132 Section 12: Real Estate and Lending

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 132 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

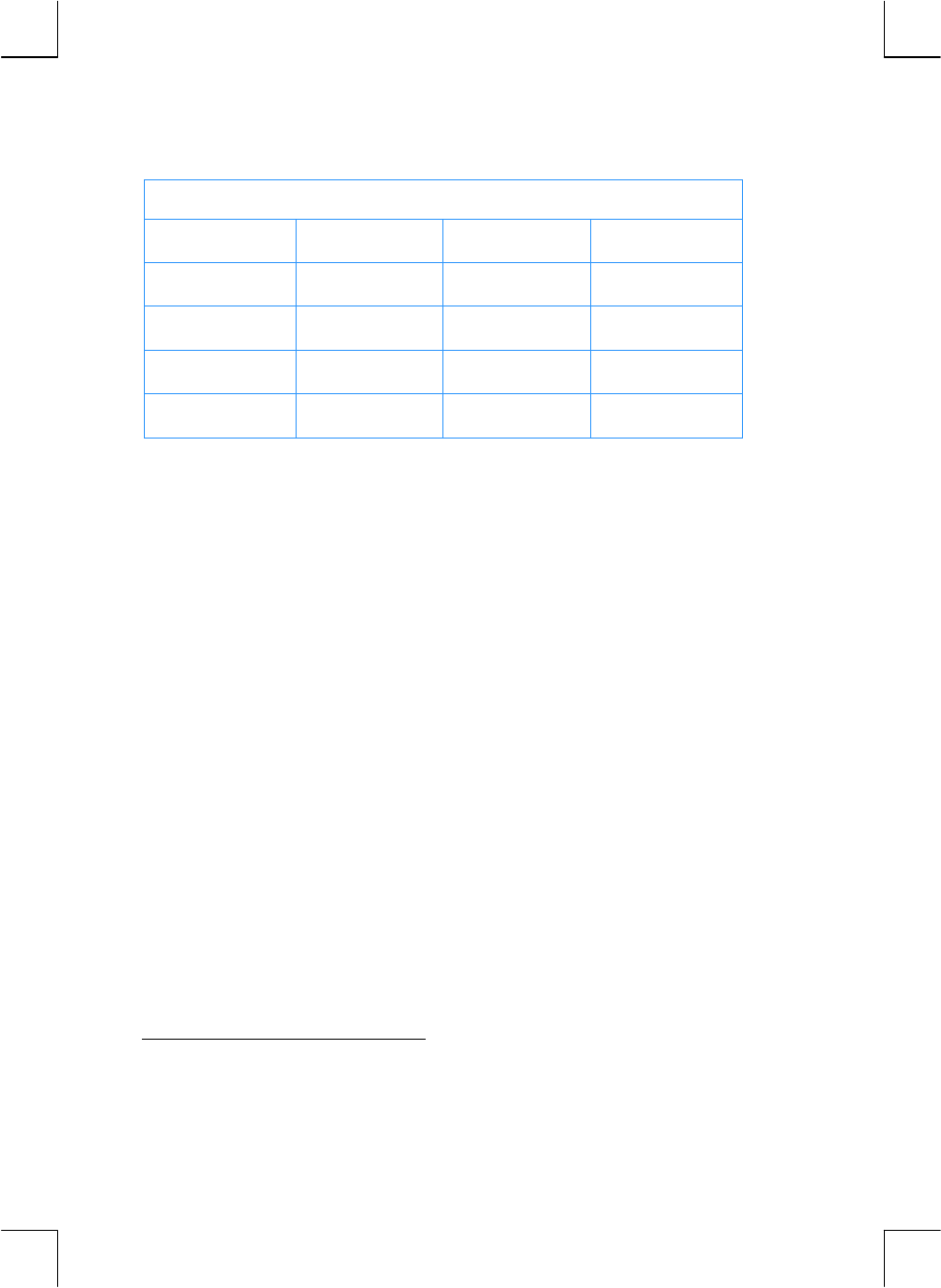

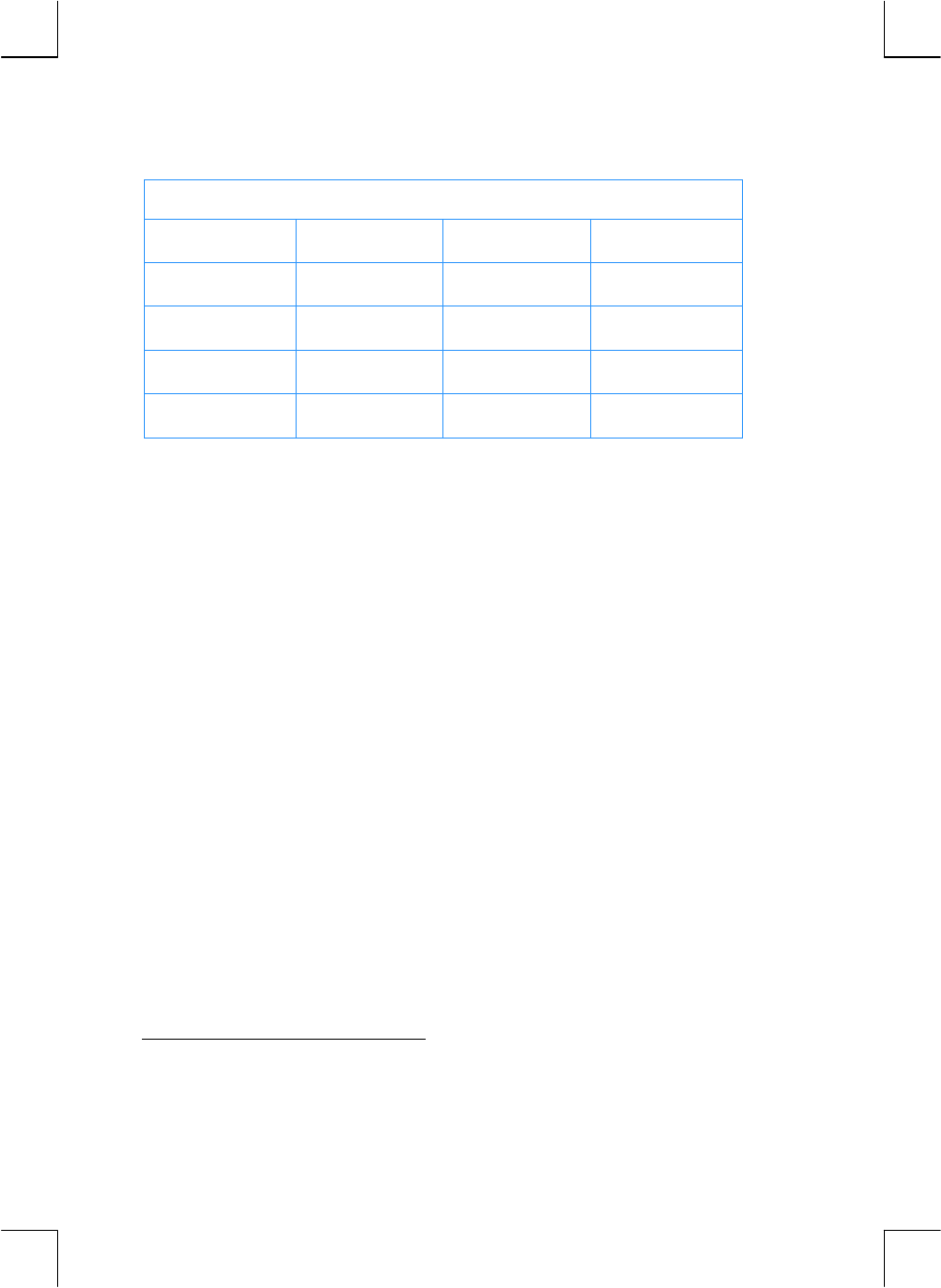

REGISTERS

n: Period i: Apprec. PV: Price PMT: Used

FV: Used

R

0

: Period R

1

: Dwn Pmt R

2

: Life

R

3

: i(Mtg)

R

4

: Taxes/Mo

R

5

: Improve.

R

6

: Closing C.

R

7

: % Comm. R

8

: Rent R

9

: Savings i R

.0

: Bracket

R

.1

: Unused.

1. Key in the program.

2. Key in the estimated down payment then press ?1.

3. Key in the life of the mortgage then press ?2.

4. Key in the annual mortgage interest rate then press ?3.

5. Key in the estimated monthly taxes then press ?4.

6. Key in the total amount estimated for monthly repairs, improvements,

incremental insurance, utility costs, and other expenses, then press ?5.

7. Key in the closing costs then press ?6.

8. Key in the selling cost as a percentage of the selling price. This should

include sales commission, escrow fees, etc. then press ?7.

9. Key in the monthly rent for the alternative housing then press ?8.

10. Key in the savings or alternative investment annual interest rate as a

percentage then press ?9.

11. Key in the combined State and Federal marginal tax rate

*

as a percentage

then press ?.0.

12. Press fCLEARG then key in the number of years involved in the

investment; press n.

13. Key in the estimated rate of yearly appreciation as a percentage then press

¼.

14. Key in the price of the house under consideration then press $.

15. Press t to compute the net proceeds from the sale of the house. (A

negative value indicates money lost.)

*

The user should key in the total marginal income tax — Federal plus State — to obtain

calculations which reflect the tax advantages of home ownership. Because of the complexities

of tax laws and different financial and tax considerations for each individual, this program

should only serve as a guide in considering an investment of this type. For more specific,

detailed information, consult a tax accountant or qualified tax advisor.