88

Convenient Operations and Setups

E

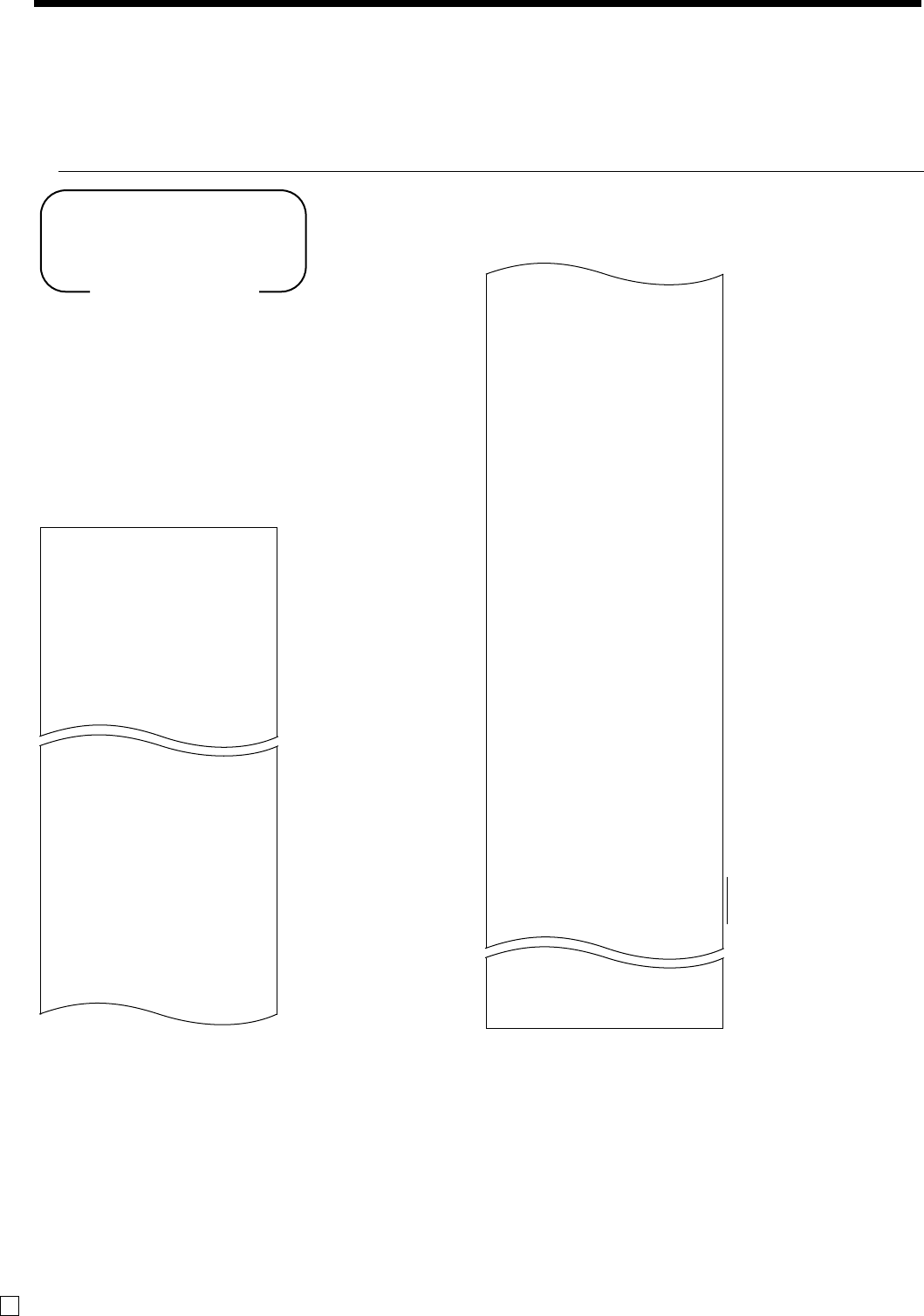

To print the daily sales read/reset report

This report shows sales except for PLUs.

OPERATION REPORT

*1

Money declaration:

Count how much cash is in the drawer and input this amount (up to 8-digits).

The cash register will automatically compare the input with the cash in drawer in the memory and print the

difference between these two amounts.

Note that if money declaration is required by programming (page 47), you cannot skip this procedure.

*2

Zero totalled departments (the amount and item numbers are both zero) are not printed.

*3

Taxable amount and tax amount are printed only if the corresponding tax table is programmed.

*4

These items can be skipped by programming.

*5

The “*” symbol is printed on the reset report, if memory overflow occurred in the totalizer.

8

8

a

Money declaration

*1

(Cash in drawer amount B)

Read: X mode

Reset: Z mode

Mode Switch

— Reset mode/date/time

— Clerk/consecutive No.

—

Report code/report title/reset symbol/

reset counter

*5

—

Department descriptor/No. of items

*2

— Sales ratio/department amount

*2

—

Non-link department No. of items

— Non-link department amount

— Gross No. of items

— Gross sales amount

— No. of customers

— Net sales amount

— Cash in drawer amount (b)

— Declared amount (a)

— Difference (b) - (a)

— Check in drawer amount

— Credit in drawer amount

— Foreign currency cash in drawer

— Foreign currency check in drawer

— Taxable amount 1

*3

Z 15-03-2002 17:20

CLERK 01 000258

0000

DAILY

Z 0001

DEPT01 QT 1015

47.07% •10339.50

DEPT02 QT 19

31.87% •7000.70

DEPT03 QT 31

18.84% •4139.10

DEPT04 QT 23

1.51% •332.67

NON-LINK DPT QT 10

0.43% •94.90

------------------------

GROSS TOTAL QT 1253

•21960.90

NET TOTAL No 545

•30217.63

CASH-INDW •29903.06

# •29903.06

•0.00

CHECK-INDW •197.17

CREDIT-INDW •183.60

CE-CASH 1 ¥7,000

CE-CHECK 1 ¥4,000

TAX-AMT 1 •732.56

TAX 1 •43.96

TAX-AMT 2 •409.72

TAX 2 •21.55

TAX-AMT 3 •272.50

TAX 3 •8.18

TAX-AMT 4 •5.50

TAX 4 •0.06

TAX •73.75

ROUNDING AMT •4.75

CANCEL TTL No 2

•108.52

RF-MODE TTL No 2

•3.74

CALCULATOR No 10

------------------------

CASH No 81

•836.86

CHECK No 9

•183.60

CREDIT No 10

•197.17

RC No 2

•78.00

PD No 1

•6.80

- No 8

•3.00

%- No 10

•4.62

REFUND No 7

•27.79

ERR CORR No 10

•12.76

#/NS No 5

------------------------

CLERK 01 No 12

•127.63

********

CLERK 02 No 6

•27.63

********

CLERK 03 No 24

------------------------

GRND TTL •0000351217.63

000001---»000253

— Tax amount 1

*3

— Taxable amount 2

*3

— Tax amount 2

*3

— Taxable amount 3

*3

— Tax amount 3

*3

— Taxable amount 4

*3

— Tax amount 4

*3

— Tax total

*4

— Rounding amount (Australia only)

— Cancellation count

— Cancellation amount

— Refund mode operation count

*4

—

Refund mode operation amount

*4

— CAL mode operation count

— Cash sales count

— Cash sales amount

— Check sales count

— Check sales amount

— Credit sales count

— Credit sales amount

— Received on Account count

— Received on Account amount

— Paid out count

— Paid out amount

— Subtraction count

— Subtraction amount

— Discount/premium count

— Discount/premium amount

— Refund key count

*4

— Refund key amount

*4

— Error correction count

— Error correction amount

— No sale count

— Clerk 1/clerk 1 sales count

— Clerk 1 sales amount

—

Training clerk

—

— Non-resettable grand-sales total

*4

— Consecutive No. range of the day

*4