87

Program 3

TE-2200/2400 Dealer's Manual

Example 3:

U.S. tax table with rate setting

TAX Price range

(7%) Min. break point Max. break point

$ .00 $ .01 $ .07

.01 .08 .21

.02 .22 .35

.03 .36 .49

.04 .50 .64

.05 .65 .78

.06 .79 .92

.07 .93 1.07

.08 1.08 1.21

.09 1.22 1.35

.10 1.36 1.49

.11 1.50 1.64

.12 1.65 1.78

.13 1.79 1.92

.14 1.93 2.07

1.40 19.93 20.07

One all sales above $20.07, compute the tax

at the rate of 7%.

Max. break point

Upper Lower

Difference Pattern

7– 0= 7 Non-cyclic

21 – 7 = 14

35 – 21 = 14

49 – 35 = 14

64 – 49 = 15 Cyclic

78 – 64 = 14

92 – 78 = 14

107 – 92 = 15

121 – 107 = 14

135 – 121 = 14

149 – 135 = 14

164 – 149 = 15 Cyclic

178 – 164 = 14

192 – 178 = 14

207 – 192 = 15

Tax rate (2-digit for integer + 4-digit for decimal) ............................... 7 %

Tax table maximum value (“0” means unlimited). ............................... 2007

Rounding/tax table system code ........................................................... 0002 (Cut off & table + rate)

Sum of a cyclic pattern ......................................................................... 100 (14+14+14+15+14+14+15)

Number of values in each cyclic pattern............................................... 7

Number of values in each non-cyclic pattern ....................................... 7

Actual value of difference of the non-cyclic and cyclic values ............ 14, 14, 14, 15, 14, 14, 15

3s

8

::::

s

8

7a

8

2007a

8

0002a

8

100a

8

7a

8

7a

8

0714a

8

1414a

8

1514a

8

1415a

8

s

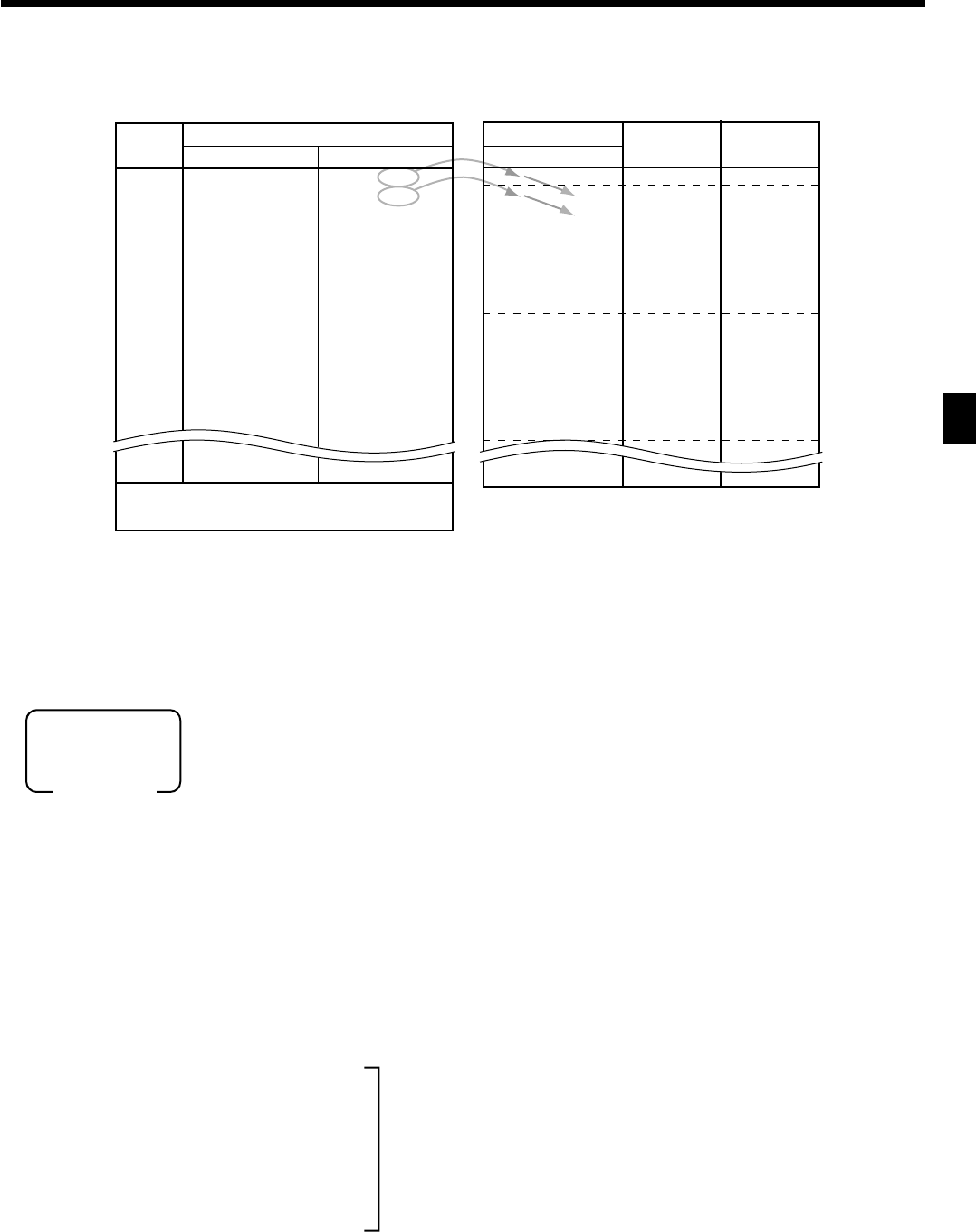

Tax table No. (0125 ~ 0325)

Tax rate (2-digit for integer + 4-digit for decimal)

Tax table maximum value (“0” means unlimited).

Rounding/tax table system code

Sum of a cyclic pattern

Number of values in each cyclic pattern

Sum of values in each non-cyclic pattern

Actual value of difference of the non-cyclic and cyclic values.

You must enter these values in 4-digit block. If the last block

comes out to be only two digits, add two zeros.

PGM

Mode switch