17

E

Getting Started

Important!

Be sure you use the federal sales tax data with your provincial sales tax data. Even if your

province use the same tax rate as another province, inputting the wrong data will result incorrect

tax calculations.

• 4 tax tables are used for the following purpose

Table 1: Used for the federal taxable items.

Table 2: Used for the provincial taxable items.

Table 3 / 4: Used for the provincial taxable items for different tax table.

X

REG

OFF

RF

PGM

Z

X2/Z2

PGM

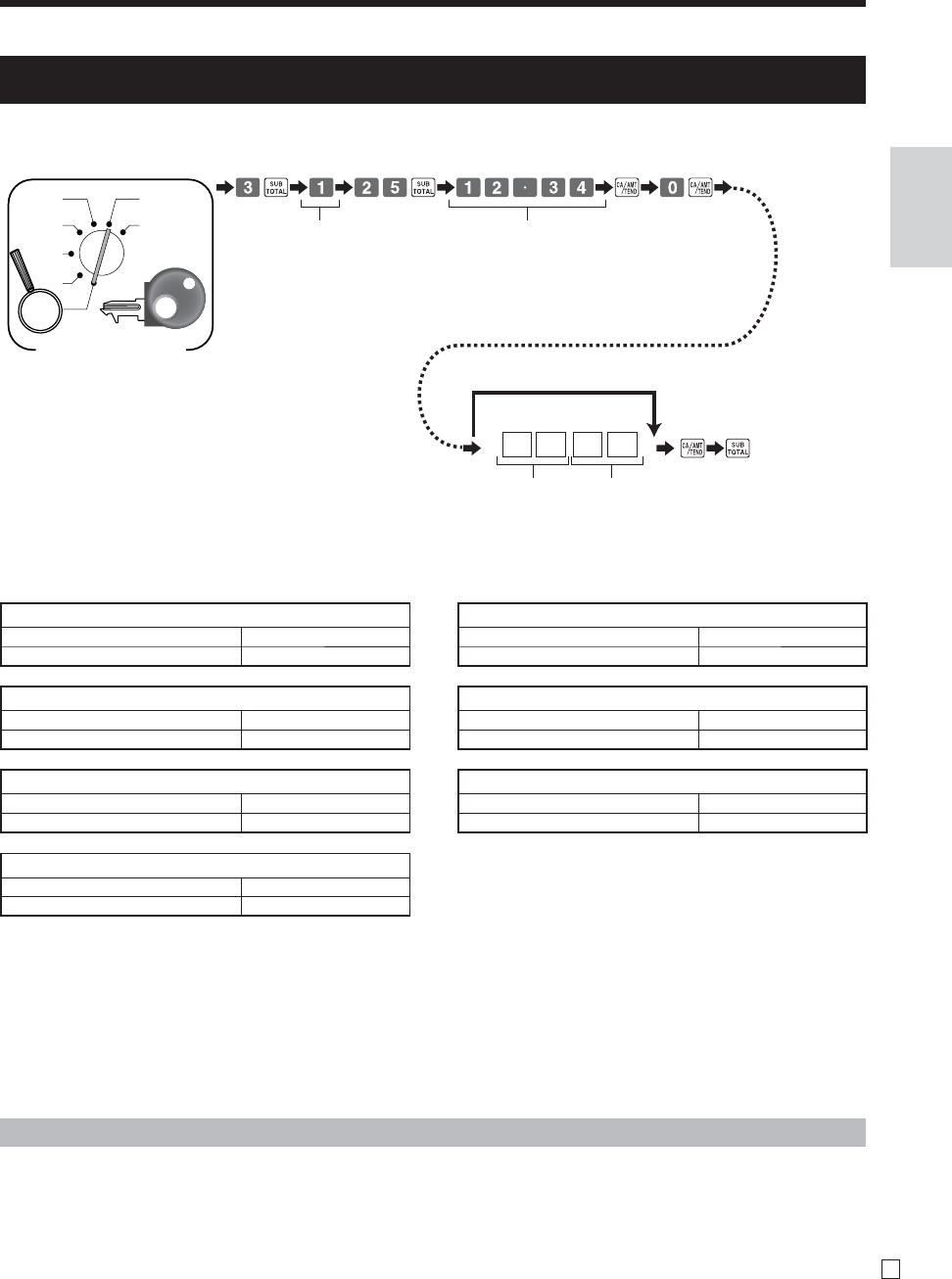

D4 D3 0 D1

Tax table No.

Tax table 1: 1

Tax table 2: 2

Tax table 3: 3

Tax table 4: 4

Tax rate

6.25%: 6^25

7%: 7

Rounding

Round off: 50

Cut off: 00

Round up: 90

Tax system

Add-on: 2

Add-in: 3

Tax on tax: 4

Skip to set “Round off / Add-in”.

8-5. Programming Canadian tax table

8. Tax table programming (continued)

Mode Switch

Alberta, North West Territory, Yukon Territory

Tax table 1 6% 5002

Tax table 2 Non

British Columbia, Manitoba, Saskatchevan

Tax table 1 6% 5002

Tax table 2 7% 5002

New Brunswick, Newfoundland & Labrador, Nova Scotia

Tax table 1 14% 5002

Tax table 2 Non

Ontario

Tax table 1 6% 5002

Tax table 2 8% 5002

Prince Edward Island

Tax table 1 6% 5002

Tax table 2 10% 5002

Quebec

Tax table 1 6% 5002

Tax table 2 7.5% 5002

Puerto Rico

Tax table 1 7% 5002

Tax table 2 Non

As of April 2009