160 Section 12: Real Estate and Lending

File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 160 of 275

Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm

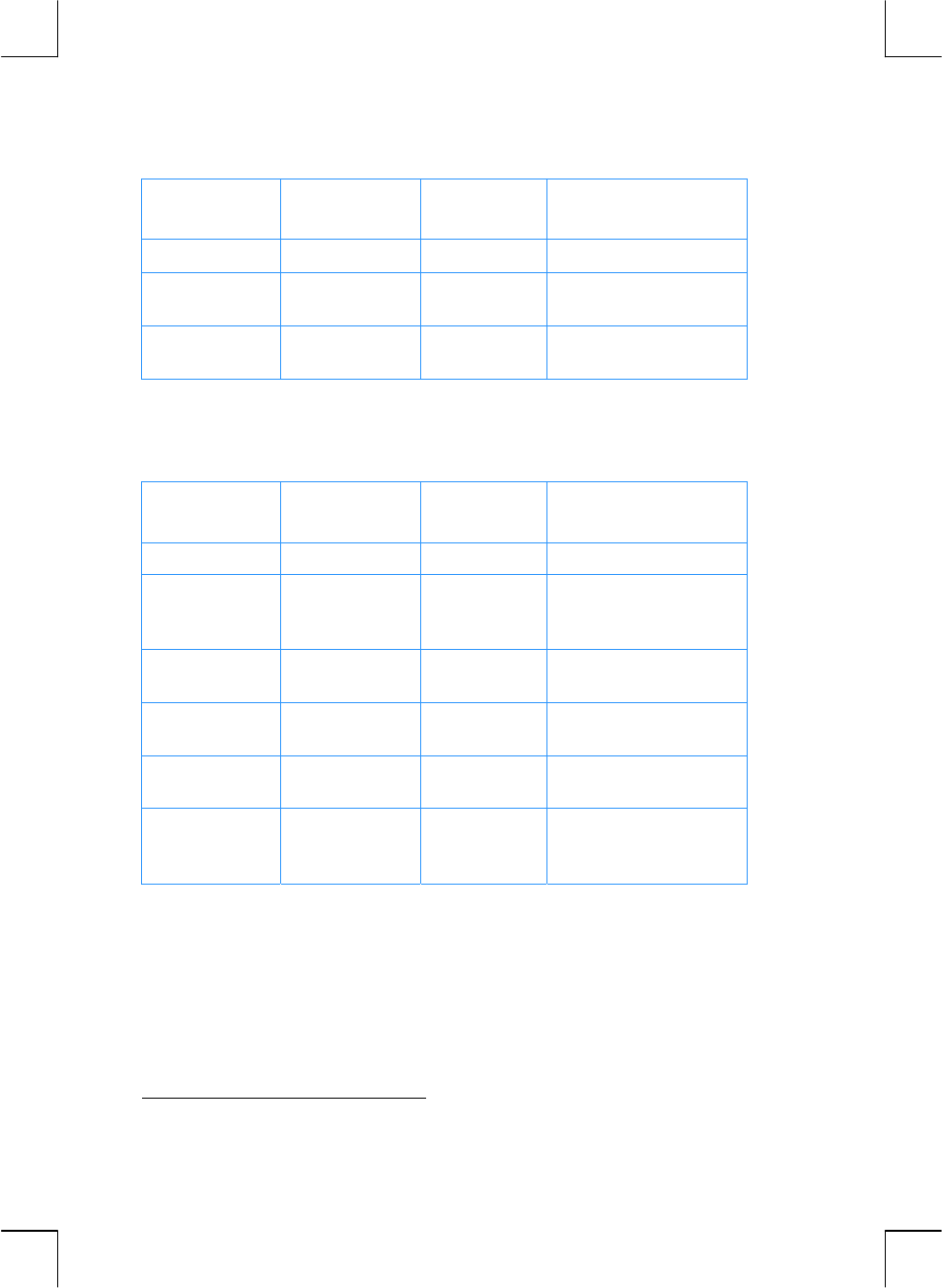

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

9

gC

9

gC

0.75

Discount rate (into i).

137.17

P

*

137.17

P

*

137.17

Monthly payments (into

PMT).

2000

M$

2000

M$

–8,777.61

Amount necessary to

prepay the note.

Example 2:

A 6.5% mortgage with 26 years remaining and a remaining

balance of $249,350 is available for purchase. Determine the price to pay for this

mortgage if the desired yield is 12%. (Since the payment amount is not given, it

must be calculated.)

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

f]

f[

gÂ

f

CLEAR

G

26

gA

gÂ

f

CLEAR

G

26

gA

312.00

Months (into n).

6.5

gC

6.5

gC

0.54

Percent monthly interest

rate (into i).

249350

Þ$

P

249350

Þ$

P

1,657.97

Monthly payment to be

received (calculated).

12

gC

12

gC

1.00

Desired monthly interest

rate (into i).

$

$

–158,361.78

Purchase price to achieve

the desired yield

(calculated).

*

Note that the payments are positive because this problem is in seen from the viewpoint of the

lender who will be receiving payments. The negative PV indicates money that was lent out.