Depreciation

67

Depreciation Example

A metalworking machine, purchased for 10,000.00, is to be depreciated over five years. Its

salvage value is estimated at 500.00. Using the straight-line method, find the depreciation

and remaining depreciable value for each of the first two years of the machine's life. See

Table 11-3.

Table 11-2 Depreciation Menu Items

Item Description

Life The expected useful life of the asset in years.

Start Start refers to the date or month in which the asset is first placed into service.

Depending on the type of depreciation, this can be the month (1-12), or, in the

case of French Straight-line and Amort F, the actual date in the selected format.

Note: for non-French depreciations, if the asset was placed into service in the

middle of March, for example, enter 3.5 for Start.

Cost The depreciable cost of the asset at acquisition.

Salvage The salvage value of the asset at the end of its useful life.

Factor The declining balance factor as a percentage. This is used for declining

balance and declining balance crossover methods only.

Year Year for which you want to calculate the depreciation.

Depreciation Depreciation in the given year.

R.Book Value Remaining book value at the end of the given year.

R.Depreciable Value Remaining depreciable value at the end of the given year.

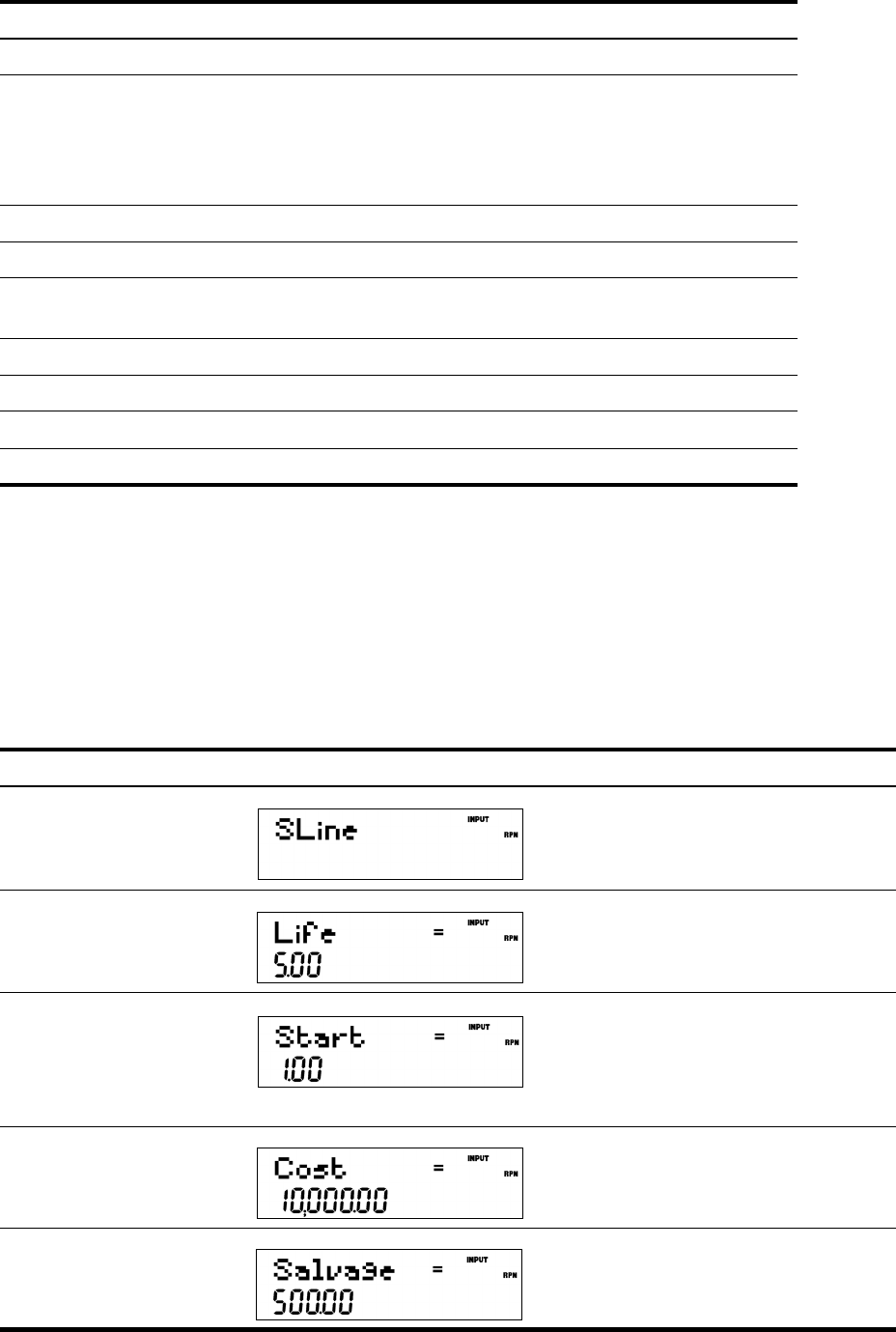

Table 11-3 Straight Line Depreciation Example

Key Display Description

:\

Opens the Depreciation menu starting with

the straight line method.

<5I

Inputs 5 for the useful life.

<

Displays the current value of Start. 1

(January) is the default value. For this

example, this value remains unchanged,

since the depreciation of the machine starts

January 1

st

(1.00 ).

<100

00I

Inputs 10,000.00 for the cost of the item.

<500

I

Inputs 500.00 for the salvage value of the

item.