Secure MICR Printer User’s Guide © Source Technologies

July 2003 Page 9 All rights reserved

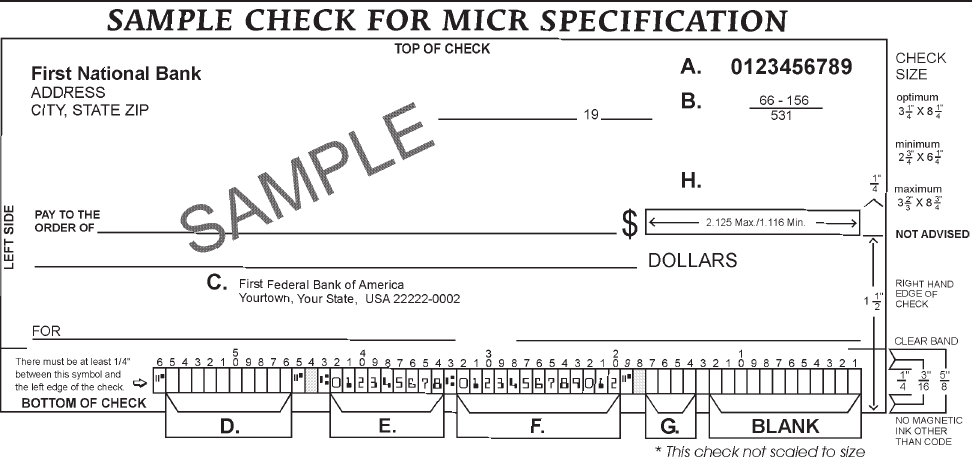

Figure 3.1: Sample Check

A. Serial Number: Must be in the upper right corner and match the serial number in the MICR

line (see D for further explanation).

B. Fractional Routing Transit Number: Should be in the upper right corner and must match

the routing transit number in the MICR line with the exception of the state prefix number

(ex. 66 = NC, 67 = SC, 64 = GA, etc.) and the preceding zeros.

C. Bank Name, State, City: The bank logo is optional. Name of bank, city and state

where the account will be assigned/opened is a required field.

D. Aux On Us (46-55): This is a required field if the customer desires services offered by

the bank which require a serial number. The serial number format is controlled by the

payor’s bank. A & D should match.

E. Routing Number (34-42): Designates the Federal Reserve district and financial

institution. Each city, state or region that the bank serves has a unique institution

identifier. IMPORTANT: positions 35-42 is the Routing Number, position 34 is the

check digit.

F. Account Number: This is a unique number assigned to the customer’s account.

G. Optional Serial Number: Used for personal accounts (checks only). A 4 digit zero

filled field that should match the serial number in the upper right corner.

H. Convenience Amount Area should be in the general location shown above in the

diagram. The illustrated box in the diagram is optional and if used, should conform to ANS

X9.7. A single stroke dollar sign is required.

Section 3: MICR Check Design