Section 13: Investment Analysis 141

File name: hp 12c_user's guide_English_HDPMBF12E44 Page: 141 of 209

Printered Date: 2005/7/29 Dimension: 14.8 cm x 21 cm

remaining depreciable value. If desired, press

:$:3=~-:M- to find the total depreciation through the

current year.

9. Press t for the amount of depreciation then, if desired, press ~ for the

remaining depreciable value for the next year. Repeat this step for the

following years.

10. For a new case press gi00 and return to step 2.

Example:

An electron beam welder which costs $50,000 is purchased 4 months

before the end of the accounting year. What will the depreciation be during the

first full accounting year (year 2) if the welder has a 6 year depreciable life, a

salvage value of $8,000 and is depreciated using the declining-balance

depreciation method

?

The declining-balance factor is 150%.

Keystrokes Display

fCLEARG

50000$

50,000.00

Book value.

8000M

8,000.00

Salvage value.

150¼

150.00

Declining-balance factor.

6n

6.00

Life.

2\

2.00

Year desired.

4t

2.00

11,458.33

Second year:

depreciation.

Sum-of-the-Years-Digits Depreciation

The following hp 12c program calculates the sum-of-the-years-digits depreciation

for the year desired with the acquisition date occurring at any time during the

year.

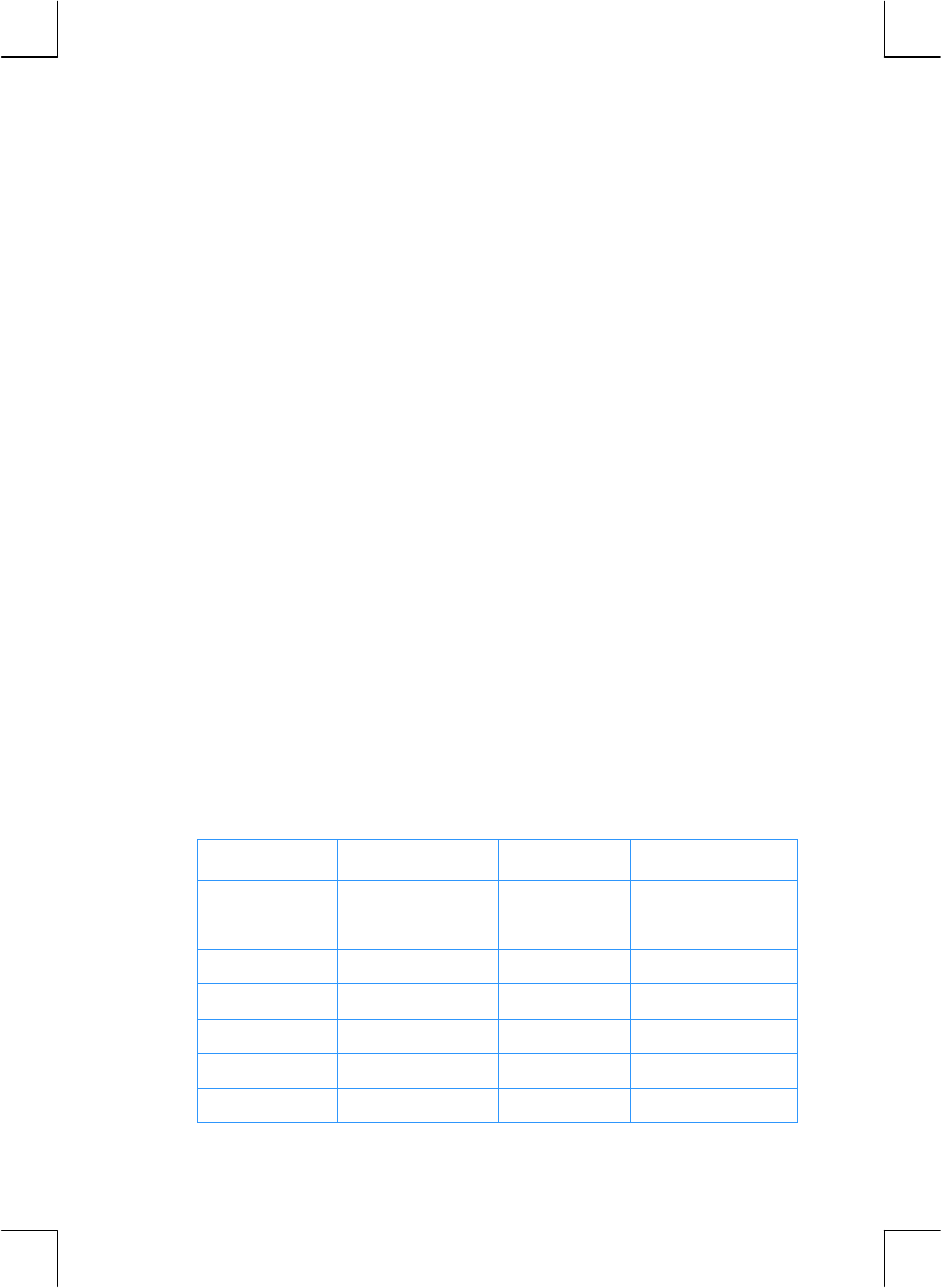

KEYSTROKES DISPLAY KEYSTROKES DISPLAY

fs

-

21- 30

fCLEARÎ

00-

n

22- 11

1

01- 1

:0

23- 45 0

2

02- 2

gm

24- 43 35

z

03- 10

gi35

25-43, 33 35

?1

04- 44 1

:2

26- 45 2

~

05- 34

gu

27- 43 31