Section 3: Basic Financial Functions 45

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 45 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

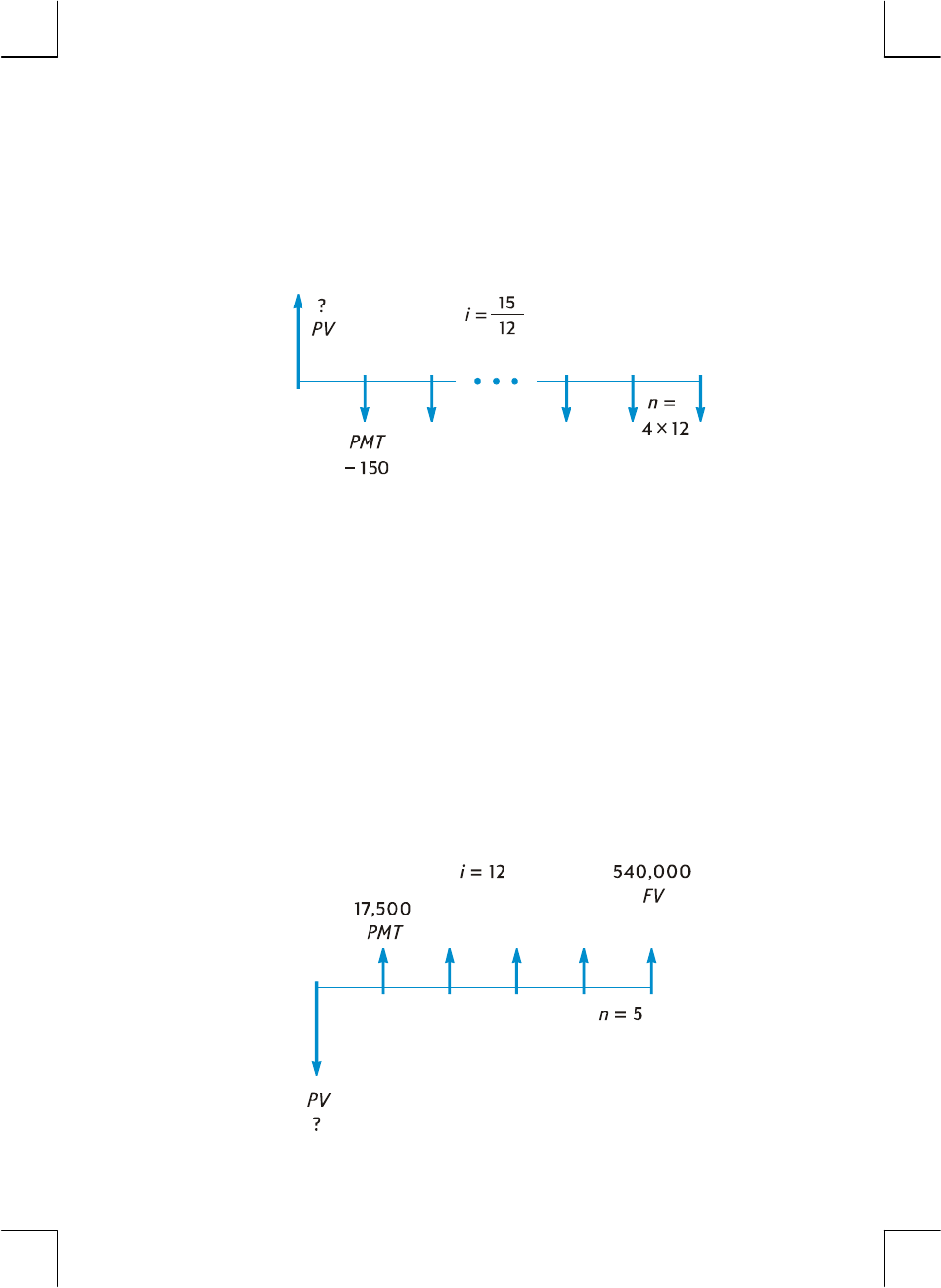

Example 1:

You’re financing a new car purchase with a loan from an institution

that requires 15% interest compounded monthly over the 4-year term of the loan. If

you can make payments of $150 at the end of each month and your down

payment will be $1,500, what is the maximum price you can pay for the car

?

(Assume the purchase date is one month prior to the date of the first payment.)

Keystrokes Display

fCLEARG

4gA

48.00

Calculates and stores n.

15gC

1.25

Calculates and stores i.

150ÞP

–150.00

Stores PMT (with minus sign for cash

paid out).

gÂ

–150.00

Sets payment mode to End.

$

5,389.72

Maximum amount of loan.

1500+

6,889.72

Maximum purchase price.

Example 2:

A development company would like to purchase a group of

condominiums with an annual net cash flow of $17,500. The expected holding

period is 5 years, and the estimated selling price at that time is $540,000.

Calculate the maximum amount the company can pay for the condominiums in

order to realize at least a 12% annual yield.