Section 12: Real Estate and Lending 159

File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 159 of 275

Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm

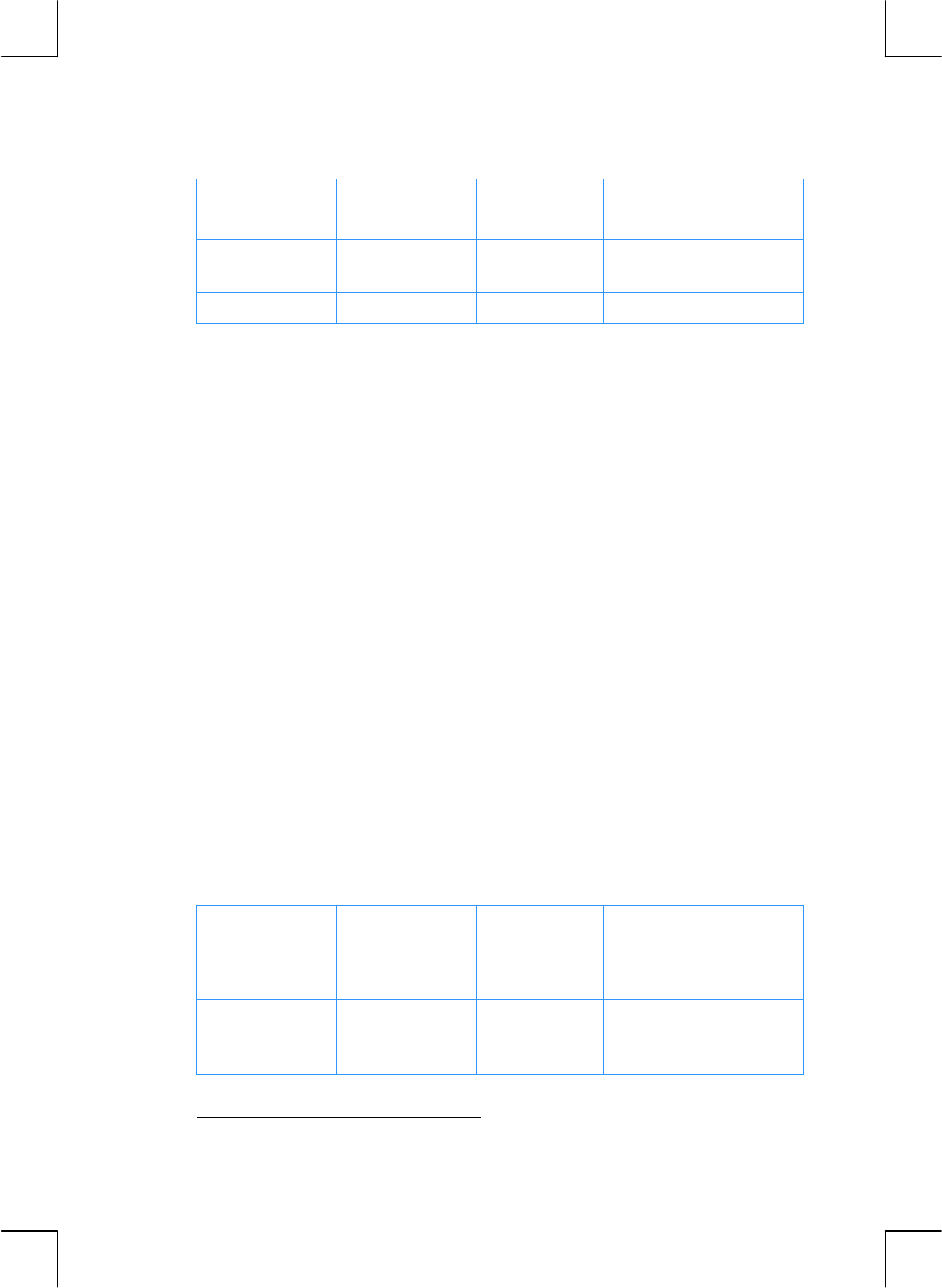

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

¼

¼

0.48

Monthly interest rate

(calculated).

12

§

§

12

³

5.73

Annual percentage rate.

Price of a Mortgage Traded at a Discount or Premium

Mortgages may be bought and/or sold at prices lower (discounted) or higher (at a

premium) than the remaining balance of the loan at the time of purchase. Given

the amount of the mortgage, the periodic payment, the timing and amount of the

balloon or prepayment, and the desired yield rate, the price of the mortgage may

be found. It should be noted that the balloon payment amount (if it exists) occurs

coincident with, and does not include, the last periodic payment amount.

Information is entered as follows:

1. Press g and fCLEARG.

2. Key in the total number of periods until the balloon payment or prepayment

occurs; press n. (If there is no balloon payment, key in total number of

payments and press n.)

3. Key in the desired periodic interest rate (yield) and press ¼.

4. Key in the periodic payment amount; press P.

*

5. Key in the balloon payment amount and press M.

*

(If there is no balloon

payment, go to step 6.)

6. Press $ to obtain the purchase price of the mortgage.

Example 1:

A lender wishes to induce the borrower to prepay a low interest rate

loan. The interest rate is 5% with 72 payments remaining of $137.17 and a

balloon payment at the end of the sixth year of $2,000. If the lender is willing to

discount the future payments at 9%, how much would the borrower need to prepay

the note

?

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

f]

f[

gÂ

f

CLEAR

G

72

n

gÂ

f

CLEARG

72n

72.00

Months (into n).

*

Positive for cash received; negative for cash paid out.