Section 13: Investment Analysis 191

File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 191 of 275

Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm

Excess Depreciation

When accelerated depreciation is used, the difference between total depreciation

charged over a given period of time and the total amount that would have been

charged under straight-line depreciation is called excess depreciation. To obtain

excess depreciation:

RPN Mode:

1. Calculate the total depreciation then press \.

2. Key in the depreciable amount (cost less salvage) then press \. Key in

the useful life of the asset in years then press z. Key in the number of

years in the income projection period then press § to get the total

straight-line depreciation charge.

3. Press - to get the excess depreciation.

ALG Mode:

1. Calculate the total depreciation then press -gØ.

2. Key in the depreciable amount (cost less salvage) then press z. Key in

the useful life of the asset in years then press §. Key in the number of

years in the income projection period then press gÙ to get the total

straight-line depreciation charge.

3. Press ³ to get the excess depreciation.

Example:

What is the excess depreciation in the previous example over 7

calendar years

?

(Because of the partial first year, there are 6.5 years depreciation

in the first 7 calendar years.)

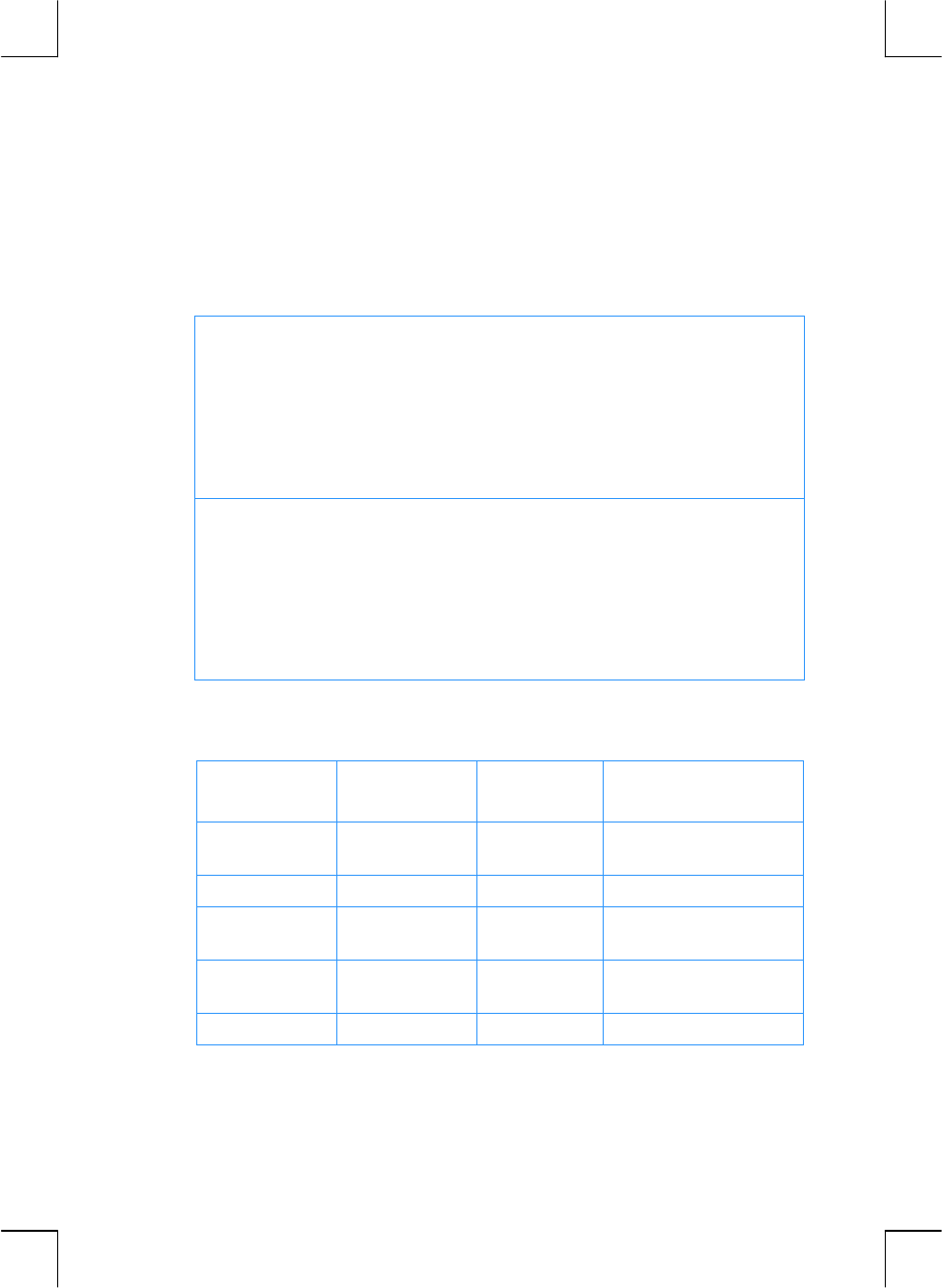

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

9429.56

\

9429.56

-gØ

9,429.56

Total depreciation throu

g

h

seventh year.

10500

\

10500

z

10,500.00

Depreciable amount.

8

z

8

§

1,312.50

Yearly straight-line

depreciation.

6.5

§

6.5

gÙ

8,531.25

Total straight-line

depreciation.

- ³

898.31

Excess depreciation