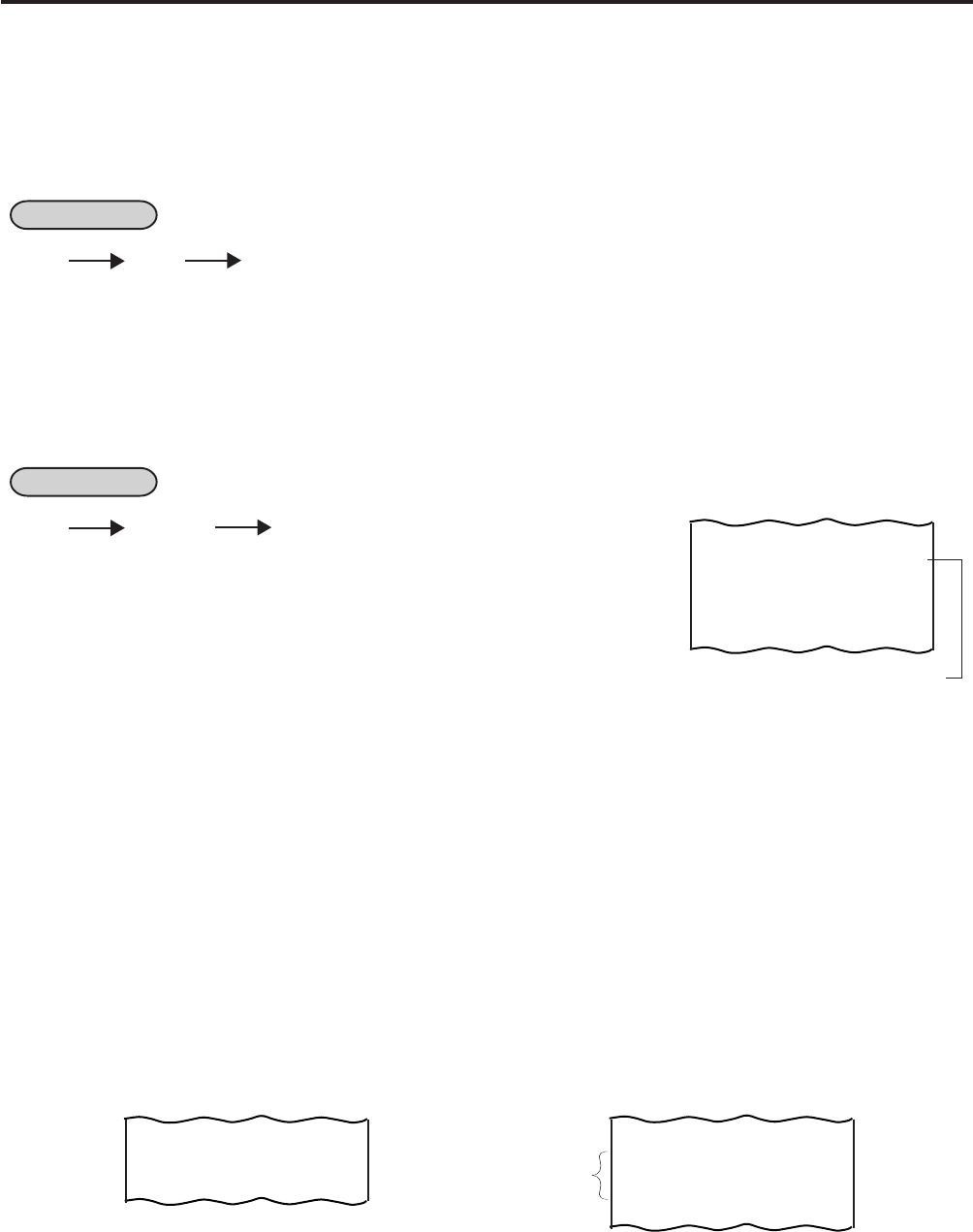

OPERATION

[ST]

(or [TXBL TL])

The sale total including taxes of the items so far entered is displayed (and the sale total pre-taxed is

printed if so programmed), but the sale is not finalized. Additional item entries are allowed, if any.

. . .

- - -

- - -

10.34 SELECTIVE ITEMIZER (SI) TOTAL READ

OPERATION -- Journal Print Format --

[SI/TL] (for Single-SI Machine)

([SI1/TL] and/or [SI/2/TL] for Dual-SI Machine)

SI Total Calculated

SNACK $10.00TS

SI1 TL -0.70

TAX $0.60

CASH $

9

.

90

SI-net Status Item Symbol

TAX $3.14

CASH $

16

.

34

TAX1 $2.48

TAX2 $0.66

CASH $

16

.

34

Example of

Separate Print

Lines

Example of

Consolidated

Print Line

The SI total is displayed and printed on journal (and printed on the receipt if so programmed).

NOTE: The fraction process method is fixed to Round OFF.

10.35 TAX CALCULATION AND PRINT

Your register has been programmed with proper tax tables (tax breaks and/or tax rates).

Each department or PLU has been programmed with proper tax status, i.e. taxable or non-taxable status of each

Tax (of maximum 4 taxes of Tax 1 to Tax 4, and GST).

On finalizing a sale, the taxes due are automatically calculated and printed on the receipt, and thus added to the

sale.

Whether all taxes (Tax 1 to Tax 4, and GST) are consolidated into one line print or individually printed in separate

lines is a program option.

-- Receipt Print Format --