28

■

■

Tax■delete

The automatic tax (tax 1, tax 2, or all tax (tax1 – tax 4)) can be deleted.

Procedure

F A

a

To cancel

1 TAX1 DELETE

2 TAX2 DELETE

3 ALL TAX DELETE

4 PST DELETE

7 TAX DELETE

NOTE

The “4 PST DELETE” function becomes effective only when the Canadian tax is selected.

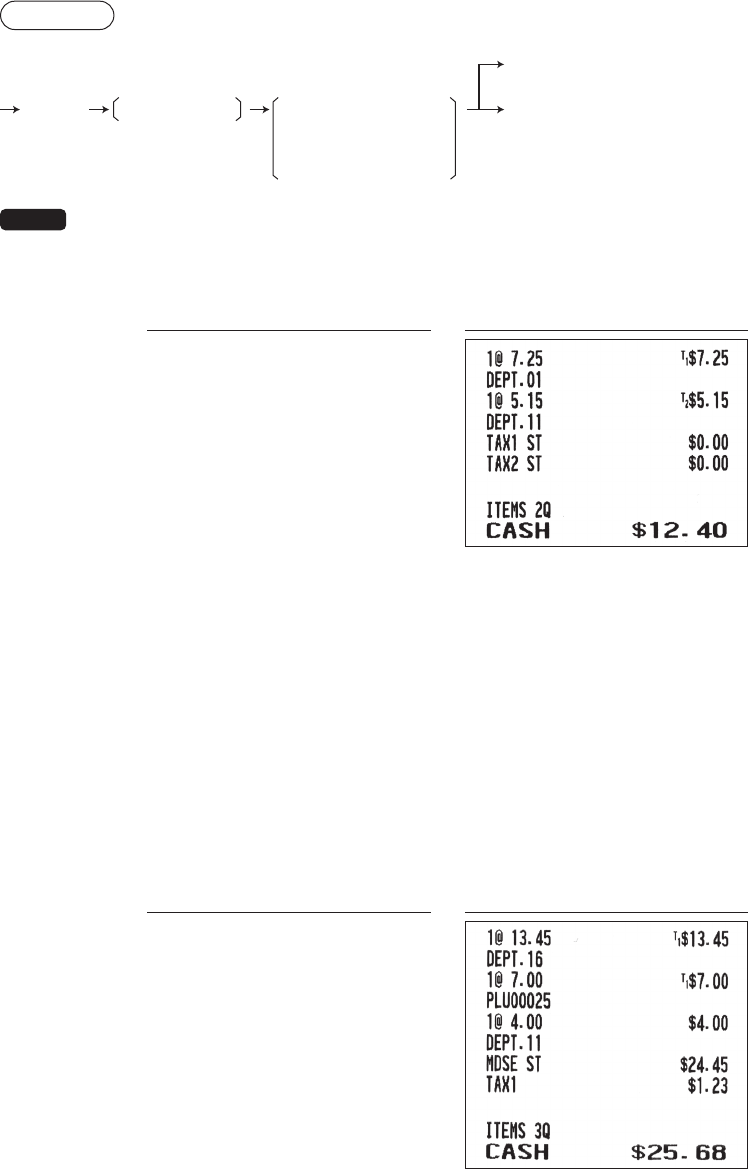

Example:Selling a $7.25 item (dept. 1, taxable 1) and another $5.15 item (dept. 11, taxable 2) for cash and

entering the sale as non-taxable

Key■operation Print

725

1

515

q

F

7

Select “TAX1 DELETE”

A

F

7

Select “TAX2 DELETE”

A

A

■

■

Tax■status■shift

The register allows you to shift the programmed tax status of each department or PLU/UPC by pressing

the

w

key before those keys. After each entry is completed, the programmed tax status of each key is

resumed.

Example: Selling the following items for cash with their programmed tax status reversed

• One $13.45 item of dept. 16 (non-taxable) as a taxable 1 item

• One $7.00 item of PLU 25 (non-taxable) as a taxable 1 item

• One $4.00 item of dept. 11 (taxable 1) as a non-taxable item

Key■operation Print

1345

w

y

25

w

p

400

w

q

A