Section 3: Basic Financial Functions 45

File name: hp 12c pt_user's guide_English_HDPMF123E27 Page: 45 of 275

Printed Date: 2005/8/1 Dimension: 14.8 cm x 21 cm

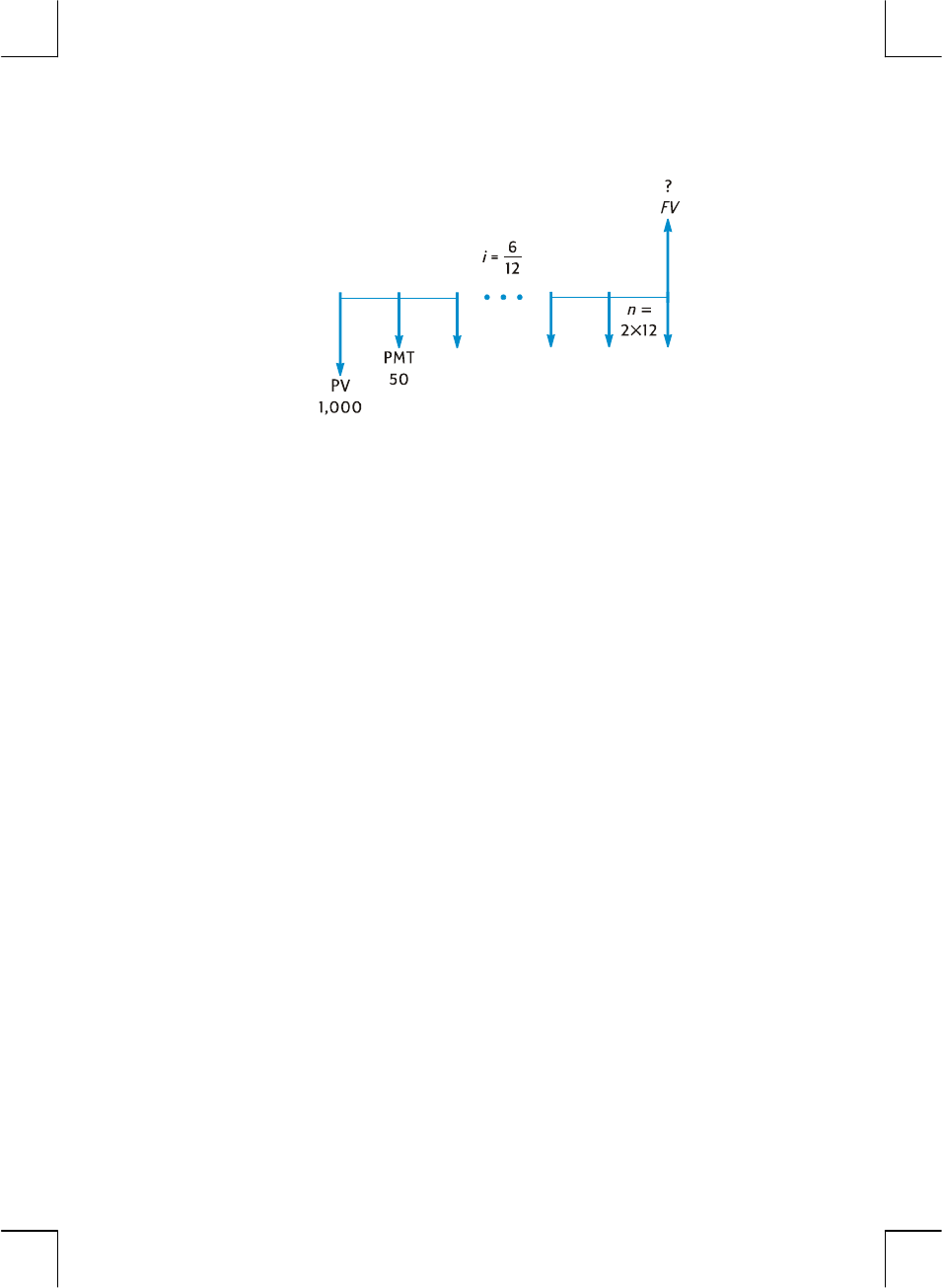

The arrow pointing up at the right of the diagram indicates that money is received

at the end of the transaction. Every completed cash flow diagram must include at

least one cash flow in each direction. Note that cash flows corresponding to the

accrual of interest are not represented by arrows in the cash flow diagram.

The quantities in the problem that correspond to the first five keys on the top row of

the keyboard are now readily apparent from the cash flow diagram.

z n is the number of compounding periods. This quantity can be expressed in

years, months, days, or any other time unit, as long as the interest rate is

expressed in terms of the same basic compounding period. In the problem

illustrated in the cash flow diagram above, n = 2 × 12.

The form in which n is entered determines whether or not the calculator

performs financial calculations in Odd-Period mode (as described on pages

63 through 67). If n is a noninteger (that is, there is at least one nonzero

digit to the right of the decimal point), calculations of i, PV, PMT, and FV are

performed in Odd-Period mode.

z i is the interest rate per compounding period. The interest rate shown in the

cash flow diagram and entered into the calculator is determined by dividing

the annual interest rate by the number of compounding periods. In the

problem illustrated above, i = 6% ÷ 12.

z PV — the present value — is the initial cash flow or the present value of a

series of future cash flows. In the problem illustrated above, PV is the $1,000

initial deposit.

z PMT is the period payment. In the problem illustrated above PMT is the $50

deposited each month. When all payments are equal, they are referred to as

annuities. (Problems involving equal payments are described in this section

under Compound Interest Calculations; problems involving unequal

payments can be handled as described in under Discounted Cash Flow

Analysis: NPV and IRR. Procedures for calculating the balance in a savings

account after a series of irregular and/or unequal deposits are included in

the hp 12c platinum Solutions Handbook.)