To delete a tax table, use the following sequence:

*1 First figure: The first figure to be entered depends upon whether the difference between a minimum

breakpoint to be entered and the preceding minimum breakpoint is not less than $1.00 or

more than 99¢. When the difference is not less than $1.00, enter “1,” and when it is not more

than 99¢, enter “0” or nothing.

Second figure: The second figure depends upon whether your tax table is to be programmed as tax table 1,

2, 3 or 4. When your tax table is to be programmed as tax table 1, enter “1”; when it is to be

programmed as tax table 2, enter “2”; when it is to be programmed as tax table 3, enter “3”;

and when it is to be programmed as tax table 4, enter “4”.

*2 If the rate is fractional (e.g. 4-3/8%), then the fractional portion (3/8) would be converted to its decimal

equivalent (i.e. .375) and the resulting rate of 4.375 would be entered. Note that the nominal rate (R) is

generally indicated on the tax table.

If you make an incorrect entry before entering the M in programming a tax table, cancel it with the

c

key; and if you make an error after entering the M, cancel it with the

ı

key. Then program

again from the beginning correctly.

• Limitations to the entry of minimum breakpoints

Your register can support a tax table consisting of no more than 72 breakpoints. (The number of breakpoints is

36 maximum when the breakpoint difference is $1.00 or more.) If the number of breakpoints exceeds the

register’s table capacity, then the manual entry approach should be used.

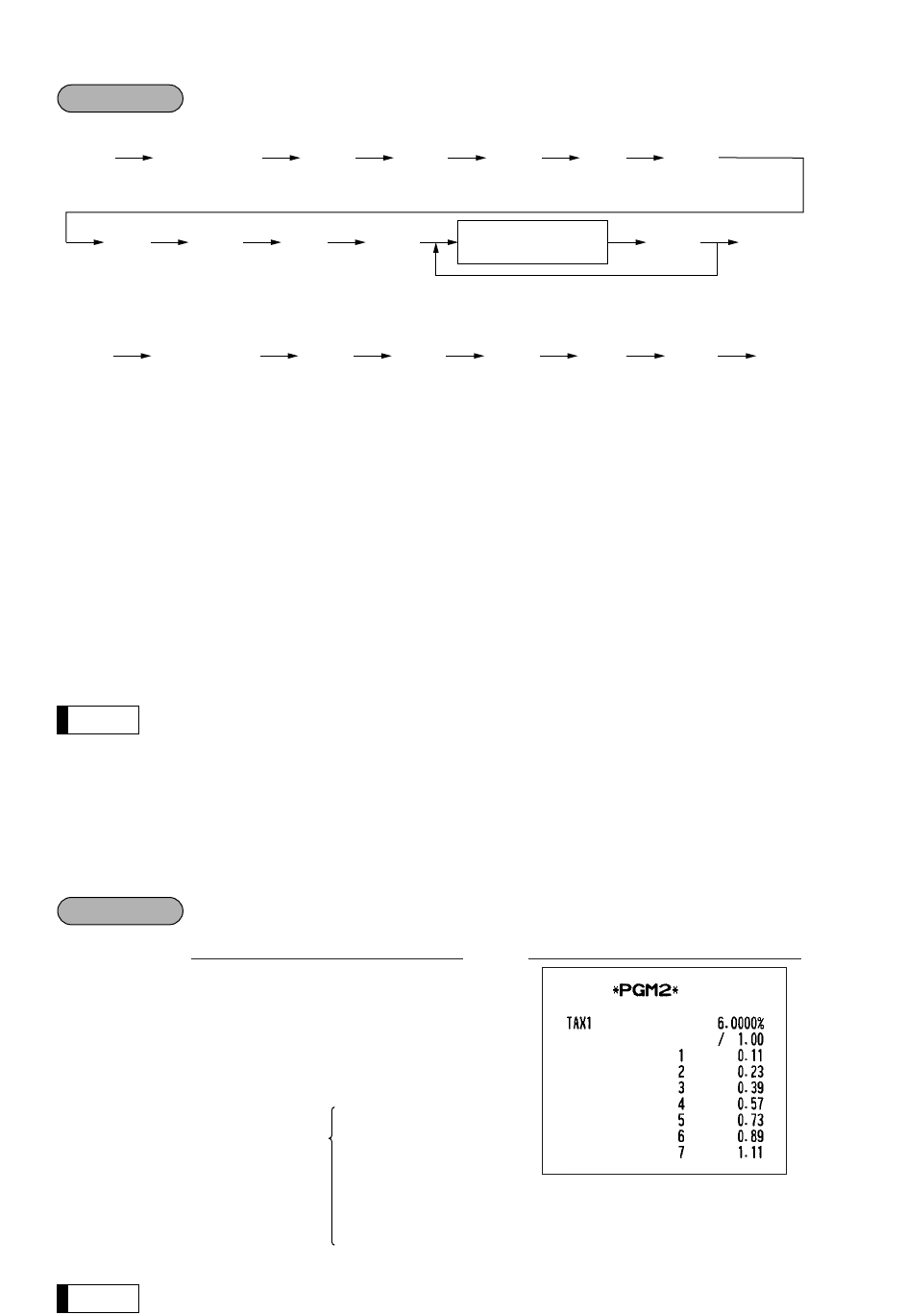

Programming the sample tax table shown on the previous page as tax table 1

You do not need to enter the trailing zeros of the tax rate (after the decimal point) but you do need

to enter the decimal point for fractions.

Note

†

1

@

6

@

100

@

1

@

11

@

23

@

39

@

57

@

73

@

89

@

111

@

a

PrintKey operation

Example

Note

† @ @ t

max. six digits

(0.0001 - 99.9999%)

max. four

digits

One- or two-

digit number

Rate

M

*1

*2

@

† @ @

max. six digits

(0.0001 - 99.9999%)

max. four

digits

One- or two-

digit number

Rate

M

*1

*2

@

max. three

digits

T

@

max. five

digits

Q

@ Ç

Minimum breakpoint

max. five digits

Repeat until the MAX point is entered.

@

Procedure

Tax rate →

M →

T →

Q →

The first

cyclic

portion

M1

(MAX point)→

94