14: Additional Examples 209

File name : English-M02-1-040308(Print).doc Print data : 2004/3/9

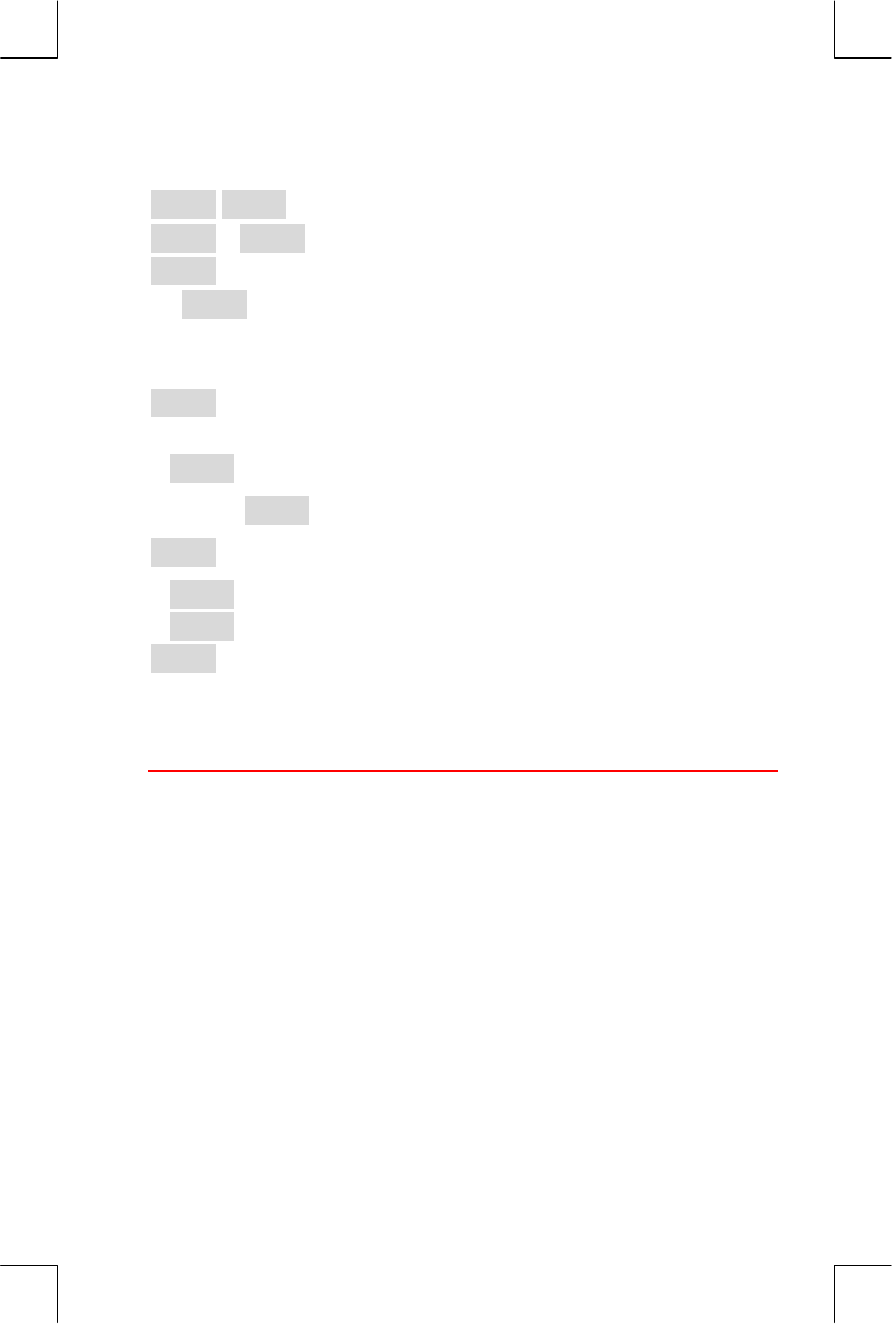

Keys: Display: Description:

Displays TVM menu.

1

e

Sets 1 payment per year

and Begin mode.

35 Stores years until

retirement.

8.175

-

28

%

Calculates and stores

interest rate diminished by

tax rate.

0

Stores no present value.

3000

&

Stores annual payment.

Calculates future value.

8

0

Calculates present-value

purchasing power of the

above FV at 8%

inflation.

Modified Internal Rate of Return

When there is more than one sign change (positive to negative or

negative to positive) in a series of cash flows, there is a potential for

more than one

IRR%. For example, the cash-flow sequence in the

following example has three sign changes and hence up to three

potential internal rates of return. (This particular example has three

positive real answers: 1.86, 14.35, and 29.02% monthly.)

The Modified Internal Rate of Return (MIRR) procedure is an alternative

that can be used when your cash-flow situation has multiple sign

changes. The procedure eliminates the sign change problem by utilizing

reinvestment and borrowing rates that you specify. Negative cash flows

are discounted at a

safe rate that reflects the return on an investment in

v

v