Section 13: Investment Analysis 189

File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 189 of 275

Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm

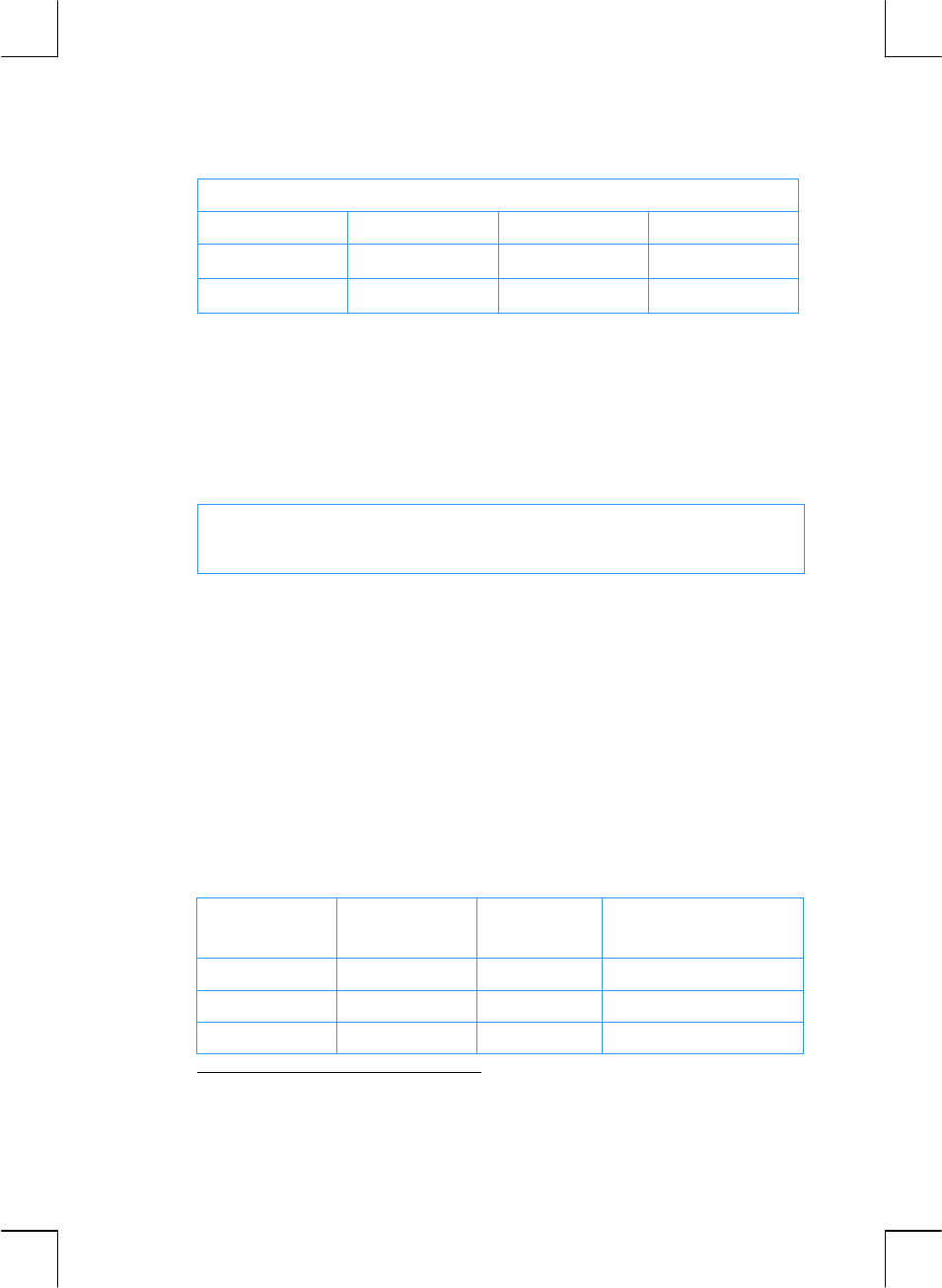

REGISTERS

n: Life i: Factor PV: Dep. Value PMT: Unused

FV: Salvage

R

0

: Used R

1

: Dep. R

2

: Counter

R

3

: Used R

4

:

Used R

5

:

Used R

6

:

Used

1. Key in the program.

2. Press fCLEARH.

3. Key in the book value then press $.

4. Key in the salvage value then press M.

5. Key in the life in years (an integer) then press n.

6. Key in the declining-balance factor as a percentage then press ¼.

7. RPN: Key in the desired year and press \.

7. ALG: Key in the desired year and press ³.

8. Key in the number of months in the first year

*

then press t

†

to calculate

the amount of depreciation for the desired year.

9. If desired, press ~ to see the remaining depreciable value.

10. If desired, press :1 to see the total depreciation through the current year.

11. Continue pressing t

*

to find the amount of depreciation for the successive

years. Steps 9 and 10 may be repeated for each year.

12. For a new case press gi000 and return to step 2.

Example:

An electronic instrument is purchased for $11,000, with 6 months

remaining in the current fiscal year. The instrument’s useful life is 8 years and the

salvage value is expected to be $500. Using a 200% declining-balance factor,

generate a depreciation schedule for the instrument’s complete life. What is the

remaining depreciable value after the first year

?

What is the total depreciation

after the 7th year

?

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

f]

f[

f

CLEAR

H

f

CLEAR

H

0.00

11000

$

11000

$

11,000.00

Book value.

*

Refer to straight-line depreciation note page 174.

†

The display will pause with the year number before displaying the amount of depreciation for

that year.