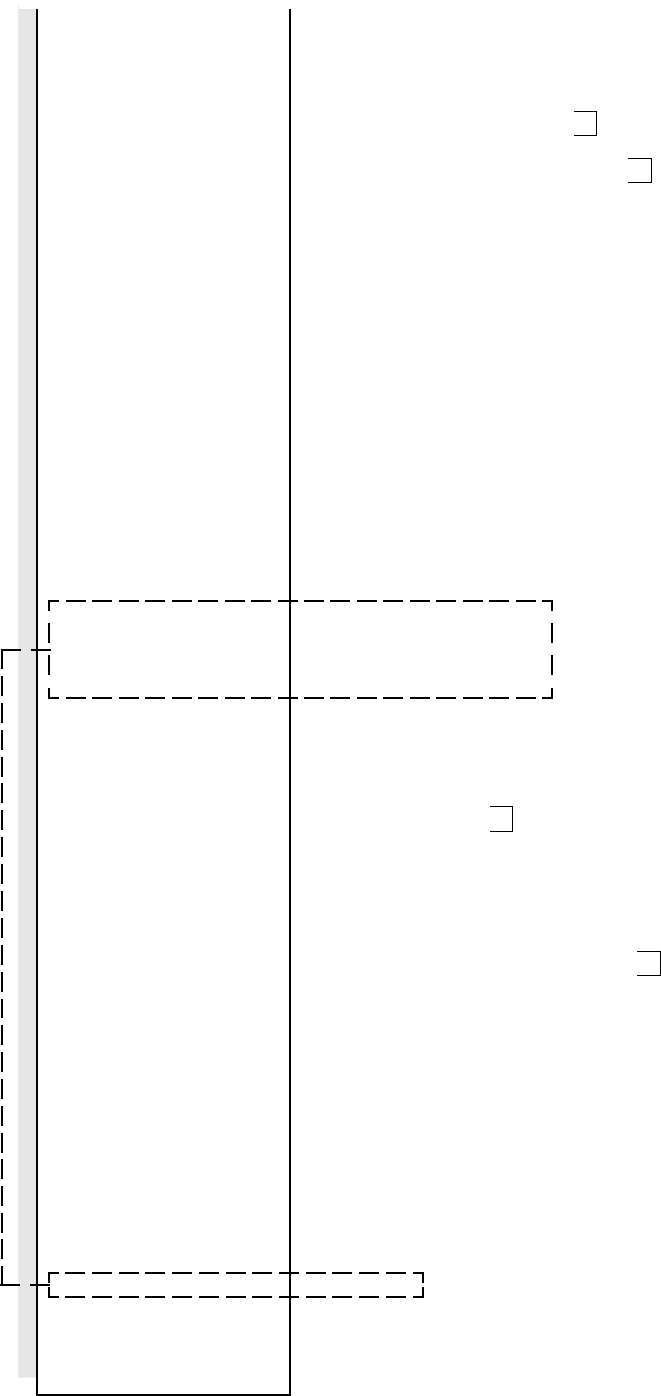

- 64 -

EO1-11115

MA-186-100 SERIES

★

1.2 06.90 1

★

2.5 3 2

★

0.0 0 3

472.

★

13.3 57.19

0. @

★

0.0 0 @

1%-

★

0.4 0 % -

1-

★

0.4 0 -

19

★

13.3 56.39

16

★

13.3 40.82

1

★

7.2 6

2

★

8.3 1

2

★

12.50

3

★

6.5 0

★

13.3 43.58

2

★

10.50

2

★

8.3 1

2

★

3.0 3

22

★

11.00 2

13

★

0.1 5 3

14

★

18.70 4

1%-

★

0.3 2 % -

6.

-14.00

5.

★

1.3 0

★

0.1 7 -

★

0.0 0 ∗

1

★

12.0 69.02

2

★

50.50

1

★

0.0 0 ∗

★

5.0 0 1

★

5.0 0 2

1

00.01 Z

020.7

13-53

EX EX EX EX TT TT TT RT RT VD VD VD VD VD VD VD VD CU CU CU CU

TX CH CK CH CK CA NS NS TX TX TX

ID ID ID PO PO RA RA TL

These items are printed on Daily Reports

only but not on Periodical Reports.

(Initial Status: Print)

(Initial Status: Non-print)

(Initial Status: Non-print)

Tax (PST) 1 Amount

Tax (PST) 2 Amount

Tax 3 (Manual Tax) Amount

Net Sale With Tax: Item Count

Amount

Sum of Other Income Depts.: Item Count

Amount

Percent Discount on Subtotal: Count

Amount

Dollar Discount: Count

Amount

Total Customer Count

All Media Sales Amount

Cash Sales: Customer Count

Amount

Check Sales: Customer Count

Amount

Charge Sales: Customer Count

Amount

Received-on-Account: Count

Amount

Paid Out: Count

Amount

Cash-in-drawer Amount

Check Count

Check-in-drawer Amount

Charge Count

Charge-in-drawer Amount

Item Correct: Count

Amount

Void: Count

Amount

Misc. Void: Count

(Item Correct and Void on other

Amount

items than departments and PLUs)

All Void: Count

Amount

Percent Discount on Item: Count

Amount

Sum of Negative Departments: Item Count

Amount

Returned Merchandise: Item Count

Amount

Negative or Returned Tax Amount

Total of Sale Amount subject to GST

Total of Sale Amount subject to Tax (PST) 1

Total of Sale Amount subject to Tax (PST) 2

Total Tax Exempt Customer Count

GST Exempt Amount

Tax (PST) 1 Exempt Amount

Tax (PST) 2 Exempt Amount

No-sale Count

Reset Count of Financial Reset Report (printed on Reset Reports only)

Receipt Consecutive No.

Current Time