62 Section 4: Additional Financial Functions

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 62 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Example:

An investor has an opportunity to purchase a piece of property for

$79,000; and he would like a 13

1

/

2

% return. He expects to be able to sell it after

10 years for $100,000 and anticipates the yearly cash flows shown in the table

below:

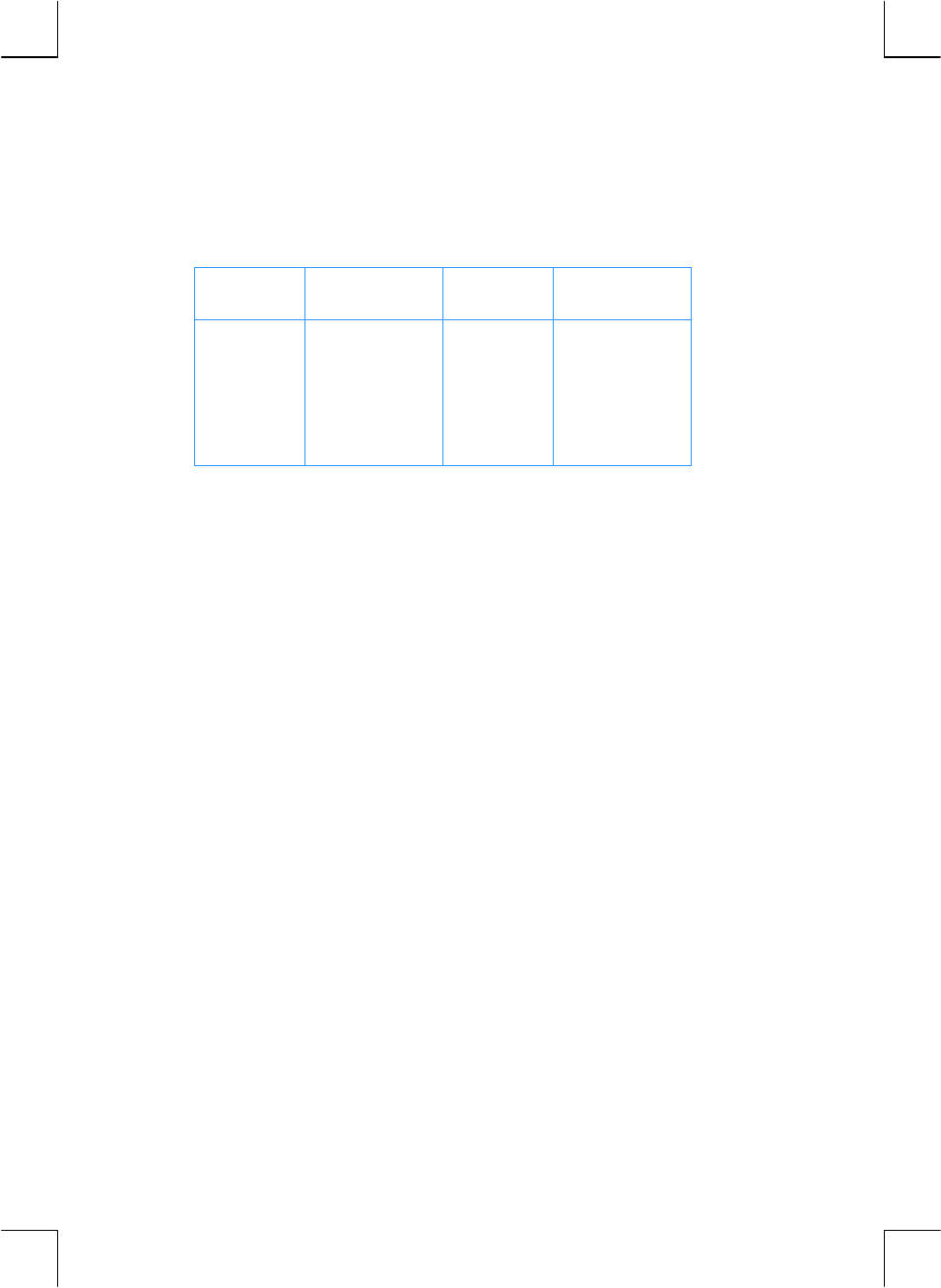

Year Cash Flow Year Cash Flow

1

2

3

4

5

$14,000

$11,000

$10,000

$10,000

$10,000

6

7

8

9

10

$9,100

$9,000

$9,000

$4,500

$100,000

Since two cash flow amounts ($10,000 and $9,000) are repeated consecutively,

we can minimize the number of storage registers required by using the method just

described.

Keystrokes Display

fCLEARH

0.00

Clears financial and storage

registers.

79000ÞgJ

–79,000.00

Initial investment (with minus si

g

n for

a negative cash flow).

14000gK

14,000.00

First cash flow amount.

11000gK

11,000.00

Next cash flow amount.

10000gK

10,000.00

Next cash flow amount.

3ga

3.00

Number of times this cash flow

amount occurs consecutively.

9100gK

9,100.00

Next cash flow amount.

9000gK

9,000.00

Next cash flow amount.

2ga

2.00

Number of times this cash flow

amount occurs consecutively.

4500gK

4,500.00

Next cash flow amount.

100000gK

100,000.00

Final cash flow amount.

:n

7.00

Seven different cash flow amounts

have been entered.

13.5¼

13.50

Stores i.

fl

907.77

NPV.

Since NPV is positive, the investment would increase the financial value of the

investor’s assets by $907.77.