86

Exampledataofabovetaxtable(8%)

TAXRATE: 8.0000 (enter 8)

CYCLE: 1.00 (enter 100)

INITIALTAX: 0.01 (enter 1)

LOWERTAX: 0.11 (enter 11)

BREAKPOINT1: 0.26 (enter 26)

BREAKPOINT2: 0.47 (enter 47)

BREAKPOINT3: 0.68 (enter 68)

BREAKPOINT4: 0.89 (enter 89)

BREAKPOINT5: 0.89 (enter 89)

BREAKPOINT6:1.11 (enter 111)

BREAKPOINT7:1.11 (enter 111)

BREAKPOINT8: 1.11 (enter 111)

•%Tax

Procedure

Program each item as follows:

•TAXRATE(Usethenumericentry)

Tax rate (max. 7 digits: 0.0000 to 999.9999%).

•LOWERTAX(Usethenumericentry)

Lowest taxable amount (max. 5 digits: 0.00 to 999.99).

■

Doughnutexempt

Procedure

Program each item as follows:

•QUANTITY(Usethenumericentry)

Quantity for doughnut tax exempt (2 digits: 1 to 99/0).

NOTE

The programming is effective for “taxable 1 & taxable 3” items on Canadian tax (CANADA TAX

01 or CANADA TAX 10).

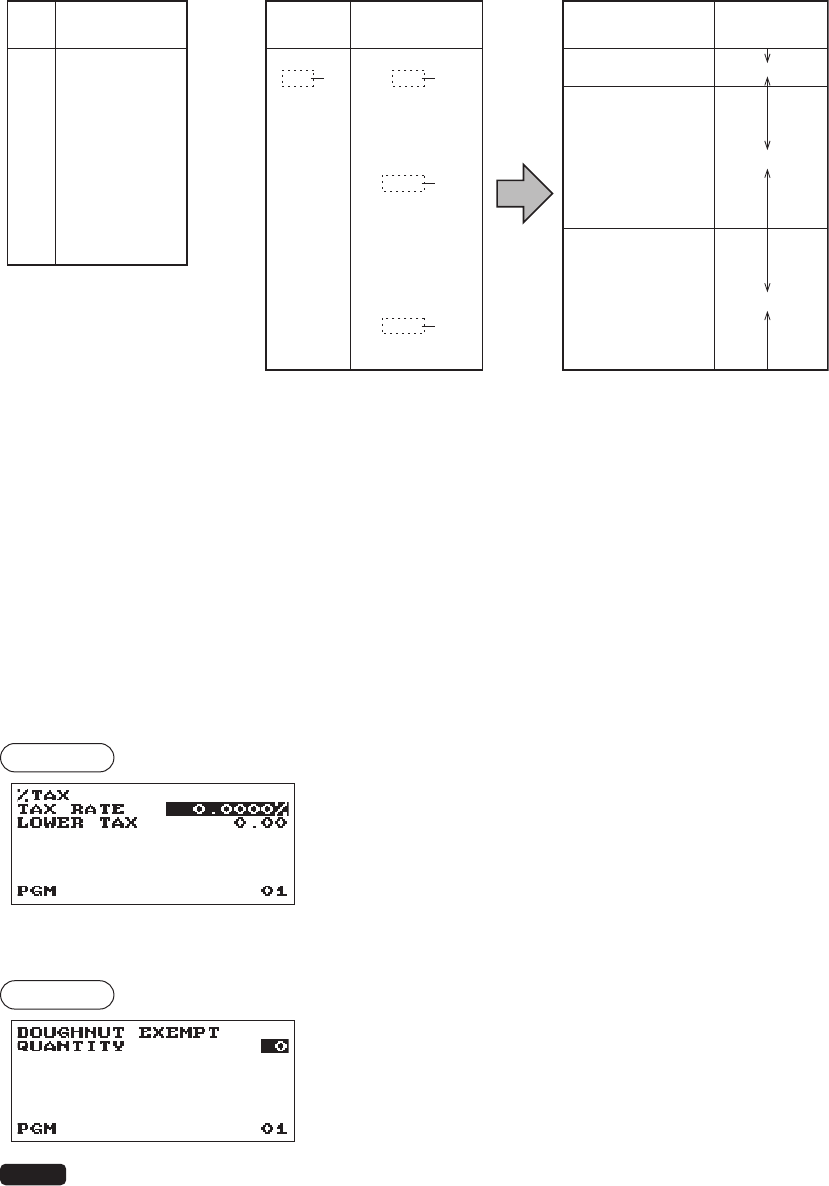

Sample tax table Modification of the left tax table

Example 8%

Tax

Minimum

breakpoint

.00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

.14

.15

.16

.17

.01

.11

.26

.47

.68

.89

.89

1.11

1.11

1.11

1.26

1.47

1.68

1.89

1.89

2.11

2.11

2.11

T Q

M1

M2

Tax

Minimum

breakpoint

.00

.01

.02

.03

.04

.06

.09

.10

.11

.12

.14

.17

.01

.11

.26

.47

.68

.89

1.11

1.26

1.47

1.68

1.89

2.11

Breakpoint

difference (¢)

1

10 (0.11-0.01)

15 (0.26-0.11)

21 (0.47-0.26)

21 (0.68-0.47)

21 (0.89-0.68)

0 (0.89-0.89)

22 (1.11-0.89)

0 (1.11-1.11)

0 (1.11-1.11)

15 (1.26-1.11)

21 (1.47-1.26)

21 (1.68-1.47)

21 (1.89-1.68)

0 (1.89-1.89)

22 (2.11-1.89)

0 (2.11-2.11)

0 (2.11-2.11)

B: Non-cyclic

C: Cyclic-1

D: Cyclic-2