35

NOTE

VAT/taxassignmentisprintedatthexedrightpositionoftheamountonthereceiptandbillas

follows:

VAT1/tax1

VAT2/tax2

VAT3/tax3

VAT4/tax4

A

B

C

D

When the multiple VAT/tax is assigned to a department or a PLU, a smaller number of the VAT/

tax will be printed.

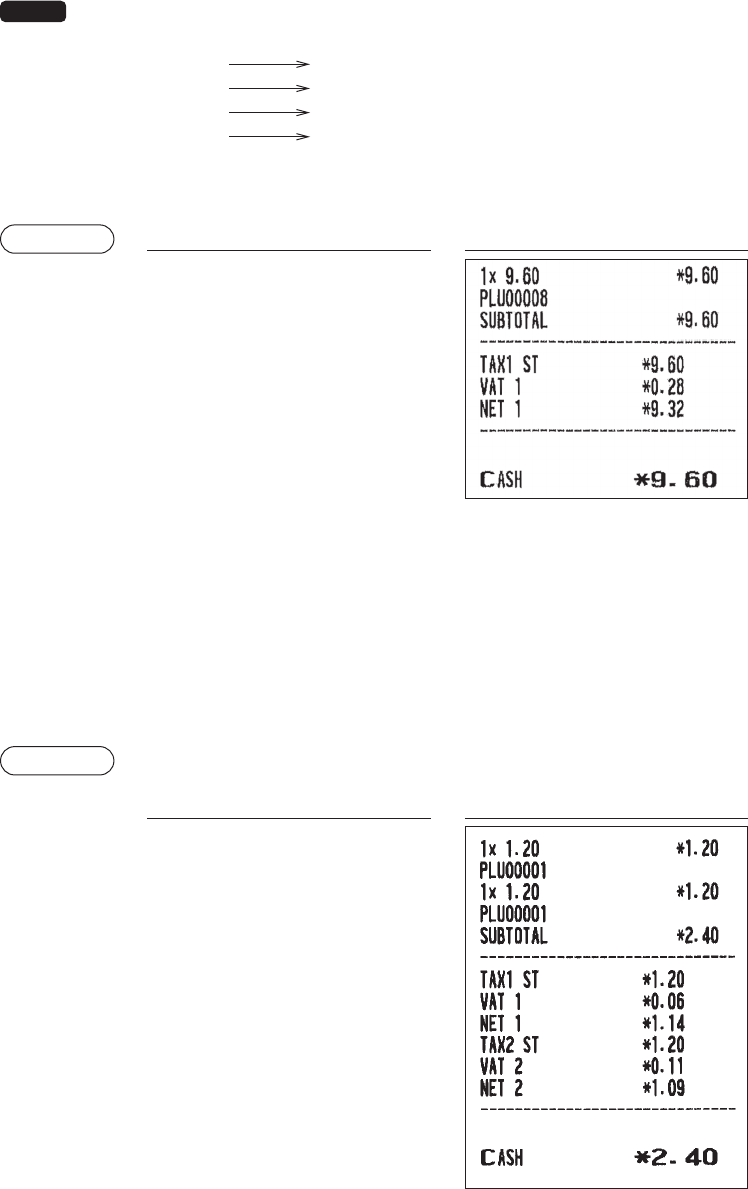

Example

Key operation Print

8

z

t

5

A

(When the manual

VAT 1 through 4

system is selected)

■

VAT shift entries (for XE-A217W/XE-A217B only)

This feature is intended to shift the tax status of a particular department (or PLU) programmed for taxable 1

or taxable 1 and taxable 3.

1. When the VAT shift entry is made for a particular department or PLU programmed for taxable 1, their tax

status shifts to taxable 2.

2. When this entry is made for a particular department (or PLU) programmed for taxable 1 and taxable 3,

the tax status “taxable 1” remains unchanged, but the other, “taxable 3” is ignored.

Example

Key operation Print

1

D

1

A

(When the Auto VAT 1

through 4 system is

selected)