Appendix — Reference Information 87

Bonds

1

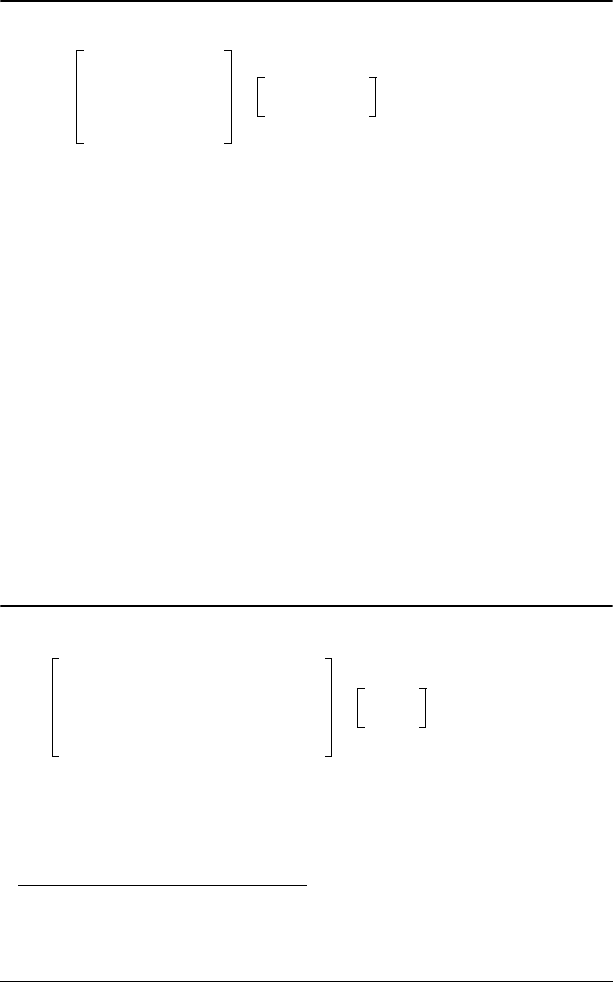

Price (given yield) with one coupon period or less to redemption:

where:

PRI =dollar price per $100 par value

RV =redemption value of the security per $100 par value (RV =

100 except in those cases where call or put features must be

considered)

R =annual interest rate (as a decimal; CPN _ 100)

M =number of coupon periods per year standard for the

particular security involved (set to 1 or 2 in Bond worksheet)

DSR =number of days from settlement date to redemption date

(maturity date, call date, put date, etc.)

E =number of days in coupon period in which the settlement

date falls

Y =annual yield (as a decimal) on investment with security held

to redemption (YLD P 100)

A =number of days from beginning of coupon period to

settlement date (accrued days)

Note: The first term computes present value of the redemption amount,

including interest, based on the yield for the invested period. The second

term computes the accrued interest agreed to be paid to the seller.

Yield (given price) with one coupon period or less to redemption:

1. Source for bond formulas (except duration): Lynch, John J., Jr., and Jan H. Mayle.

Standard Securities Calculation Methods. New York: Securities Industry Association,

1986.

PRI

RV

100 R×

M

------------------

+

1

DSR

E

-----------

Y

M

-----

⎠

⎞

×

⎝

⎛

+

---------------------------------------

A

E

---

100 R×

M

------------------

×–=

Y

RV

100

---------

R

M

-----

+

⎝⎠

⎛⎞

PRI

100

----------

A

E

---

R

M

-----

×

⎝⎠

⎛⎞

+

⎝⎠

⎛⎞

–

PRI

100

----------

A

E

---

R

M

-----

×

⎝⎠

⎛⎞

+

---------------------------------------------------------------------------

ME×

DSR

--------------

×=