170 Section 12: Real Estate and Lending

File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 170 of 275

Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm

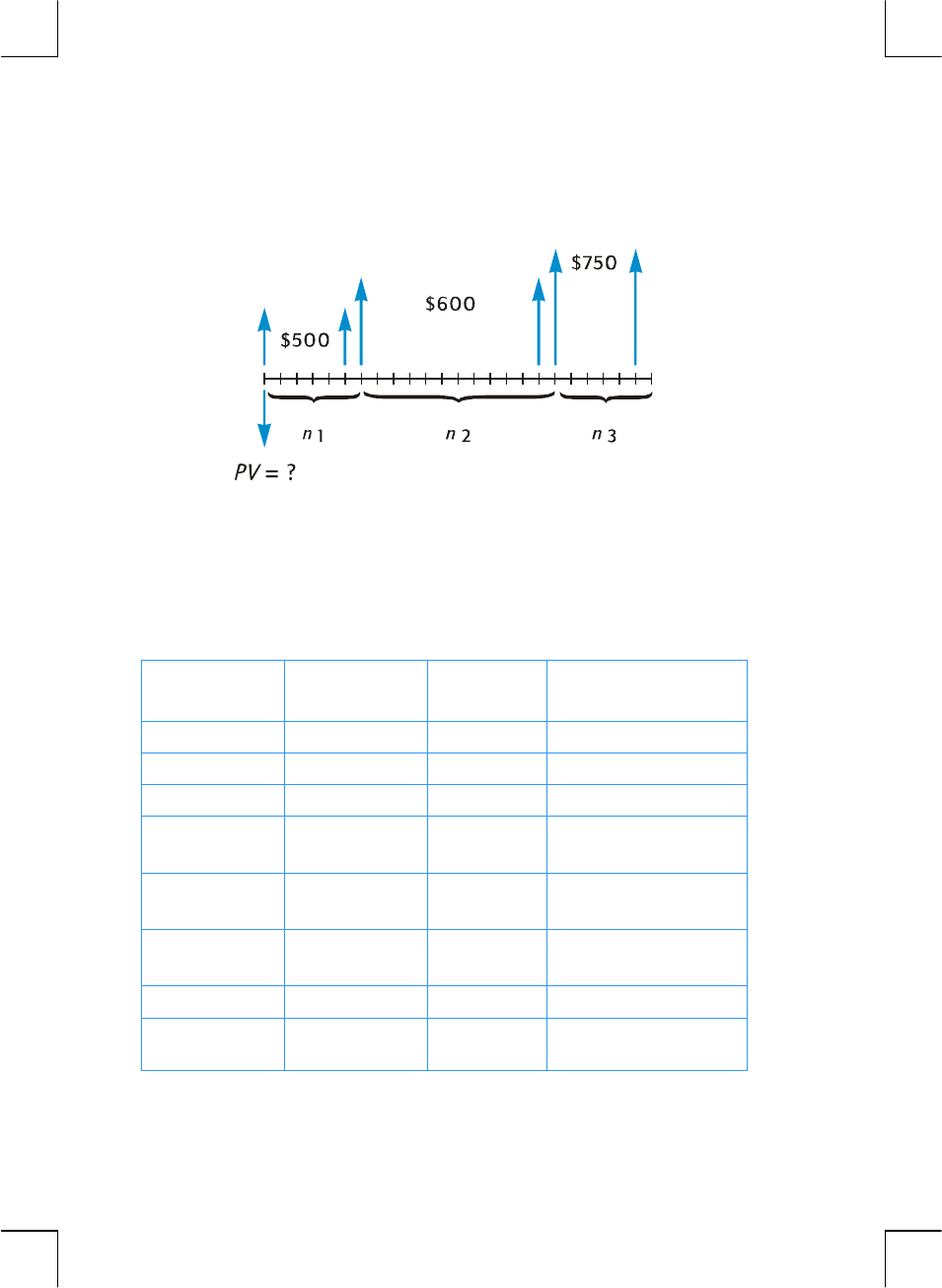

In the example cited, the rental payment stream for months 7 through 24 are

“deferred annuities,” as they start at some time in the future. The cash flow

diagram from the investor’s viewpoint looks like this:

To find today’s present value of the cash flows assuming a desired yield, the NPV

technique may be used. (Refer to pages 73 through 77.)

Example 2:

A 2-year lease calls for monthly payments (at the beginning of the

month) of $500 per month for the first 6 months, $600 per month for the next 12

months, and $750 per month for the last 6 months. If you wish to earn 13.5%

annually on these cash flows, how much should you invest (what is the present

value of the lease)

?

Keystrokes

(RPN mode)

Keystrokes

(ALG mode)

Display

f]

f[

f

CLEAR

H

f

CLEAR

H

0.00

Initialize.

500

gJ

500

gJ

500.00

First cash flow.

gK

5

ga

gK

5

ga

500.00

5.00

Second through sixth cash

flows.

600

gK

12

ga

600

gK

12

ga

600.00

12.00

Next twelve cash flows.

750

gK

6

ga

750

gK

6

ga

750.00

6.00

Last six cash flows.

13.5

gC

13.5

gC

1.13

Monthly interest rate.

fl

fl

12,831.75

Amount to invest to

achieve a 13.5% yield.