12

Printing VAT Information on Customer

Receipts

You can program the cash register to print VAT information

on the customer receipt according to your business' or

country's requirements.

Programming the Cash Register to Print the

Required VAT Information

With reference to the section "System Options", by setting

machine conditions 61, 62, 63, 64, 65 and 66 you program the

cash register to print the VAT information that you need.

1. Control lock key position: PRG.

2. Type the [machine condition number] followed by

status number

, then press .

3. Turn the control lock key to the OFF position.

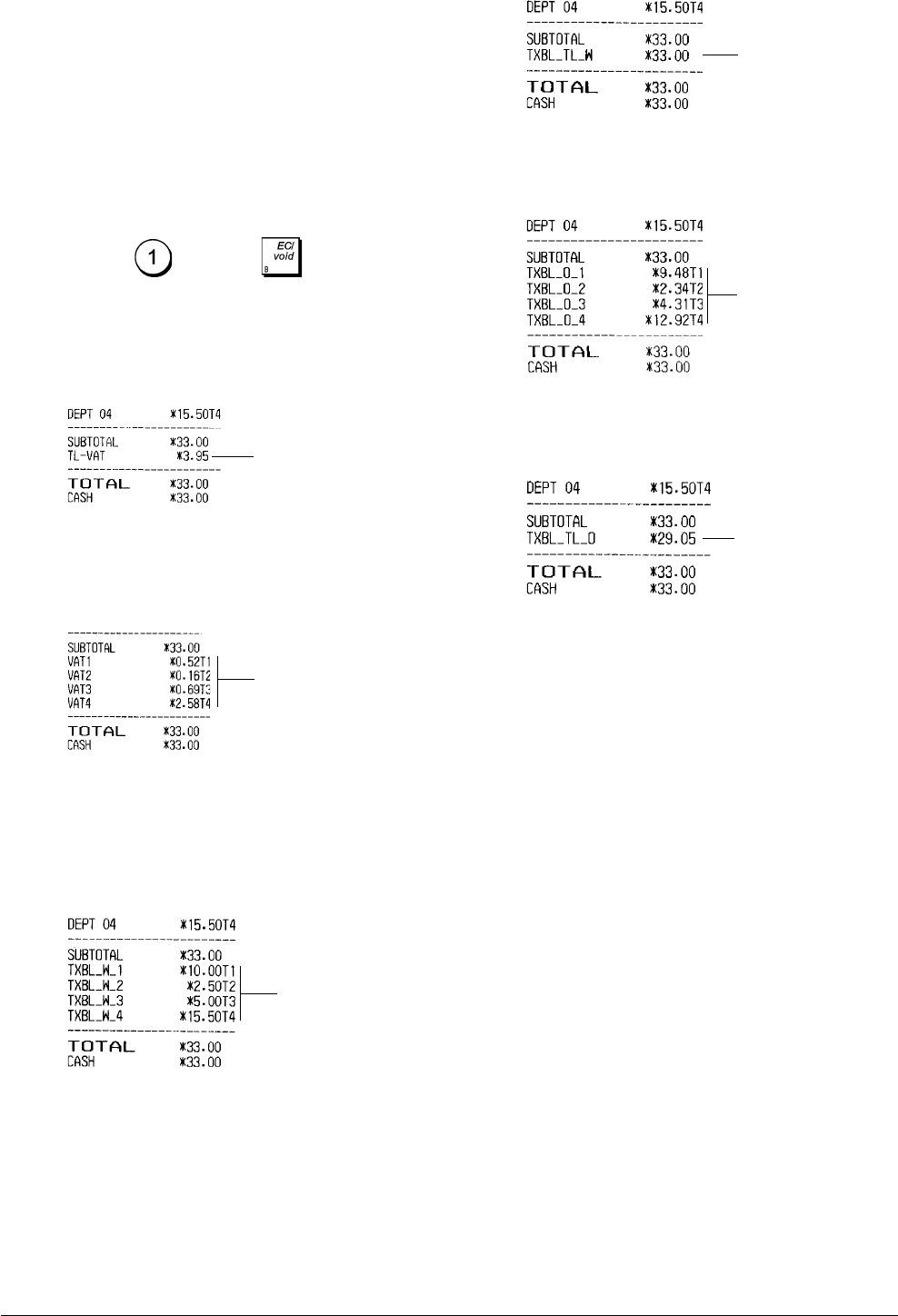

Receipt With Sum of all VAT Amounts Calculated

(TL-VAT) - Machine Condition 61

Receipt With Taxed Sales Totals Split per Rate -

Machine Condition 62

Receipt With Sales Totals With VAT Split per Rate

(TXBL_W) - Machine Condition 63

Receipt with Overall Sales Total With VAT (TXBL_TL_W)

- Machine Condition 64

Receipt With the Sales Totals without VAT Split per

Rate (TXBL_0) - Machine Condition 65

Receipt With Sales Total Without VAT (TXBL_TL) -

Machine Condition 66

Clerk System

The Clerk System is a security feature that enables you to

control access to the cash register and monitor the number

of transactions and the sales of up to 15 Clerks.

Your cash register is configured at the factory with the

Clerk System deactivated. When the Clerk System is

deactivated, the cash register can be used freely.

You can activate the Clerk System for a degree of protection

and sales monitoring. With the Clerk System activated, the

cash register can be used after entering just a clerk number

from 1 to 15, or a clerk number and its associated 3-digit

security code depending on the degree of security pro-

grammed.

With the Clerk System activated you can decide an opera-

tional status for each clerk, thus enabling all activities for the

clerk or disabling the clerk from performing certain transac-

tions.

You can also program other clerk-related features. See

"System Options", Machine conditions 7, 8 and 52 for details.

Sales totals

without VAT

split per

rate

Sales total

without VAT

Sum of the

individual VAT

totals

Sales totals

with VAT split

per rate

VAT totals per

programmed

rate

Overall sales

total with VAT