Bonds

47

Table 5-1 Bond Menu Items

Variable Description

Call Call value. Default is set for a call price per 100.00 face value. A bond at maturity

has a call value of 100% of its face value. Note: input only.

Yield% Yield% to maturity or yield% to call date for given price. Note: input/output.

Price Price per 100.00 face value for a given yield. Note: input/output.

Accrued Interest accrued from the last coupon or payment date until the settlement date for

a given yield. Note: this item is Read-only.

Actual/Cal.360 Actual (365-day calendar) or Cal.360 (30-day month/360-day year calendar).

Press I to toggle between these options.

Annual/Semiannual

Bond coupon (payment) frequency. Press I to toggle between these

options.

Bond Calculation Example

What price should you pay on April 28, 2010 for a 6.75% U.S. Treasury bond maturing on June 4, 2020, if you want a

yield of 4.75%? Assume the bond is calculated on a semiannual coupon payment on an actual/actual basis. See Table 5-

2. The example below is shown with RPN as the active operating mode.

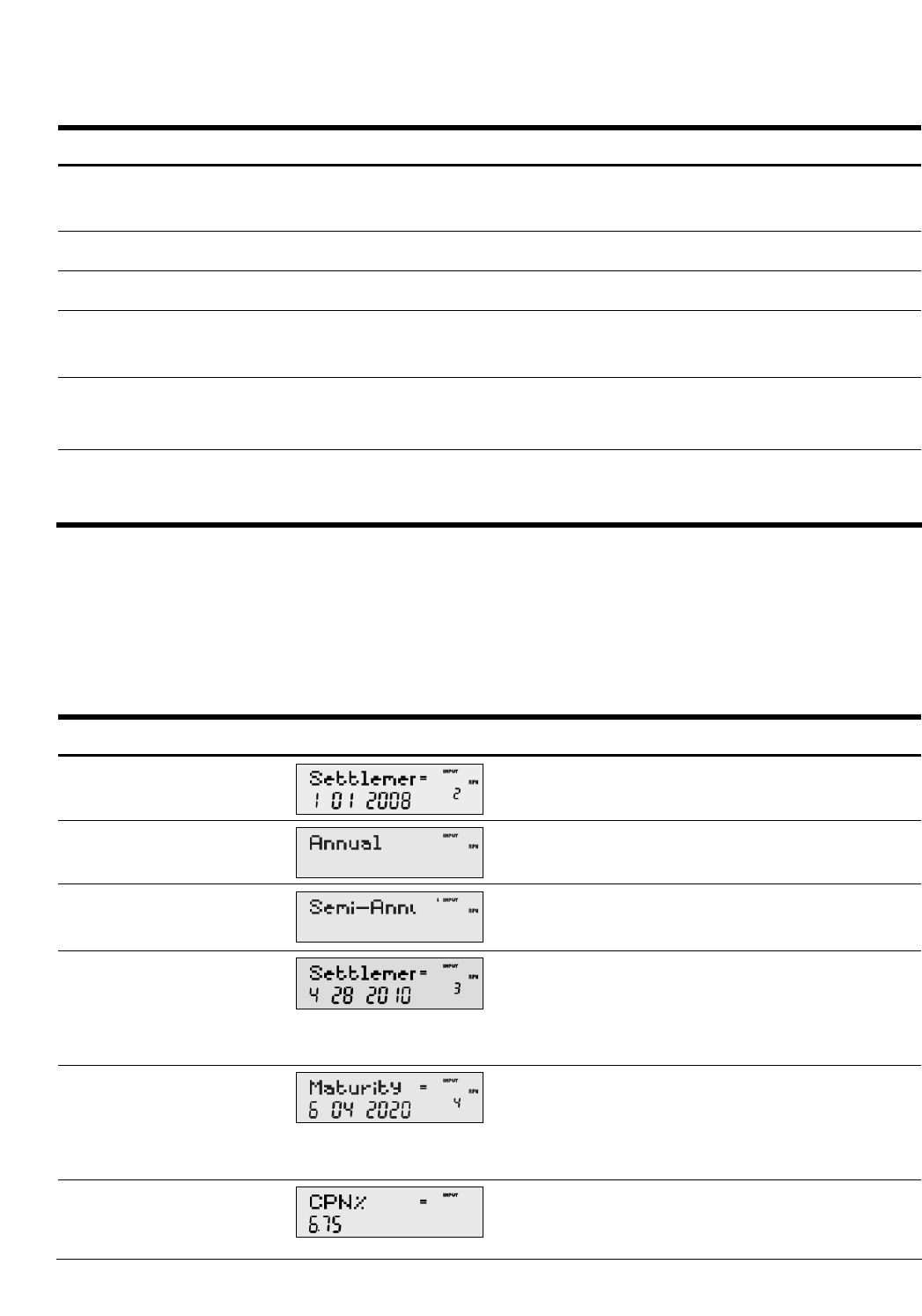

Table 5-2 Bond Calculation Example

Key Display Description

B

Opens the Bond menu.

>

Scrolls to bond coupon (payment) frequency.

I

Selects semiannual coupon payment, as required by the

example.

<4.28

2010

I

Inputs April 28, 2010 for the settlement date (

mm.ddyyyy

format).

<6.04

2020

I

Inputs June 4, 2020 for the maturity date.

<6.75

I

Inputs

6.75%

for the value for

CPN%

.