144 Section 13: Investment Analysis

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 144 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Full- and Partial-Year Depreciation with Crossover

When calculating declining-balance depreciation it is often advantageous for tax

purposes to switch from declining balance to straight-line depreciation at some

point. This hp 12c program calculates the optimum crossover point and

automatically switches to straight-line depreciation at the appropriate time. The

crossover point is the end of the year in which the declining-balance depreciation

last exceeds or equals the amount of straight-line depreciation. The straight-line

depreciation is determined by dividing the remaining depreciable value by the

remaining useful life.

Given the desired year and the number of months in the first year, this program

calculates the depreciation for the desired year, the remaining depreciable value,

and the total depreciation through the current year.

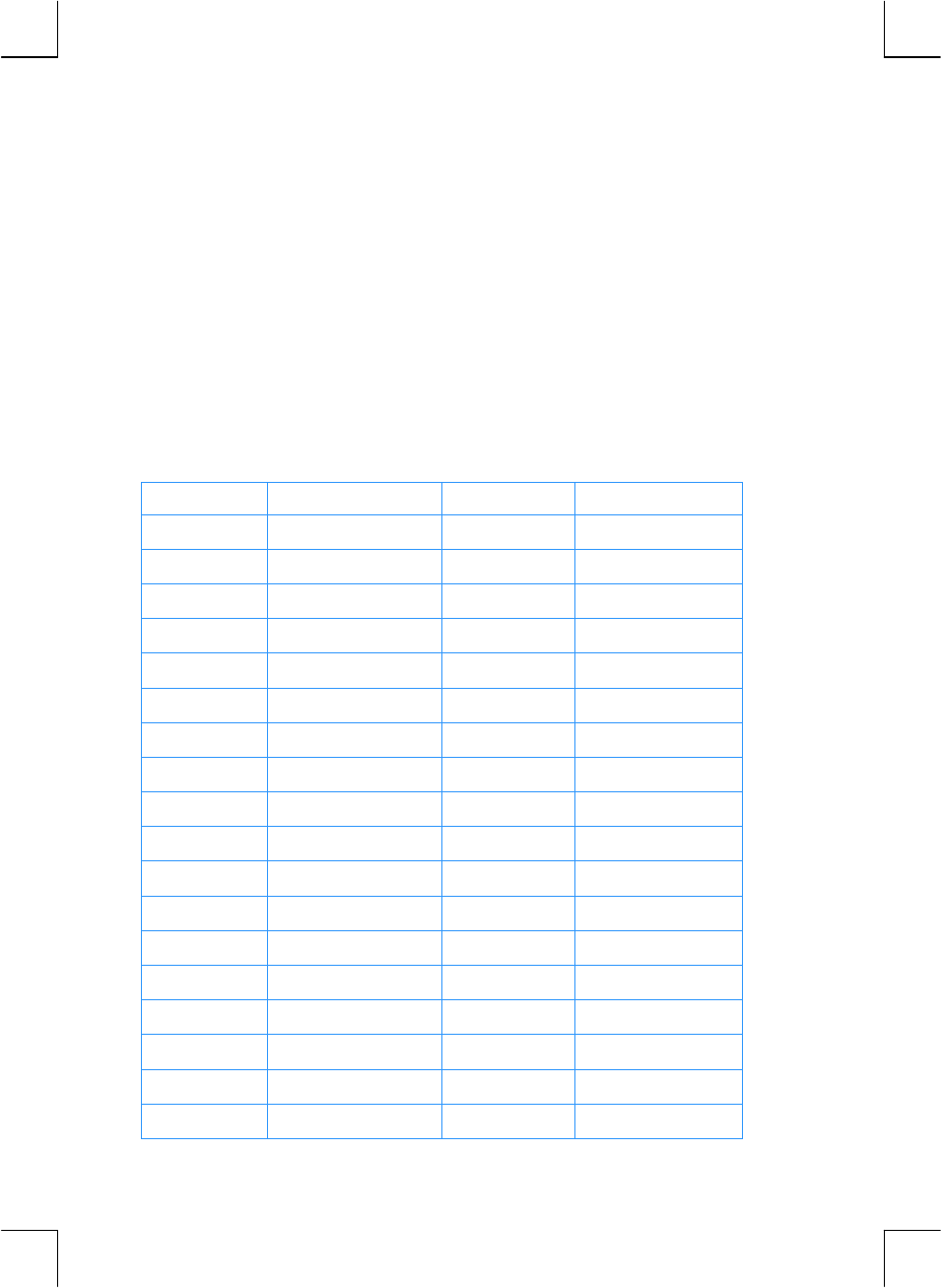

KEYSTROKES DISPLAY KEYSTROKES DISPLAY

fs

:4

48- 45 4

fCLEARÎ

00-

z

49- 10

1

01- 1

go

50- 43 34

2

02- 2

gi53

51-43, 33 53

z

03- 10

gi65

52-43, 33 65

?6

04- 44 6

d

53- 33

:n

05- 45 11

0

54- 0

~

06- 34

:0

55- 45 0

-

07- 30

go

56- 43 34

?4

08- 44 4

gi86

57-43, 33 86

d

09- 33

:$

58- 45 13

?0

10- 44 0

:5

59- 45 5

1

11- 1

-

60- 30

?-0

12-44 30 0

$

61- 13

?2

13- 44 2

1

62- 1

?3

14- 44 3

?-4

63-44 30 4

f#

15- 42 25

gi40

64-43, 33 40

:6

16- 45 6

:4

65- 45 4