158 Section 14: Leasing

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 158 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

Example 2:

Using the information from example 1, what would the monthly

payments be if the lessor desired a yield of 18% annually

?

Keystrokes Display

487.29

From previous example.

18\12z

1.50

Monthly interest rate.

?1t

520.81

Monthly payment received by lessor.

Solving For Yield

Solving for yield is essentially the same as solving for Internal Rate of Return (IRR).

The keystrokes are as follows:

1. Press fCLEARH.

2. Key in the amount of the first cash flow then press gJ. This initial amount

is the difference between the initial loan amount and any payments received

at closing time. Observe the sign convention: positive for cash received and

negative for cash paid out.

3. Key in the amount of the first cash flow then press gK. Then key in the

number of times that cash flow occurs then press ga.

4. Key in 0gK then the number of advance payments minus one. Then

press ga.

5. Key in the residual then press gK. Then press fL to solve for

periodic yield.

Example:

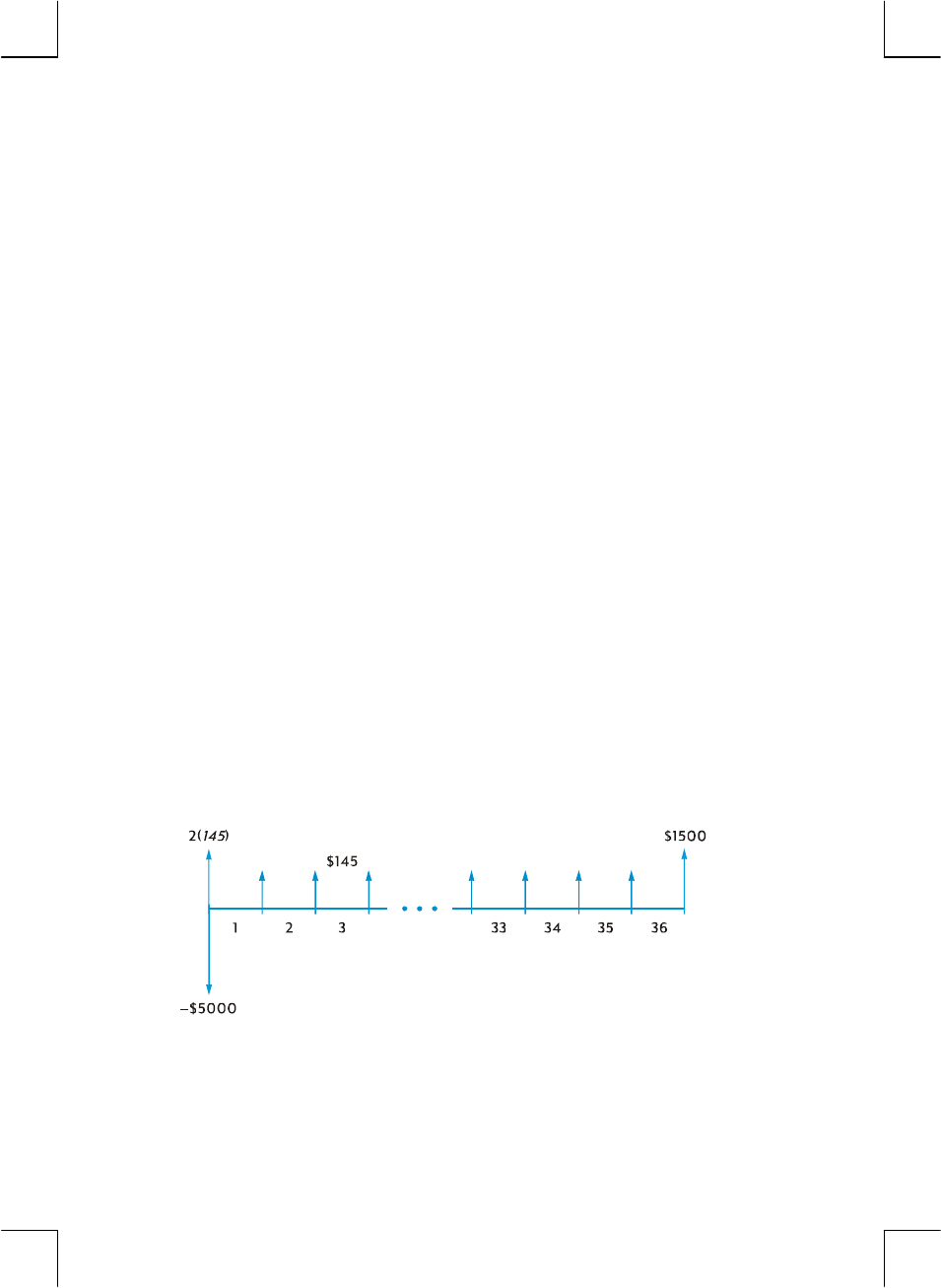

Equipment worth $5000 is leased for 36 months at $145 per month.

The lessee has agreed to pay the first and last month’s payments in advance. At

the end of the lease, the equipment may be purchased for $1500. What is the

annual yield to the lessor if the equipment is purchased

?

Keystrokes Display

fCLEARH

5000Þ\

145\2