19

DEPARTMENT TAX STATUS

__________________________________________________________________

A total of 16 departments are available on your cash register. Each department can represent a category of merchandise. For

example, Department 1 can represent sales of beverages, Department 2; sandwiches, Department 3; candy, etc. Each

department can be programmed as taxable or non-taxable. If desired, each department can also be programmed with a preset

price.

The programming of the departments consists of 3 steps; selecting the Multiple/Single Item Sale, Tax Status and Department

Preset Price.

1. Tax Status - allows you to tax or not to tax a department key.

2. Multiple/Single Item Sales - Multiple Item Sale (Standard) allows many items to be rung up within a transaction.

Single Item Sale allows only one item to be rung up in a transaction.

3. Department Preset Price (Optional) - allows you to program a price in a department key to save time when ringing

up a sales entry. The price will automatically ring up each time the appropriate department key is pressed.

Note: You can have up to 4 Tax Rates. These are set in the section - Tax Rate. Use the chart below to determine how you want

a department to calculate taxes. Keep in mind, for the sake of simplicity, you can set just 1 fixed rate and use that for all

departments.

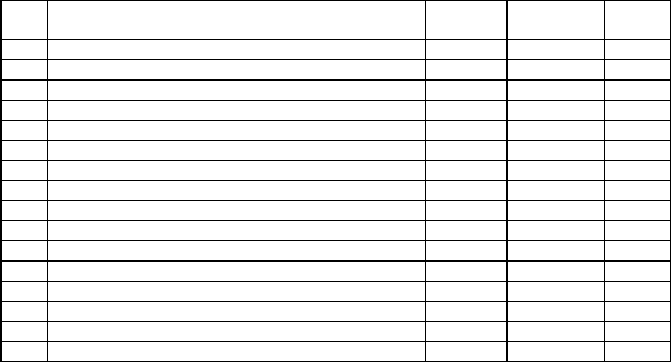

Tax Rate Chart

S2

Code

USA CANADIAN VAT

00 Non-Taxable

01 Taxable by TAX 1

02 Taxable by TAX 2

03 Taxable by TAX 3

04 Taxable by TAX 4

05 Taxable by TAX 1 and TAX 2

06 Taxable by TAX 1 and TAX 3

07 Taxable by TAX 1 and TAX 4

08 Taxable by TAX 2 and TAX 3

09 Taxable by TAX 2 and TAX 4

10 Taxable by TAX 3 and TAX 4

11 Taxable by TAX 1, TAX 2 and TAX 3

12 Taxable by TAX 1, TAX 2 and TAX 4

13 Taxable by TAX 1, TAX 3 and TAX 4

14 Taxable by TAX 2, TAX 3 and TAX 4

15 Taxable by TAX 1, TAX 2, TAX 3 and TAX 4

abcoffice

www.abcoffice.com 1-800-658-8788