82

TaxProgramming

Use the following procedure to select any option included in the tax group:

NOTE

The register is adapted to US and Canadian tax systems. If the Canadian tax system is required,

the tax system must be changed (see page 83 for tax system selections), then program the tax

rate or tax table and quantity for doughnut exempt which are described in this section.

Prior to the entry of sales transactions, the tax programming must be performed in accordance with the

laws of the state. The register is provided with programming four different tax rate. The one-tax system is

sufcient to cover most areas. However, in some areas that has a separate local tax (such as a Parish tax)

or a hospitality tax, the multi-tax system is useful.

If the taxable item is entered, the tax will be automatically added to merchandise subtotal according to the

programmed tax status for the department. The tax can be also entered manually.

The register is provided with two types of tax programming methods. The % tax method is used for a straight

percentage rate per dollar. The table tax method requires tax break information from the state or local tax

ofces. Use the method which is acceptable in the state. The necessary data of tax programming will be

presented at local tax ofce.

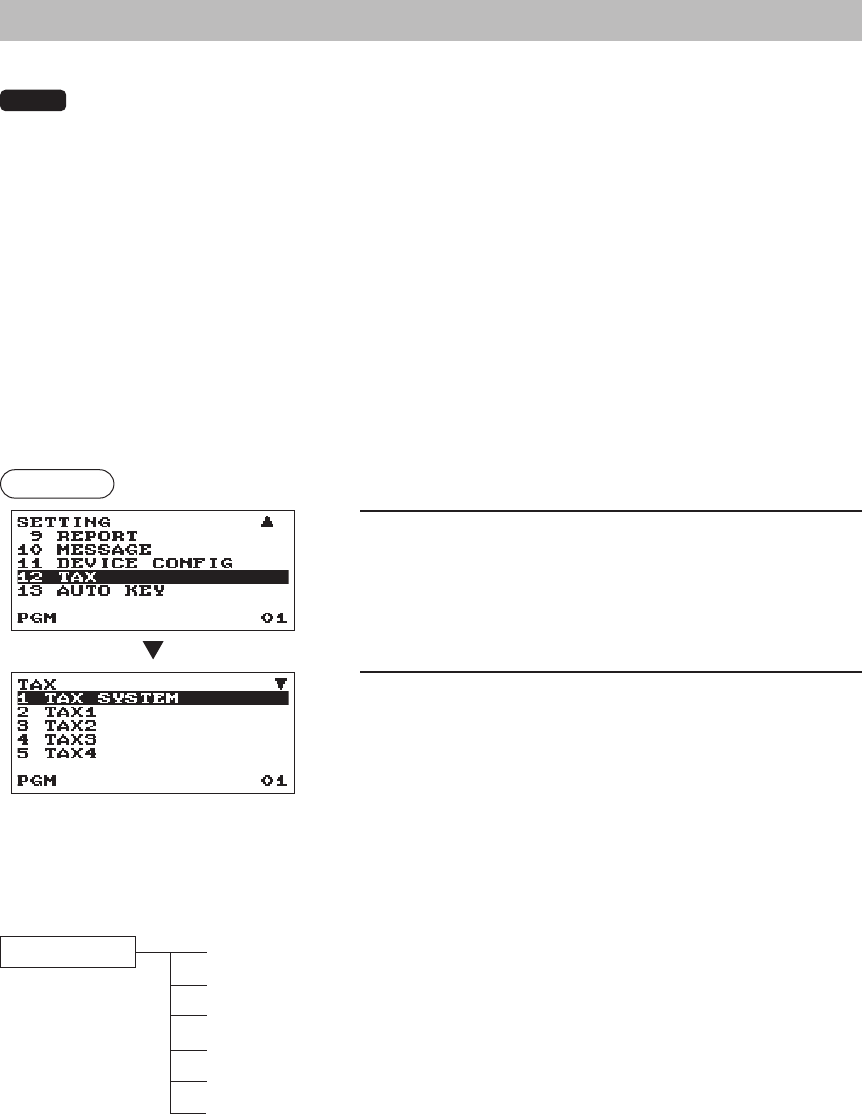

Procedure

1.

In the SETTING window, select “12 TAX.”

• The TAX window will appear.

2.

Select any option from the following options list:

1 TAX SYSTEM

Tax system

2 TAX1

Tax1

3 TAX2

Tax2

4 TAX3

Tax3

5 TAX4

Tax4

6 DOUGHNUT EXEMPT

Doughnut exempt

The following illustration shows those options included in this programming group.

12 TAX 1 TAX SYSTEM

l

See “Tax system” on page 83.

2 TAX1

l

See “Tax 1 through 4” on page 84.

3 TAX2

l

See “Tax 1 through 4” on page 84.

4 TAX3

l

See “Tax 1 through 4” on page 84.

5 TAX4

l

See “Tax 1 through 4” on page 84.

6

DOUGHNUT EXEMPT

l

See “Doughnut exempt” on page 86.

The screen continues.