Source Technologies, LLC ST9630 Secure MICR Printer User’s Guide

26

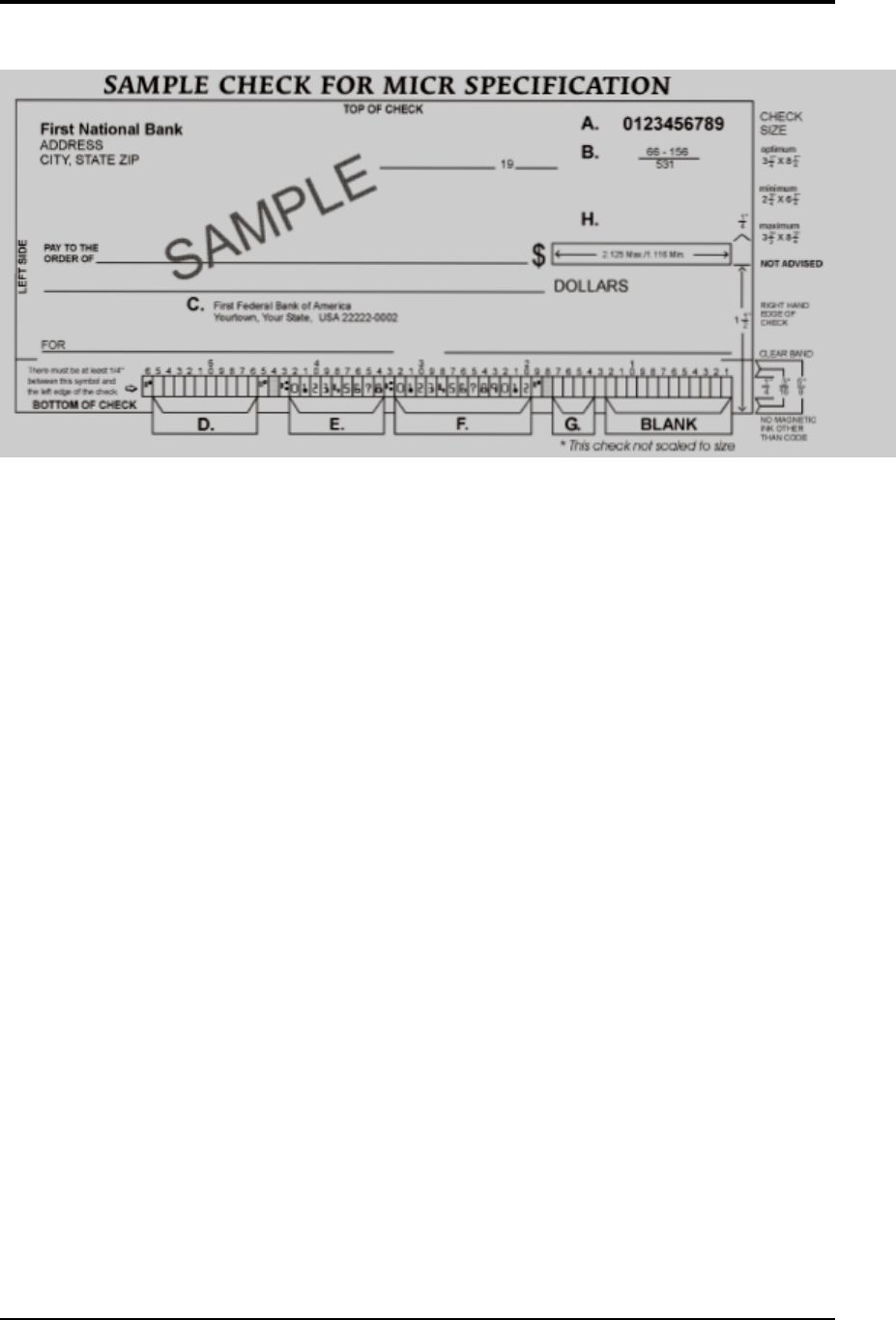

Figure 3.1: Sample Check

A. Serial Number: Must be in the upper right corner and match the serial number in the

MICR line (see D for further explanation).

B. Fractional Routing Transit Number: Should be in the upper right corner and must

match the routing transit number in the MICR line with the exception of the state

prefix number (ex. 66 = NC, 67 = SC, 64 = GA, etc.) and the preceding zeros.

C. Bank Name, State, City: The bank logo is optional. Name of bank, city and state

where the account will be assigned/opened are required fields.

D. Aux On-Us (46-55): This is a required field if the customer desires services offered

by the bank which require a serial number. The serial number format is controlled by

the payer’s bank. A & D should match.

E. Routing Number (34-42): Designates the Federal Reserve district and financial

institution. Each city, state or region that the bank serves has a unique institution

identifier. IMPORTANT: positions 35-42 are the Routing Numbers; position 34 is the

check digit.

F. Account Number: This is a unique number assigned to the customer’s account.

G. Optional Serial Number: Used for personal accounts (checks only). This should be

a 4-digit, zero-filled field that matches the serial number in the upper right corner.

H. Convenience Amount Area: should be in the general location shown above in the

diagram. The illustrated box in the diagram is optional and if used, should conform

to ANS X9.7. A single stroke dollar sign is required.

MICR Check Design | 3