164

Tax Programming

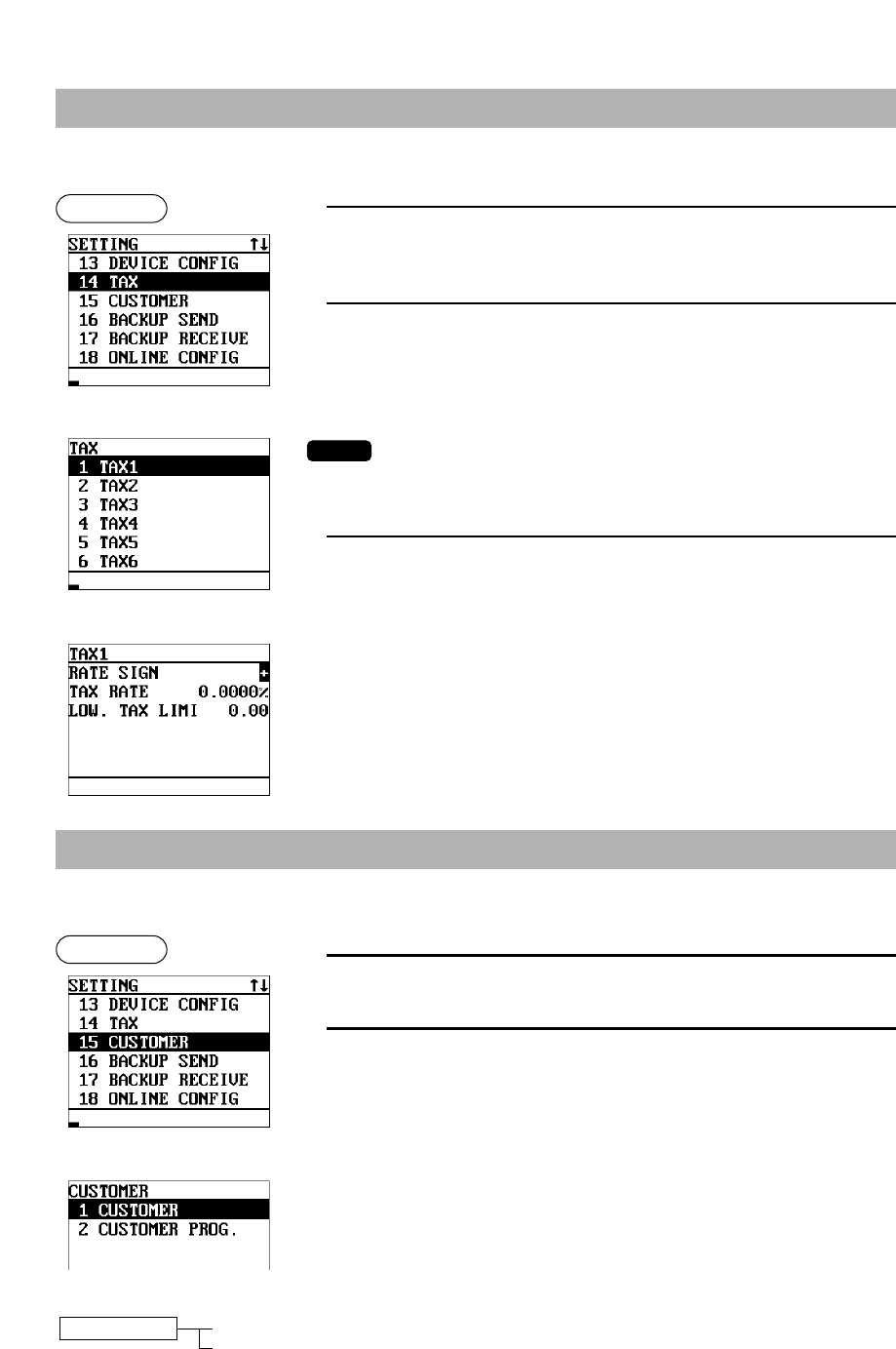

Use the following procedure to select any option included in the tax group:

1.

From the SETTING menu, select “14 TAX.”

• The TAX menu will appear.

2.

Select any option from the following options list:

1 TAX1: Tax 1 2 TAX2: Tax 2

3 TAX3: Tax 3 4 TAX4: Tax 4

5 TAX5: Tax 5 6 TAX6: Tax 6

If the

D

key is pressed on the tax number selection menu, the tax rate in

the cursor position will be deleted.

3.

Program each item as follows:

• RATE SIGN (Use the selective entry)

–: Minus rate

+: Plus rate

• TAX RATE (Use the numeric entry)

Tax rate (max. 7 digits: 0.0000 to 999.9999%)

• LOWER TAX LIMIT (Use the numeric entry)

Lowest taxable amount (max. 5 digits: 0.01 to 999.99)

• This option is not available in the VAT system.

NOTE

Procedure

▼

▼

▼

The following illustration shows those options included in the customer programming group.

15 CUSTOMER 1 CUSTOMER

➡

See “Customer code” on page 165.

2 CUSTOMER PROG.

➡

See “Customer programming” on page 165.

Customer Programming

Use the following procedure to select any option included in the customer programming group:

1.

In the SETTING window, select “15 CUSTOMER”.

2.

Select an option form the following option list:

1 CUSTOMER: Customer code

2 CUSTOMER PROG.: Customer programming

Procedure