7: Cash Flow Calculations 101

File name : English-M02-1-040308(Print).doc Print data : 2004/3/9

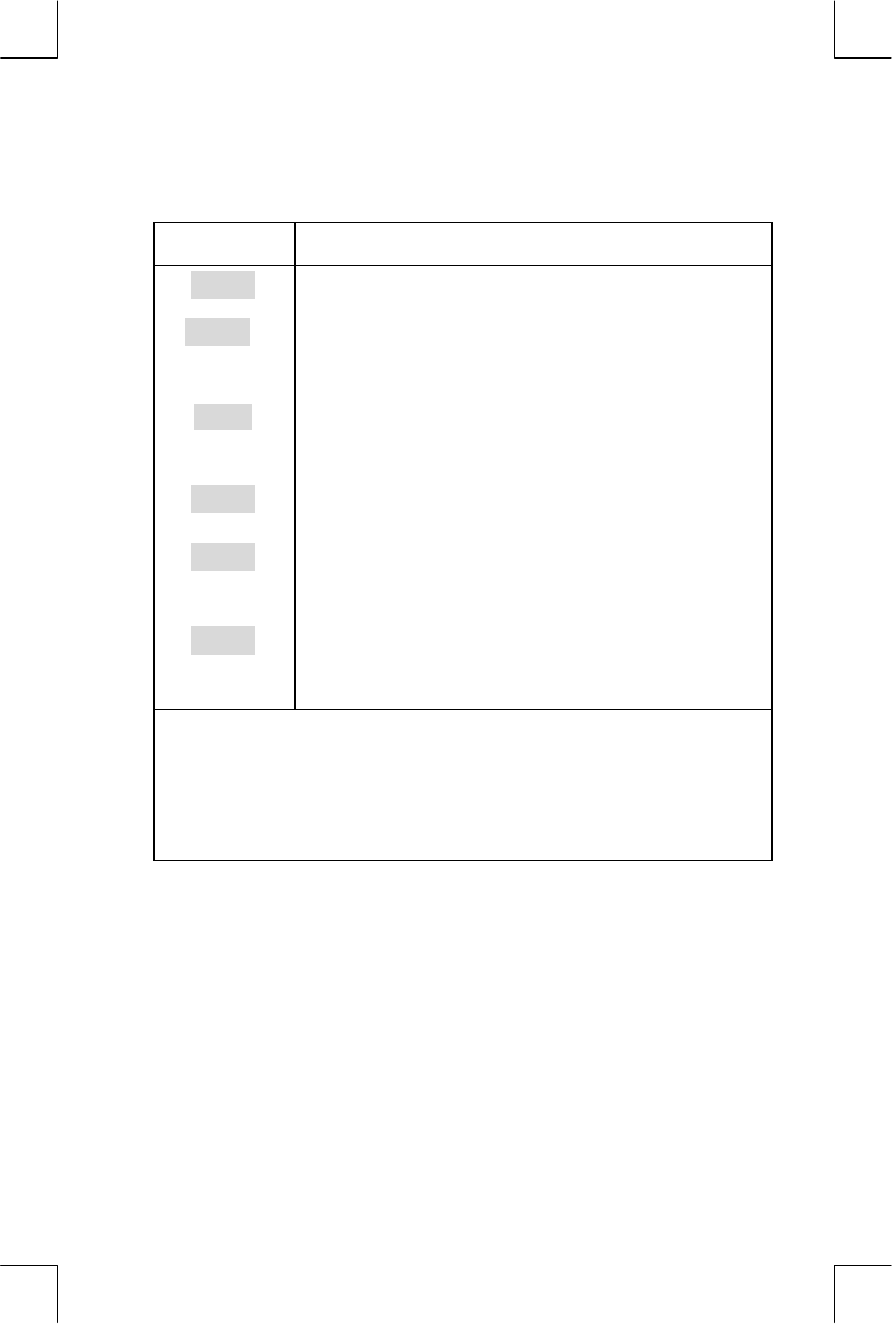

Table 7-2. The CALC Menu for CFLO Lists

Menu Label Description

Calculates the sum of the cash flows.

* Calculates the internal rate of return—the interest

(discount) rate at which the net present value of the

cash flows equals zero.

Stores the periodic interest rate, expressed as a

percentage (sometimes called cost of capital,

discount rate, or required rate of return).

Given I%, calculates the net present value—the

present value of a series of cash flows.

Given I%, calculates the net uniform series—the

dollar amount of constant, equal cash flows having

a present value equivalent to the net present value.

Given I%, calculates the net future value of a series

of cash flows by finding the future value of the net

present value.

*

The calculations for internal rate of return are complex and may take a

relatively long time. To interrupt the calculation, press any key. In certain

cases, the calculator displays a message indicating that the calculation

cannot continue without further information from you, or that there is no

solution. Refer to appendix B for additional information about calculating

IRR%.

About the Internal Rate of Return (IRR%). A “conventional investment”

is considered attractive if IRR% exceeds the cost of capital. A

conventional investment meets two criteria—(1) the sequence of cash

flows changes sign only once, and (2) the sum (TOTAL) of the cash flows

is positive.

Remember that the calculator determines a periodic IRR%. If the cash

flows occur monthly, then IRR% is a monthly value, too. Multiply it by 12

for an annual value.