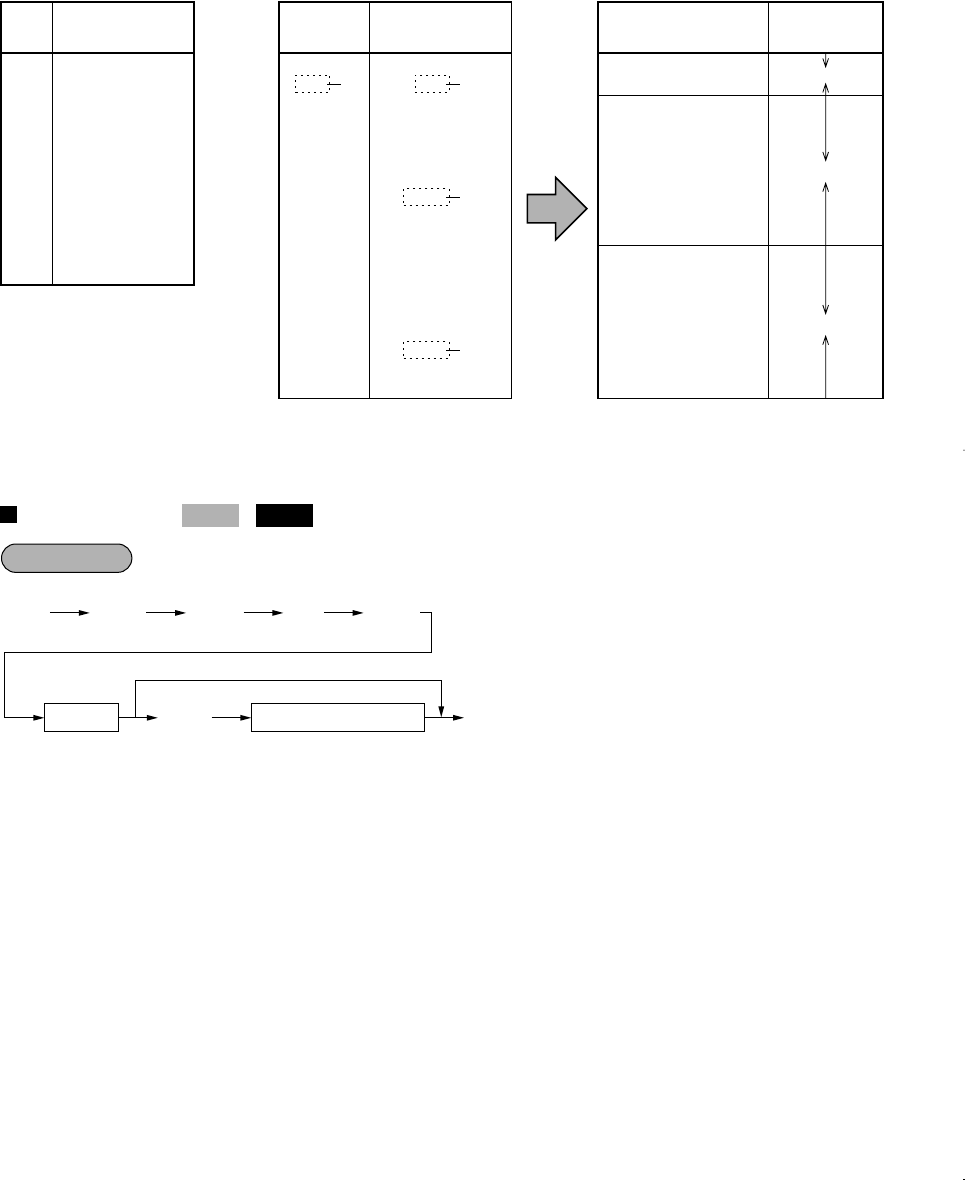

• If the tax is not provided for every cent, modify the tax table by setting the tax for every cent in the

following way.

When setting the tax, consider the minimum breakpoint corresponding to unprovided tax to be the same as the

one corresponding to the tax provided on a large amount.

Sample tax table Modification of the left tax table

Example 8%

From the modified tax table above;

Rate = 8(%), T = $0.01 = 1¢, Q = $0.11 = 11¢, M1 = 1.11, M2 = 2.11, M = 100

The tax rate

*A: When you program a tax rate as tax rate 1, enter “1”; when you program it as tax rate 2, enter “2”; when you

program it as tax rate 3, enter “3”; and when you program it as tax rate 4, enter “4”.

2711

*

A

.

@ @

@

a

When the lowest taxable amount is zero

max. six digits:

0.0001 to

99.9999%

max. five digits:

1¢ to $999.99

1 to 4

Lowest taxable amountTax rate

(Note: A minimum value of 1 must be entered.)

Procedure

2711

PGM 2

Tax

Minimum

breakpoint

.00

.01

.02

.03

.04

.05

.06

.07

.08

.09

.10

.11

.12

.13

.14

.15

.16

.17

.01

.11

.26

.47

.68

.89

.89

1.11

1.11

1.11

1.26

1.47

1.68

1.89

1.89

2.11

2.11

2.11

T Q

M1

M2

Tax

Minimum

breakpoint

.00

.01

.02

.03

.04

.06

.09

.10

.11

.12

.14

.17

.01

.11

.26

.47

.68

.89

1.11

1.26

1.47

1.68

1.89

2.11

Breakpoint

difference (¢)

1

10 (0.11-0.01)

15 (0.26-0.11)

21 (0.47-0.26)

21 (0.68-0.47)

21 (0.89-0.68)

0 (0.89-0.89)

22 (1.11-0.89)

0 (1.11-1.11)

0 (1.11-1.11)

15 (1.26-1.11)

21 (1.47-1.26)

21 (1.68-1.47)

21 (1.89-1.68)

0 (1.89-1.89)

22 (2.11-1.89)

0 (2.11-2.11)

0 (2.11-2.11)

B: Non-cyclic

C: Cyclic-1

D: Cyclic-2

85

ER-A410/A420(SEC)-3 03.12.22 0:18 PM Page 85