10. REGISTERING PROCEDURE AND PRINT FORMAT

EO1-11095

10-19

10.28 SELECTIVE ITEMIZER (SI) STATUS MODIFICATION

- - -- - -

TAX5 $0.50

- - -

- - -

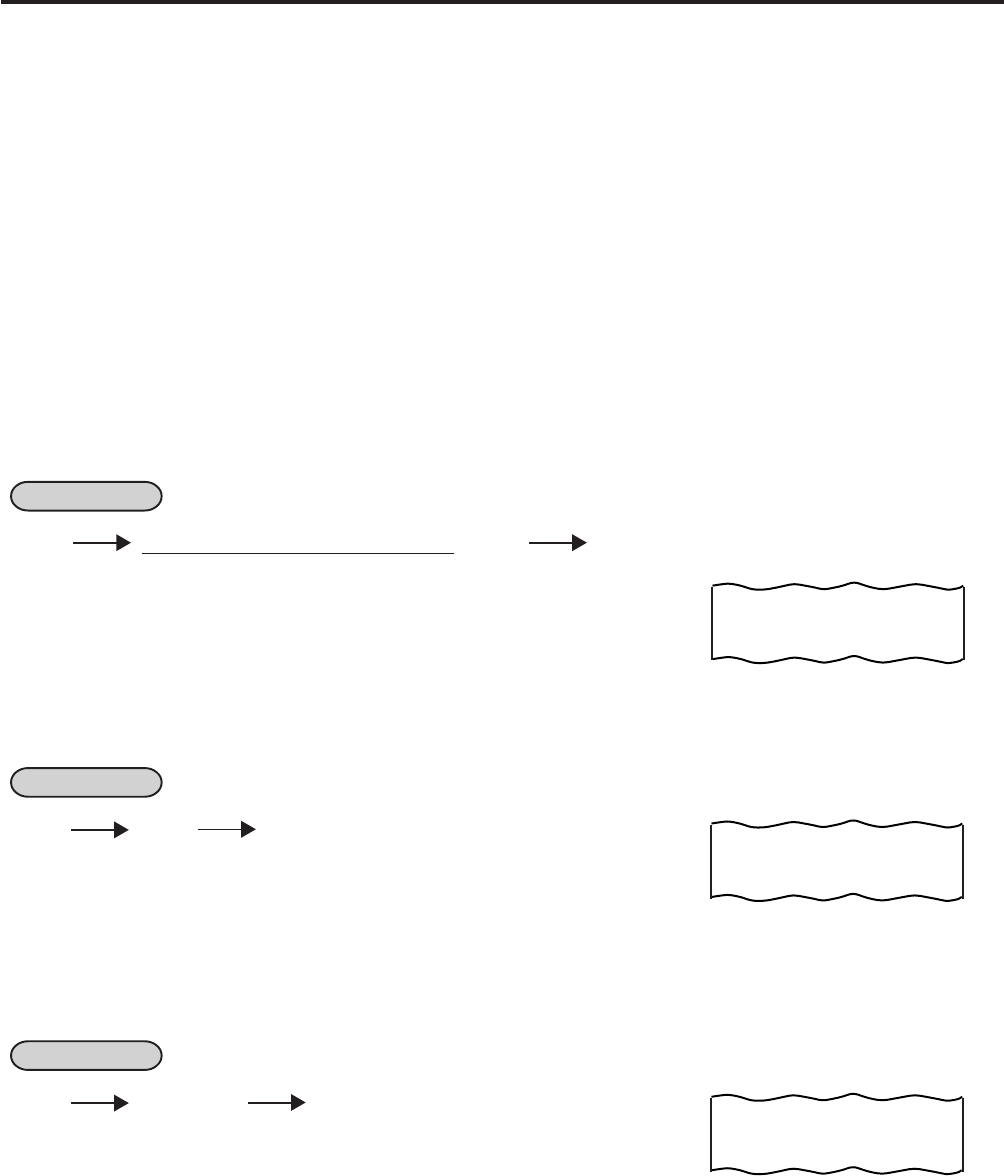

10.31 SUBTOTAL (Sale Total Pre-taxed) READ

OPERATION -- Receipt Print Format --

[ST]

SUBTL $6.00

The sale total (pre-taxed) of the items so far entered is

displayed (and printed if so programmed), but the sale is

not finalized. Additional item entries are allowed, if any.

. . .

- - -

- - -

TXBL TL $9.20

The sale total including taxes due of the items so far entered

is displayed (and printed if so programmed), but the sale is

not finalized. Additional item entries are allowed, if any.

. . .

10.32 TAXABLE TOTAL (Sale Total With Taxes) READ

OPERATION -- Receipt Print Format --

[TXBL TL]

10.28 SELECTIVE ITEMIZER (SI) STATUS MODIFICATION

Depress [SI/M] (or [SI1/M] and/or [SI2/M]) for entering the required Department or PLU item, the same way as

[LC OPEN] is operated for Departments and PLUs. The SI-net status is reversed to non-net status, and vice

versa.

10.29 TAX STATUS or FOOD STAMP STATUS MODIFICATION

Depress [TX/M] (or [TX1/M], [TX2/M], [TX3/M], [TX4/M], [GST/M]), in the same way as [LC OPEN] is operated,

prior to or any time during the entry sequence of the required Department, PLU, or any other tax-status-

programmable item ([DOLL DISC], [%-], [%+], [STR CPN], [VND CPN], [BTL RTN]). The taxable status is

reversed to non-taxable, and vice versa. The [FS/M] key operates the same to reverse from the Food Stampable

status to non-stampable, and vice versa, of the required item.

10.30 MANUAL TAX ENTRY (where irregular tax amount addition is applied)

OPERATION

|Irregular Tax Amount to be Added| [TAX] -- Receipt Print Format --