88 Appendix — Reference Information

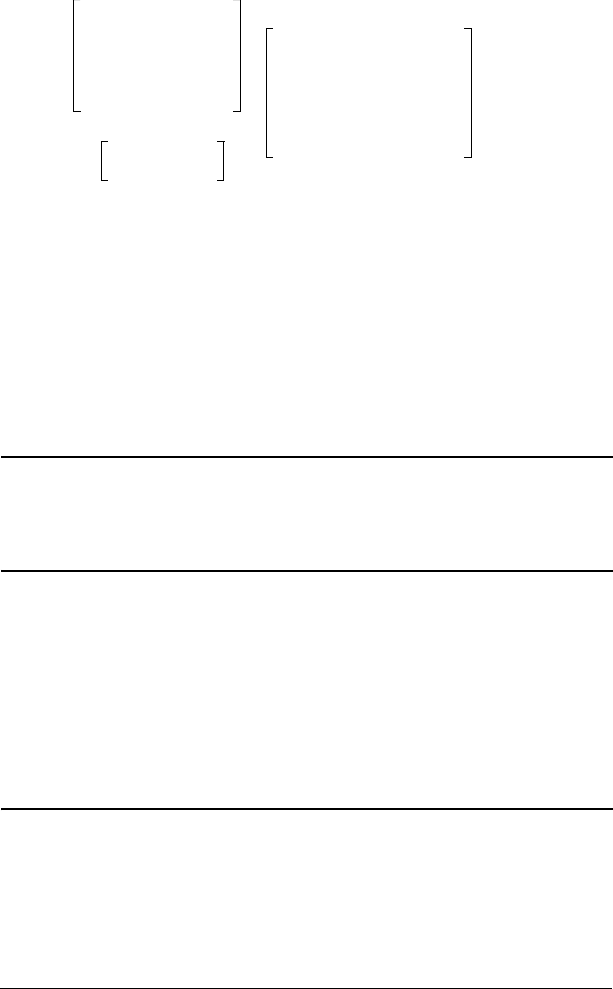

Price (given yield) with more than one coupon period to redemption:

where: N =number of coupons payable between settlement date and

redemption date (maturity date, call date, put date, etc.). (If this

number contains a fraction, raise it to the next whole number;

for example, 2.4 = 3)

DSC =number of days from settlement date to next coupon date

K =summation counter

Note: The first term computes present value of the redemption amount,

not including interest. The second term computes the present values for

all future coupon payments. The third term computes the accrued

interest agreed to be paid to the seller.

Yield (given price) with more than one coupon period to redemption:

Yield is found through an iterative search process using the “Price with

more than one coupon period to redemption” formula.

Accrued interest for securities with standard coupons or interest at

maturity:

where:

AI =accrued interest

PA R =par value (principal amount to be paid at maturity)

Depreciation

RDV = CST N SAL N accumulated depreciation

Values for

DEP, RDV, CST, and SAL are rounded to the number of

decimals you choose to be displayed.

In the following formulas,

FSTYR = (13 N MO1) P 12.

PRI

RV

1

Y

M

-----

+

⎝⎠

⎛⎞

N 1–

DSC

E

------------

+

-------------------------------------------

100

R

M

-----

A

E

---

××–

100

R

M

-----

×

1

Y

M

-----

+

⎝⎠

⎛⎞

K 1–

DSC

E

------------

+

-------------------------------------------

K 1=

N

∑

+=

AI PAR

R

M

-----

A

E

---

××=